-

VRight AARYANA posted an update in the group Retail Investor Forum

2 months, 2 weeks agoMove over FIIs… Bharat’s SIP Army is running the show!

India is witnessing a financial revolution—and it’s being driven by investors from Tier II and III towns, backed by low-cost, high-impact SIPs.

Key Metrics & Momentum:

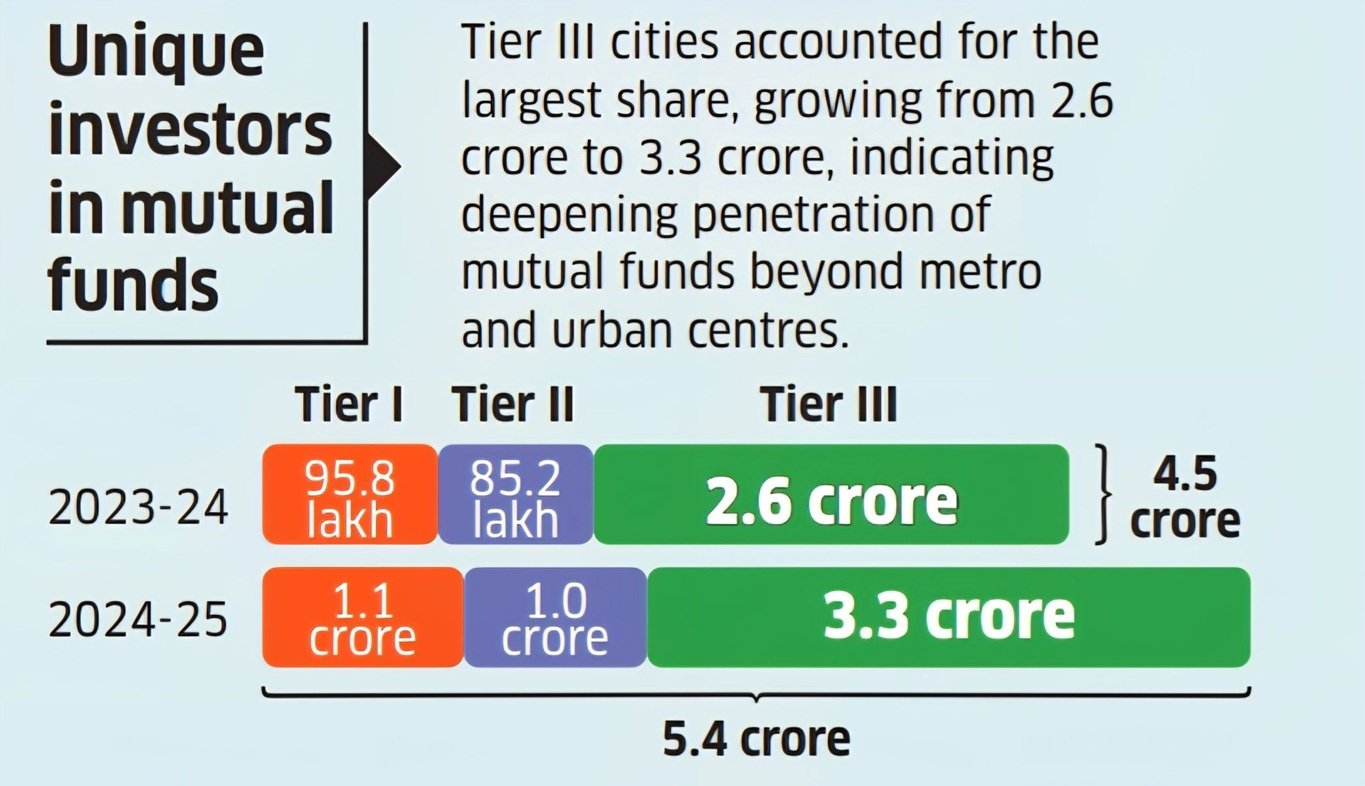

Unique mutual fund investors surged to 5.4 crore in FY 2024–25, powered largely by Tier III city participation.

SIP folios of under ₹500 doubled during the same period—showing how “small” investments are growing exponentially.

Mutual fund folios rocketed from 17.75 crore in March 2024 to 23.24 crore by March 2025, a growth of nearly 31%.

As of May 2025, folios reached 23.83 crore, representing a 28% year-on-year jump.

AUM climbed from ₹53.40 lakh crore in March 2024 to ₹65.74 lakh crore in March 2025, a stellar 23% growth.

Industry AUM soared from ₹27.12 trillion in July 2020 to ₹75.36 trillion in July 2025—more than 3× in just five years.

SIPs Keep Breaking Records:

May 2025 SIP inflows hit a record ₹26,688 crore, superseding April’s figure.

June 2025 inched up further to ₹27,269 crore, while active SIP accounts crossed 8.64 crore.

July 2025 smashed records again: ₹28,464 crore in SIPs and 91.1 million active SIP accounts.

Notably, equity mutual funds saw 81% month-on-month inflow growth, led by small-cap (61% surge), mid-cap (38%), and large-cap (25%) segments.

Market Sovereignty & Inclusion:

In Q1 2025, retail investors overtook foreign investors in market ownership, marking a milestone in financial self-reliance.

SEBI is pushing for ₹250 SIPs under its “Choti SIP” initiative—making investing even more accessible for first-time and small-town savers.

A first-time earner in a Tier III town is now “just as likely to start with a mutual fund as someone in Mumbai or Delhi.”

Why It Matters for India’s Growth Story:

Financial inclusion at scale: Millions from small towns are building wealth, creating a parallel growth engine.

Productive capital flows: Household savings are shifting from unproductive assets (like gold or real estate) towards equity markets.

Macroeconomic impact: Rising disposable incomes and investments boost per capita GDP—propelling India’s growth trajectory.

Bullish outlook: With India’s SIP-driven financial ecosystem deepening, a decade-long bull run—and multi-fold economic growth—seems far from improbable.

The next chapter of India’s growth will be written by ordinary investors with extraordinary discipline.

#SIP #MutualFunds #RetailInvestors #SmallTownIndia #WealthCreation #BharatRising #BullRun #FinancialInclusion #GDPGrowth #ChotiSIP #MFRevolution