-

VRIGHT Exchange -Insight Hooks posted an update in the group VRIGHT Exchange | Daily Digest: Corporate & Economy

1 month, 2 weeks agoVRIGHT Exchange | Weekly Review & Preview for September 15–20, 2025

Market Overview

• Nifty +0.9%, Sensex +0.9%, marking the third consecutive weekly gain, with closing levels near Nifty 50: 25,327, Sensex: 82,626• Broader indices outperformed: Midcaps +1.5%, Smallcaps +2.9%

• Key bullish drivers:

o Fed’s 25 bps rate cut and guidance for further easing

o Optimism around India–U.S. trade talks

o SEBI clean chit to Adani Group improving sentiment

Sector Momentum• Auto stocks surged early in the week following consumption-boosting tax cuts (GST reductions), led by Mahindra, Hyundai, TVS and M&M

• IT and Pharma soared after Fed policy relief and favorable U.S. drug regulatory actions, with Biocon and Natco among the top performers

• Energy and PSU banks gained, supported by order wins and policy tailwinds; Adani Power rallied ~12% after SEBI vindication accompanied by positive brokerage upgrades

Macro & FX Trends

• Foreign inflows resumed—FPIs bought an estimated ₹367 crore on Friday

• Rupee traded steady at ₹88.13–₹88.22/USD, under RBI intervention to limit volatility despite higher U.S. yields

• Govt food stocks surged—rice at 48.2 million tonnes and wheat at 33.3 million tonnes, offering policy flexibility ahead of festive demandPreview of Week Ahead

Key Catalysts

• U.S.–India trade talks in Washington (from Sept 22): Potential clarity on tariffs and market access

• Forthcoming U.S. data (jobs, inflation): Fed’s next moves may hinge on labor market trajectory.

• India CPI / IIP data: Signals for RBI’s rate and liquidity policy in Q4.

• Corporate earnings flow: Key releases from IT majors, infra names, banks & pharma.

• Geopolitical risks: Sanctions on Iran’s Chabahar port led to Friday weakness, reminding investors of exogenous risksBottom Line:

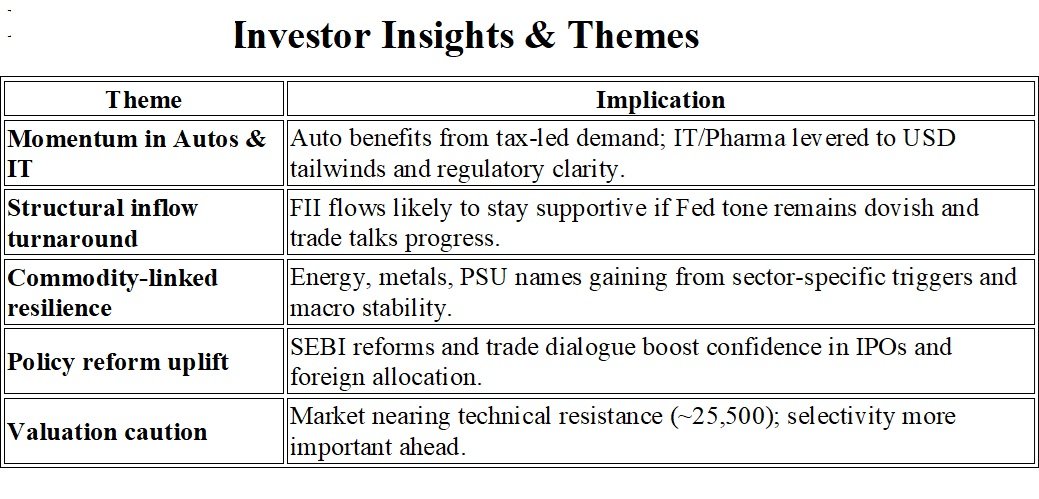

This week’s global cues and domestic regulatory clarity powered a meaningful rally.

Looking ahead, momentum hinges on trade progress, corporate earnings, and macro releases.

The risk-reward for public market allocations remains tilted to quality, high growth, and policy-aligned sectors.