-

VRIGHT Exchange – IPO Pulse posted an update in the group VRIGHT Exchange-IPO Tracker

1 month, 1 week agoIndia Heads for Busiest Month for IPOs in Nearly Three Decades

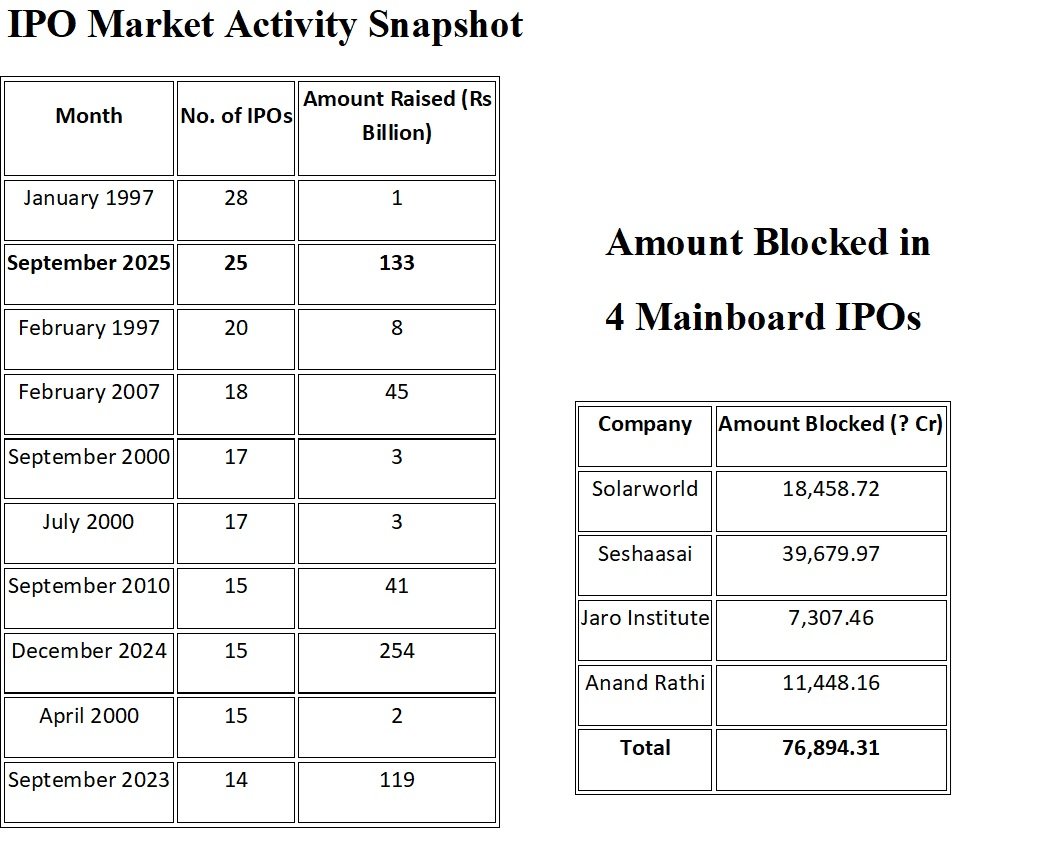

September 2025 is shaping up to be a landmark month for India’s IPO market, with 25 companies expected to go public on the main exchange board. This makes it the busiest month since January 1997, when 28 IPOs were launched.

Key Insight:

While January 1997 had the largest number of IPOs, the funds raised were negligible. In contrast, September 2025 marks a maturity phase for Indian capital markets, where fewer but larger IPOs are commanding significant investor interest.➡ Nearly ₹77,000 crore has been blocked in subscriptions for just these four IPOs — excluding SME IPO subscriptions.

Market Context

• Amount Raised: Of the 25 IPOs this month, 15 companies have already raised nearly $1 billion, while the remaining 10 are expected to raise an additional $500 million, per NSE data.• Investor Trends: FIIs have been particularly active, investing almost ₹429 billion ($4.8 billion) in IPOs and placements this year, despite being net sellers of ₹1.8 trillion in the broader secondary market.

• Tailwinds Driving Activity: According to Dharmesh Mehta, CEO of DAM Capital, this surge is fueled by:

o Strong business fundamentals and growth prospects

o Attractive valuations

o Robust domestic liquidity

o Renewed foreign investor participation• Annual Timing Factor: September traditionally sees heightened IPO activity as companies rush to list before October to avoid an additional quarter’s audit and prospectus updates.

Future Pipeline

The IPO calendar remains strong beyond September. Around 75 companies — including Tata Capital and LG Electronics India — have already secured regulatory approval and are expected to tap the markets in the coming months.Investor Takeaway:

India’s IPO market has entered a new phase of scale and depth. Unlike the late 1990s, when IPO volumes were high but fundraising modest, the 2020s are seeing fewer but much larger deals, reflecting both domestic investor strength and global investor appetite for Indian growth stories.