-

Shubham Gandhi posted an update in the group Top Investment Picks @ India Research & Analyst Network

2 months, 2 weeks agoNifty 50 vs. Laggard Stocks: A Five-Year Wealth Creation Story

Between August 2020 and August 2025, the Nifty 50 index has delivered ~75–80% absolute returns, translating into a healthy 12% CAGR. This performance was powered by leadership in banking, IT, energy, infrastructure, and manufacturing.

In contrast, a basket of once-popular but now underperforming stocks — spanning FMCG, footwear, chemicals, and telecom — delivered close to 0% absolute returns over the same period (–1% to +1% CAGR).

Put simply:

• ₹10 lakh invested in the Nifty 50 in 2020 → ~₹17.5–18 lakh today.

• ₹10 lakh invested in these laggards → still ~₹10 lakh (or lower).

This divergence shows how sectoral rotation, valuation discipline, and structural shifts decide wealth creation in markets.Why These Stocks Lagged Behind Nifty

1. Goodyear (0%)

• Tyre demand growth muted compared to outperformers like MRF/CEAT.

• Export and OEM slowdown restricted topline.

• A cyclical play without strong growth triggers.2. SBI Card (0%)

• IPO priced at expensive multiples (50–60x PE).

• Fintech, UPI, and BNPL ate into growth.

• Loan book lagged broader banking recovery.3. IGL (0%)

• CNG adoption in Delhi NCR saturated.

• Policy uncertainty on gas pricing.

• Expansion to new cities too slow.4. Venky’s (+1%)

• Poultry remains a commodity business.

• Raw material volatility (maize, soy) erodes profits.

• No long-term compounding story.5. Dabur (+0.5%)

• Low single-digit volume growth.

• Expensive valuations (~60x PE).

• Competitive heat from Patanjali and regional FMCG players.6. Berger Paints (+2%)

• Valuations peaked 2016–20.

• Asian Paints dominance + Grasim entry.

• Margin pressure from crude-linked raw materials.7. Atul (+1%)

• Specialty chemicals cycle peaked in 2020–21.

• China’s supply comeback + weak exports.

• Market rotated to PSU/infra/defence themes.8. Biocon (–1%)

• Biosimilar ramp-up slower than promised.

• FDA issues and delayed approvals.

• Investor patience ran out → derating.9. Bata (–2%)

• Post-COVID demand for formal wear weak.

• Competition from Metro, Relaxo, Campus.

• Expensive valuations vs. low growth.10. PVR (–2%)

• OTT streaming structurally hit cinema business.

• PVR-Inox merger failed to restore momentum.

• Investors shifted to digital consumption.11. Relaxo (–4%)

• Input costs (rubber, EVA) squeezed margins.

• Weak demand in mass footwear.

• Lost share to Bata/Metro/Campus.12. Vodafone Idea (–3%)

• Debt + AGR dues + tariff wars.

• Market share ceded to Jio & Airtel.

• Survival mode, not growth mode.The Big Picture: Why the Index Outperformed

• Leadership Shift – Nifty’s gains came from PSU banks, defence, infra, railways, and manufacturing themes these laggards missed.

• Valuation Traps – Over-owned defensives (FMCG, paints, footwear) were priced for perfection in 2020, leaving no upside.

• Disruption – Telecom, footwear, FMCG, and entertainment saw structural disruption (UPI, OTT, regional brands).

• Global/Regulatory Headwinds – Pharma and chemicals faced China competition andIn simple terms: The index rewarded growth + rotation, while laggards stayed stuck in disruption or expensive defensives.

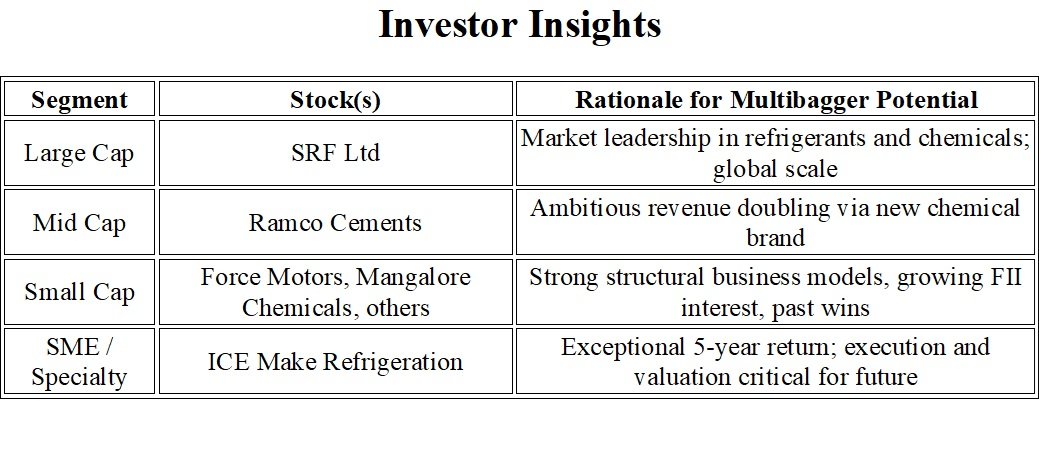

Looking Ahead: Potential Wealth Creators (2025–2030)

Large Cap – Steady Compounders

• Reliance Industries – Energy, retail, and digital powerhouse.

• HDFC Bank – Credit growth + pristine asset quality.

• TCS – Global IT demand resilience.> Expected CAGR: 12–15% (reliable compounding).

Mid Cap – Growth Engines

Persistent Systems – Cloud & AI adoption tailwind.

Polycab India – Rapid expansion in wires & cables.

CAMS – Mutual fund penetration story.> Expected CAGR: 15–20%.

Small Cap – Potential Multibaggers

• Ice Make Refrigeration Ltd – Cold chain & ESG cooling solutions.

• KPI Green Energy – Solar & renewables aligned with policy push.

• Vaibhav Global – Niche e-commerce global play.> Potential: 3–5x in five years, with execution risks.

Key Insights for Investors

• Large Caps = Core stability.

• Mid Caps = Blend of stability + growth.

• Small Caps = Selective, high-reward bets.A balanced portfolio across these three categories is the best way to compound wealth while managing risks in the coming decade.