-

VRight AARYANA posted an update in the group Financial Services Group

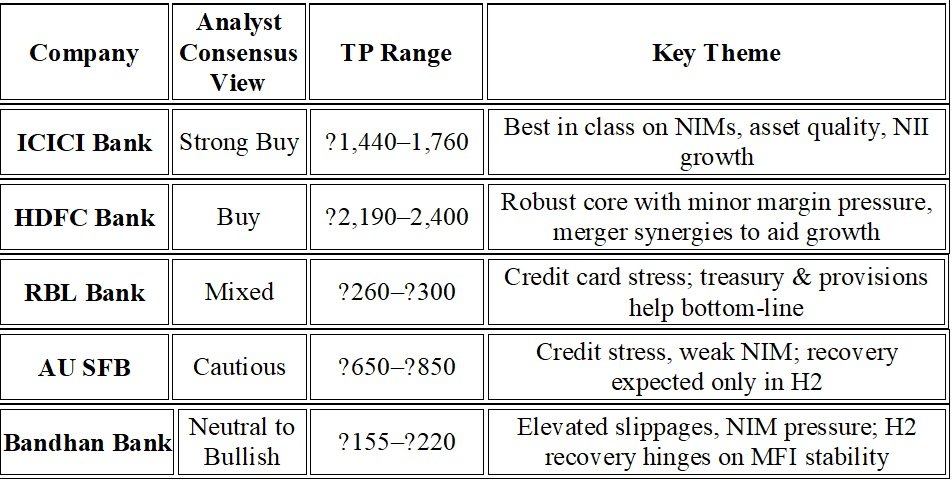

3 months, 2 weeks agoInstitutional Analyst Views

ICICI Bank — Strong Quarter Across Metrics

Consensus Rating: ★ BUY / Outperform

TP Range: ₹1,440 – ₹1,760

Key Positives:

Strong NII and core PPOP; only major bank with sequential NII growth despite rate cuts (CLSA, Nomura).

Asset quality stable, unlike recent Axis Bank concerns (Bernstein).

NIM compression limited to 5–7 bps; far better than peers (Nuvama, CLSA).

Deposit growth (+13%) and CASA (+14%) remained healthy (Jefferies).

Risks / Watchpoints:

Soft loan growth, but management expects a rebound.

Valuation:

Trades at 2.6x forward BVPS; justified by resilient performance (Nomura).

HDFC Bank — Robust Core with One-offs in Play

Consensus Rating: ★ BUY / Outperform

TP Range: ₹2,190 – ₹2,400

Key Positives:

Solid growth in operating profit (+50% YoY), strong deposit traction.

Asset quality best-in-class, even with seasonal farm stress.

Monetisation of merger synergies to benefit FY26–27 performance (Jefferies, Nomura).

Challenges:

NIM compression larger than peers (19 bps QoQ); due to EBLR book re-pricing (Nuvama).

Adjusted EPS growth (ex one-offs) at 7% YoY (Bernstein).

Valuation:

Valued at ~2.3x FY27 BVPS; still among top picks.

RBL Bank — Mixed Quarter with Credit Card Stress

Ratings Diverged: CLSA: Hold; IIFL & Citi: BuyTP Range: ₹260 – ₹300

Positives:

Treasury gains helped; credit cost better than expected (CLSA).

JLG slippage subsiding; contingency buffer of 1% created (Citi).

Provisions fell sharply QoQ, supporting PAT beat (IIFL).

Concerns:

Loan growth tepid (9% YoY).

Elevated stress in credit card and business banking segments.

Operating performance below estimates.

AU Small Finance Bank — Disappointing Quarter

Ratings: Citi: Neutral; Nuvama: ReduceTP Range: ₹650 – ₹850

Key Issues:

NIM fell 38 bps QoQ to 5.4%.

Credit cost up 1.97%; delinquencies rose in south-based mortgages & credit cards.

Treasury support masked core weakness.

Guidance:

NIMs expected to stabilize by 2QFY26; improvement likely in H2.

Bandhan Bank — Under Pressure; MFI Stress Continues

Ratings Diverged: JPM: Neutral; CLSA/Macquarie: Outperform; Jefferies: BuyTP Range: ₹155 – ₹220

Challenges:

Slippages remain high; credit costs elevated.

NIM compression due to shift to secured lending.

FY26 ROA guidance faces downside risks (Macquarie).

Silver Linings:

Slippages slightly better than feared.

Jefferies notes profit slightly above expectations.

Outlook:

Recovery likely in H2FY26; stress persists near term.