-

TGI SME Capital Advisors posted an update in the group VRIGHT Exchange | CEO Insights Circle

1 month, 3 weeks agoSeven Lessons Every SME CEO Must Learn to Grow

By Ajay Thakur, CEO & Managing Partner, TGI SME Capital Advisors

Running an SME is not easy. Most CEOs wear multiple hats—managing operations, handling clients, watching cash flows, firefighting crises, and still dreaming of growth.

Yet, the difference between those who remain “small” and those who transform into market leaders lies not in luck, but in the mindset and principles they adopt.

Over the years, after meeting with thousands of small and medium businesses, I have seen clear patterns. Some companies scale beyond expectations. Others remain stuck in cycles of debt and short-term survival.

The lessons are clear and worth sharing—because India’s economic future depends on SMEs evolving with courage, discipline, and vision.

Here are seven lessons every SME CEO should reflect on:1. Debt is Not Your Only Lifeline

Most SME promoters instinctively reach for bank loans whenever capital is needed. Debt has its role, but depending only on loans is a trap. High interest costs and collateral demands often limit growth.Equity—whether from private investors, strategic partners, or eventually the markets—brings in more than just money. It strengthens the balance sheet, reduces leverage, and signals credibility to suppliers, customers, and employees.

An SME that relies only on loans may survive, but an SME that embraces equity can truly grow.

2. Governance is Growth Capital

One of the biggest mindset shifts SMEs must make is around governance. Too often, accounting is informal, reporting is irregular, and compliance is treated as an expense rather than an investment.But governance is not a box-ticking exercise—it is your most powerful marketing tool. When investors, partners, or even large clients see audited accounts, professional boards, and transparent disclosures, their trust multiplies.

Companies that invest in governance early discover that capital and partnerships flow much faster to those who are accountable and transparent.

3. Vision Determines Valuation

SMEs often assume investors only look at past numbers. The truth is, markets and investors value your future more than your history. A modest company with a bold, credible growth plan can command premium valuations. On the other hand, even a profitable firm can struggle if it cannot articulate where it wants to be in five years.Your vision and your ability to communicate it with clarity can often matter as much as your balance sheet. Numbers open the door, but vision convinces others to walk through it with you.

4. Professionalize Early

Many SMEs remain family-run businesses, hesitant to bring in outside professionals. The fear is losing control. The reality is the opposite—professionalization strengthens, not weakens, ownership.A skilled CFO can handle complex financial planning and compliance. Professional HR systems help attract and retain talent. Structured processes create resilience. These are not luxuries—they are survival tools as you scale.

An SME that professionalizes before it desperately needs to is the one best placed to seize opportunities when they arrive.

5. Growth is a Journey, Not a Transaction

Some CEOs believe raising funds or hitting a revenue milestone is the “end goal.” In reality, every milestone is just the beginning of the next phase.When you expand, you don’t just gain more customers—you also gain more scrutiny. When you hire, you don’t just get talent—you also need systems to integrate them.

Growth multiplies opportunities and responsibilities alike. The sooner leaders accept that growth is a continuous journey, not a one-time event, the more sustainably their companies expand.

6. Prepare for Bad Times in Good Times

If COVID taught SMEs anything, it is this: resilience matters more than short-term profit. Supply chains break, demand collapses, and cash flow tightens.The companies that survived were those that built buffers—by conserving cash, diversifying products and markets, and maintaining transparent communication with stakeholders.

Success is not just about thriving in good times, it is also about surviving the storms. Building resilience into the DNA of a company is as important as building profitability.

7. Think like a Marathon Runner

Many SMEs chase quick wins—paying off loans, buying machinery, hitting next year’s sales target. But true wealth creation comes from thinking long-term.Small caps today can become mid-caps tomorrow and large-caps the day after. But this happens only when leaders plan beyond immediate fixes and build for generational impact.

The CEO who runs the business like a marathon, not a sprint, creates not only financial wealth but also enduring legacy.

Learning from Peers

Every sector offers lessons worth borrowing. Manufacturing SMEs show the power of efficiency and global competitiveness. Pharma SMEs demonstrate how R&D and compliance create long-term moats.Tech SMEs prove that intellectual property and talent can create premium value. Consumer SMEs remind us that brand and storytelling turn local players into national champions.

The smartest CEOs are those who don’t just learn from their own mistakes—they also learn from others’ successes and failures.

The Opportunity Ahead: India’s Amrit Kaal

India is entering a unique period of growth, often called the Amrit Kaal. Domestic demand is booming, government support for SMEs is stronger than ever, and global investors are looking for alternatives beyond China.This is a once-in-a-generation chance for Indian SMEs. But seizing it requires a new mindset.

As I often remind entrepreneurs: “SME ko chhota sochna band karna hoga. Vision bada rakho—market usse value karega.”

Closing Note to CEOs

The journey of an SME CEO is tough, but also deeply rewarding. The decisions you make today—about governance, capital, professionalization, and resilience—will determine not just your company’s future, but also your contribution to India’s growth story.

Remember: markets are not for the big, they are for the bold.Every SME has the potential to move from vision to victory. The only question is whether you are ready to think beyond the familiar, embrace change, and run the marathon. Because the future of Bharat’s economy depends on it.

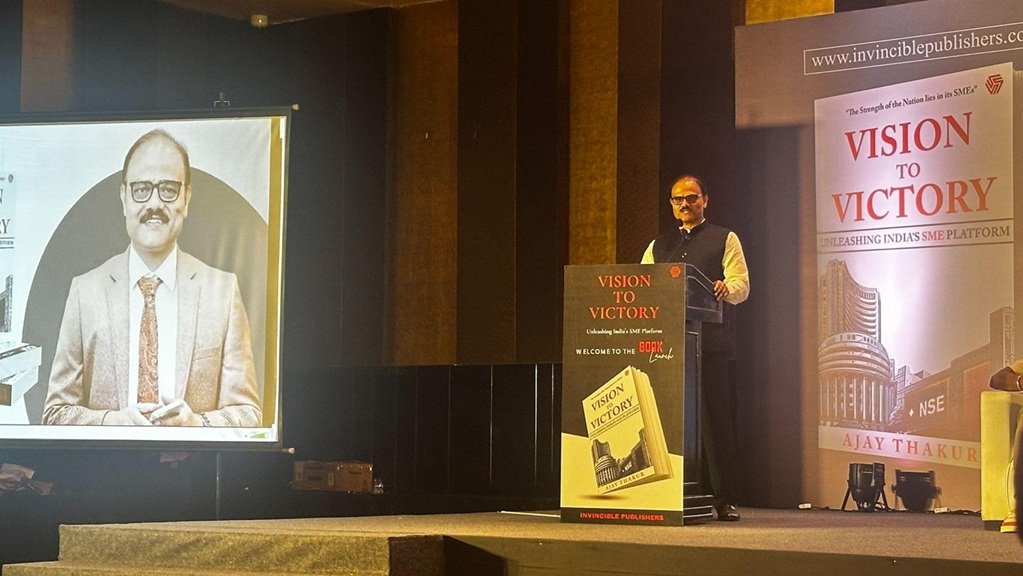

_______________________________________________________About the Author: Ajay Thakur is the CEO and Managing Partner of TGI SME Capital Advisors, a firm that empowers Indian SMEs with strategic capital, deep research, and long-term partnerships.

With over 30 years of experience in capital markets, he was instrumental in launching India’s first SME platform at BSE, through which more than 1,000 SMEs have raised nearly ₹18,000 crore.

He is also the author of “Vision to Victory – Unleashing India’s SME Growth Story”, where he shares insights on nurturing entrepreneurship and capital access.

Today, he continues to focus on helping small and mid-cap companies scale, innovate, and create lasting value—transforming tomorrow’s SMEs into India’s future large-cap leaders.

Reacted by Ayesha Aryan Rana And 1 Other -