-

Aryan Rana posted an update in the group Visionary Market Voices

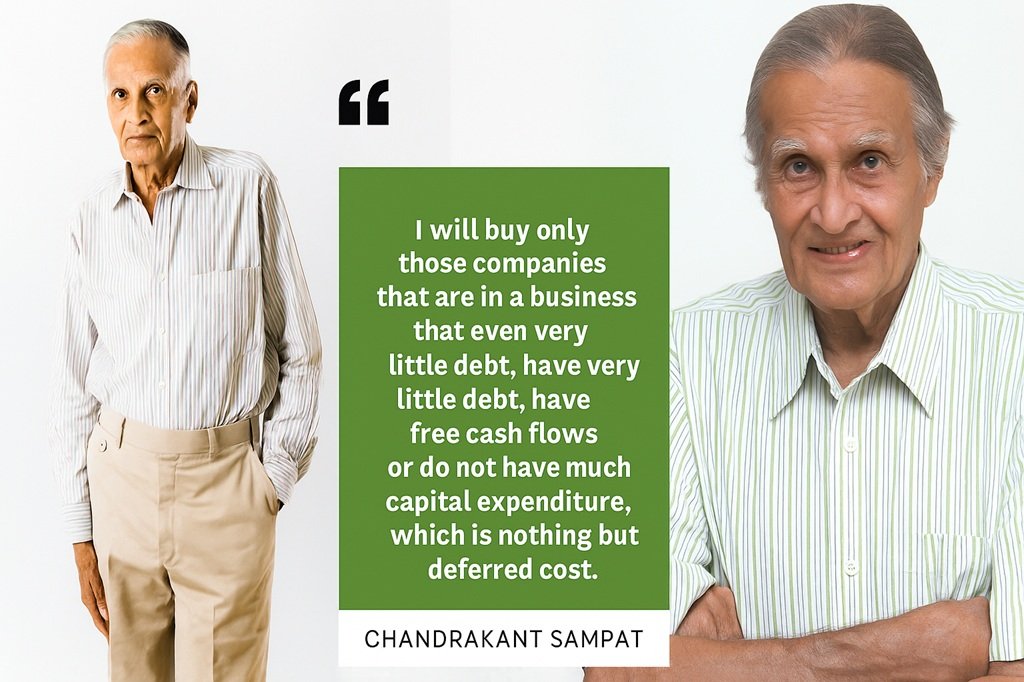

3 months, 2 weeks agoInvesting With Purpose: Lessons from India’s First Value Investor — Mr Chandrakant Sampat

“To be a good investor, all one has to do is dream.” — Chandrakant Sampat

In a time when investing is often clouded by hype, noise, and speculation, the story of Mr Chandrakant Sampat shines like a guiding light for anyone starting their journey in the stock market.

Sampat ji, as he was fondly known, entered the stock market in 1955 with nothing but a cheque book and a pen. Leaving behind the family business, he ventured into a world that was unstructured and uncertain — but also full of opportunity for those who had clarity, conviction, and character.

He wasn’t just a stock picker. He was a visionary. A mentor to legends like Parag Parikh, Radhakishan Damani, and even Rakesh Jhunjhunwala in their formative years. Sampat ji didn’t chase fads — he built fortunes with simplicity, discipline, and spiritual depth.

Mr Sampat ’s Golden Investment Checklist

For new investors, this is where you begin. A blueprint that has stood the test of time:

Low or No Debt

ROCE (Return on Capital Employed) > 25%

Free Cash Flow Positive

P/E Below 15

Dividend Yield of 3–4%Buy When:

– The stock is at an 8–10 year low, or

– Down 40%+ from its peakHis approach was value-driven, patient, and focused on quality over quantity. A typical Sampat ji portfolio had just 8–10 well-researched companies. He believed that over-diversification kills conviction.

Big Wins Through Big Vision

While many chased trends, Sampat ji quietly accumulated stakes in global consumer giants that had just listed in India post-1973’s FERA reforms.Stocks like HUL, Nestlé, Gillette, Colgate, and P&G became multi-generational wealth creators.

He bought them at such low prices that after decades of splits and bonuses, his effective cost was almost zero.

In some cases, returns were 100x to 200x.

His next bold move came during the 1984 market crash after Indira Gandhi’s assassination. While others panicked, Sampat ji loaded up on Bosch and other high-quality companies — again, betting on fear and winning with patience.

The Mind of a Master

Chandrakant Sampat wasn’t just an investor. He was a spiritual thinker, deeply influenced by the Bhagavad Gita, which he often quoted in investing conversations.He believed:

• Markets are the best teacher.

• Mistakes are part of the learning.

• Conventional education closes the mind.He lived simply, avoided media, never used a mobile phone, and stayed away from public attention. He jogged daily, practiced yoga, read widely, and lived frugally — teaching that discipline in life translates into discipline in investing.

In his later years, Sampat ji shifted most of his capital to cash and cash equivalents, wary of the rapid technological disruption in the markets.

Even in exit, he showed foresight.Legacy That Lives On

Legends like Parag Parikh and Radhakishan Damani credit their investing philosophies to Sampat ji’s influence. In a tribute, Parag Parikh said: “Whatever I am, it’s because of Sampat ji. He inspired me to enter the capital market.”For young investors today, his story is a reminder that wealth is not created by luck, but by discipline, clarity, and time.

Sampat’s 3 Pillars of Investing Wisdom for Beginners

1. Buy simple, high-quality businesses.

2. Hold for the long term. Let compounding do its work.

3. Invest in yourself — learn, unlearn, and grow.Final Thought

In a noisy world filled with hot tips and short-term greed, Chandrakant Sampat’s life is a call to slow down, to think clearly, and to invest purposefully.“To be a good investor, all one has to do is dream.”

Start your journey with a dream — and the V-right principles.Welcome to VRIGHT Exchange.

No Noise. Just Value.