-

VRight AARYANA posted an update in the group Capital Goods / Electrical Equipment Group

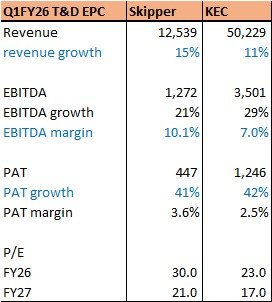

3 months agoQ1FY26 Skipper (NOT RATED) results – High growth trajectory continues

-> Revenue/EBITDA/PAT growth of 15/21/41% yoy

-> Revenue of 12.5bn (+15% yoy) driven by Engineering Products (+24% yoy) and Polymer Products (+39% yoy). Infra projects segment revenue declined 39% yoy.

-> As a result, the share of Engineering Products (mainly transmission towers and poles) in revenue mix has increased to 82% from 76% in Q1FY25.

-> EBITDA of INR1.27bn (+21% yoy). EBITDA margin of 10.1% (+50bps yoy, qoq)

-> EBIT margin of the Engineering Products segment expanded 90bps yoy to 11.5% while Polymer Products Products margin improved 40bps yoy to 3%.

-> Interest Cost as % of sales has come in at 4.2% (lowest in atleast last 16 quarters)

-> Financial leverage boosted bottomline further with PAT margin of 3.6% (+70bps yoy)

-> PAT grew 41% yoy to INR447mn

-> The company has incorporated three wholly new subsidiaries in (1) Abu Dhabi (proposed investment of upto $10,000), (2) USA (proposed investment of upto $50,000), (3) Brazil (proposed investment of upto $20,000)

-> The stock trades at 30/21x FY26/FY27 EPS based on consensus estimates. Consensus is building EPS CAGR of 31% over FY25-27E.

More after the earnings call and management commentary.

By : Abhijeet Singh, Lead – Capital Goods, Defense

Systematix