-

Janardhan Chavan posted an update in the group Analyst & Investor Events

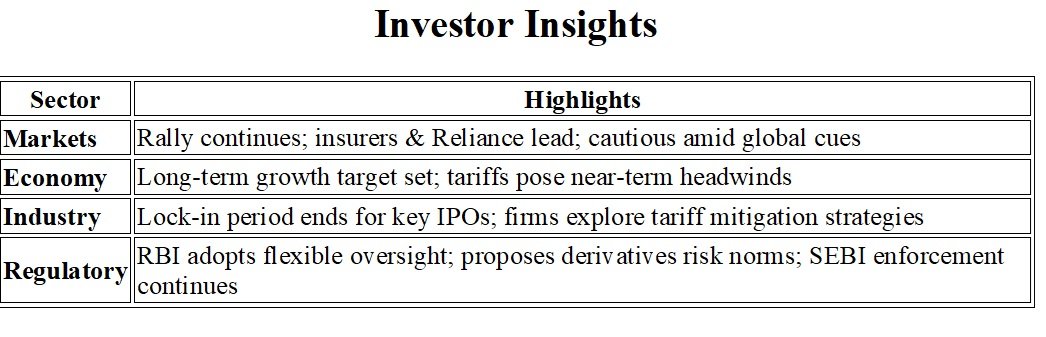

2 months, 2 weeks agoSector-wise News Update -21 August

Markets & Equities

• Market Opened Higher: India’s equity indices extended their winning streak, with the Nifty 50 rising 0.23% to 25,106.5 and the BSE Sensex climbing 0.27% to 82,067.9. Gains were led by financials and Reliance Industries, while IT stocks dipped ahead of the U.S. Federal Reserve’s Jackson Hole symposium.• Key Drivers: A proposed GST exemption on health and life insurance premiums, combined with S&P’s upgrade of India’s credit rating, fueled investor optimism. JP Morgan reiterated an “overweight” stance on Reliance, adding strength to markets.

• Muted Global Cues: Nifty futures indicated a flat opening, with markets cautious ahead of Fed’s Jackson Hole event. FPI outflows continued, offset partly by DII inflows.

Economy & Macroeconomic Outlook

• Growth Ambitions: India’s Finance Ministry reiterated the need for sustained 8% annual GDP growth to offset geopolitical pressures, aiming to hit a developed economy status by 2047. This will require increasing investment from 31% to 35% of GDP and supporting labor-intensive exports.• Tariff Headwinds: An HSBC report warns that U.S. tariffs could shave off 30 basis points from growth over the next year, increasing to 70 bps if rates reach 50%, posing risks to exports and SME-led consumption.

Corporate & Industry Developments

• Stock Spotlight: Shares of Vibhor Steel Tubes (20% of equity) and Borana Weaves (6%) snapped their lock-in period and became tradeable, drawing market attention.• Strategic Pivot: Indian corporates are weighing options to mitigate tariffs via cross-border M&A or setting up manufacturing hubs in low-tariff regions like UAE, Mexico, and the U.S.

• Industry Report Released: The Express Industry Council of India (EICI), with KPMG, launched a report ahead of Union Minister Nitin Gadkari, highlighting the express industry as vital to economic resilience, logistics innovation, and MSME support.

Regulatory Updates

• RBI Embraces Outcome-Based Framework: The central bank signaled a shift from rigid rule-based regulations to principles- and outcome-based regulation, promoting flexibility and innovation while enhancing inter-regulatory collaboration.

Strengthening Derivatives Oversight: RBI proposed new counterparty credit risk norms for banks in equity and commodity derivatives, ensuring adequate capital buffers and market resilience.

• SEBI Actions & Compliance Notices: SEBI issued multiple Recovery Proceedings, including notices to defaulters in trading violations and IPO filings, and a DRHP addendum for WeWork India.Corporate & Market Updates

• Shanti Gold International (Q1FY26, YoY):

o Net Profit surged 174% to ₹24.6 crore (vs. ₹9 crore).

o Revenue rose 22.1% to ₹292.8 crore (vs. ₹239.8 crore).• Tech Mahindra: Incorporated a new wholly owned subsidiary, Tech Mahindra Regional Headquarters, in Saudi Arabia to provide strategic direction and management support to its entities in Bahrain and Egypt.

• Zee Entertainment: Update: Aditya Birla Finance has approached the Delhi High Court against the arbitral tribunal’s award in its case with the company.

• Glenmark Pharmaceuticals: Completed the acquisition of a stake in O2 Renewable Energy XXIV, investing the remaining ₹24 lakh. With this, total investment stands at ₹1.99 crore, raising ownership to 32.95%.

• Shree Cement: Income tax demand for FY22 reduced to ₹221.72 crore (from earlier ₹588.65 crore) following a rectification order.

• UltraTech Cement: The MPS Committee approved the sale of up to 2.01 crore equity shares (6.49% stake) in India Cements Ltd. via stock exchange mechanism. Floor price: ₹368 per share.

• Hitachi Energy: Board appointed Ismo Antero Haka as Chairman, replacing Achim Michael Braun.

• Reliance Industries: Subsidiary Reliance TerraTech completed its voluntary winding-up process and filed a ‘Certificate of Termination’ with the Texas Secretary of State.

• AGI Greenpac: Received a disputed demand notice of ₹40.61 crore from Telangana Southern Power Distribution for surplus power procured between 2002–2022.

• SBFC Finance: Board approved the allotment of 20,000 NCDs (face value ₹1 lakh each), aggregating to ₹200 crore, on a private placement basis.

• Exide Industries: Invested an additional ₹100 crore into its wholly owned arm, Exide Energy Solutions, through a rights issue.

• Vedanta: Informed NCLT of its plan to provide a corporate guarantee in favour of the Ministry of Petroleum and Natural Gas (MoPNG).

• Jupiter Wagons: Its unlisted subsidiary Jupiter Tatravagonka Railwheel Factory Pvt. Ltd. received an LOI to supply wheelsets for Vande Bharat trains.

• Titan Company: P. B. Balaji stepped down as Non-Executive, Non-Independent Director, effective August 20.

• Fedbank Financial Services: Board meeting scheduled on Aug 25 to consider issuance of NCDs worth up to ₹2,500 crore.

• Clean Science & Technology: Promoters Ashok Boob and Krishna Boob are reportedly planning to offload up to a 24% stake via a block deal.

• RailTel Corporation of India:

o Received a ₹35 crore work order from Kerala State IT Mission for O&M of SDC project.

o Secured another ₹15.4 crore order from the Odisha Higher Education Department.

• Godrej Properties: Acquired a 7% equity stake in Godrej Skyline Developers from an existing shareholder.