-

VRIGHT Exchange – Daily Digest posted an update in the group VRIGHT Exchange | Daily Digest: Corporate & Economy

3 weeks, 6 days agoMacro & Market Context

Macro & External Developments

• The rupee is under pressure, nearing record lows (~₹88.78–88.82 per USD), prompting RBI intervention in spot and swap markets to defend currency stability.

• The RBI is launching a deposit tokenisation pilot today (Oct 8), marking a notable push into fintech and digital banking infrastructure.

• The World Bank warned that new U.S. tariffs on Indian exports could dampen South Asia’s growth in 2026, though India’s FY26 growth forecast was upgraded to ~6.5%.

• Weak global cues, especially from U.S. and Asian markets, may temper sentiment today — the expectation is a cautious start for Nifty and Sensex.

• Globally, new U.S. tariffs on pharma, furniture, and other goods are being rolled out — raising uncertainty for trade flows.

Market Sentiment, Technicals & Flow

• Indian indices opened flat (Sensex just below 82,000; Nifty near 25,100) in early trade, reflecting cautious optimism.

• Technically, Nifty is facing resistance in the 25,200–25,300 zone; a break below 25,000 could trigger short-term correction.

• Bank Nifty has shown relative strength, forming a bullish candle and breaking resistance trendlines on solid volume.

• Gold and silver prices remain firm domestically, reflecting safe-haven demand amid mixed global cues.

Investor Insights

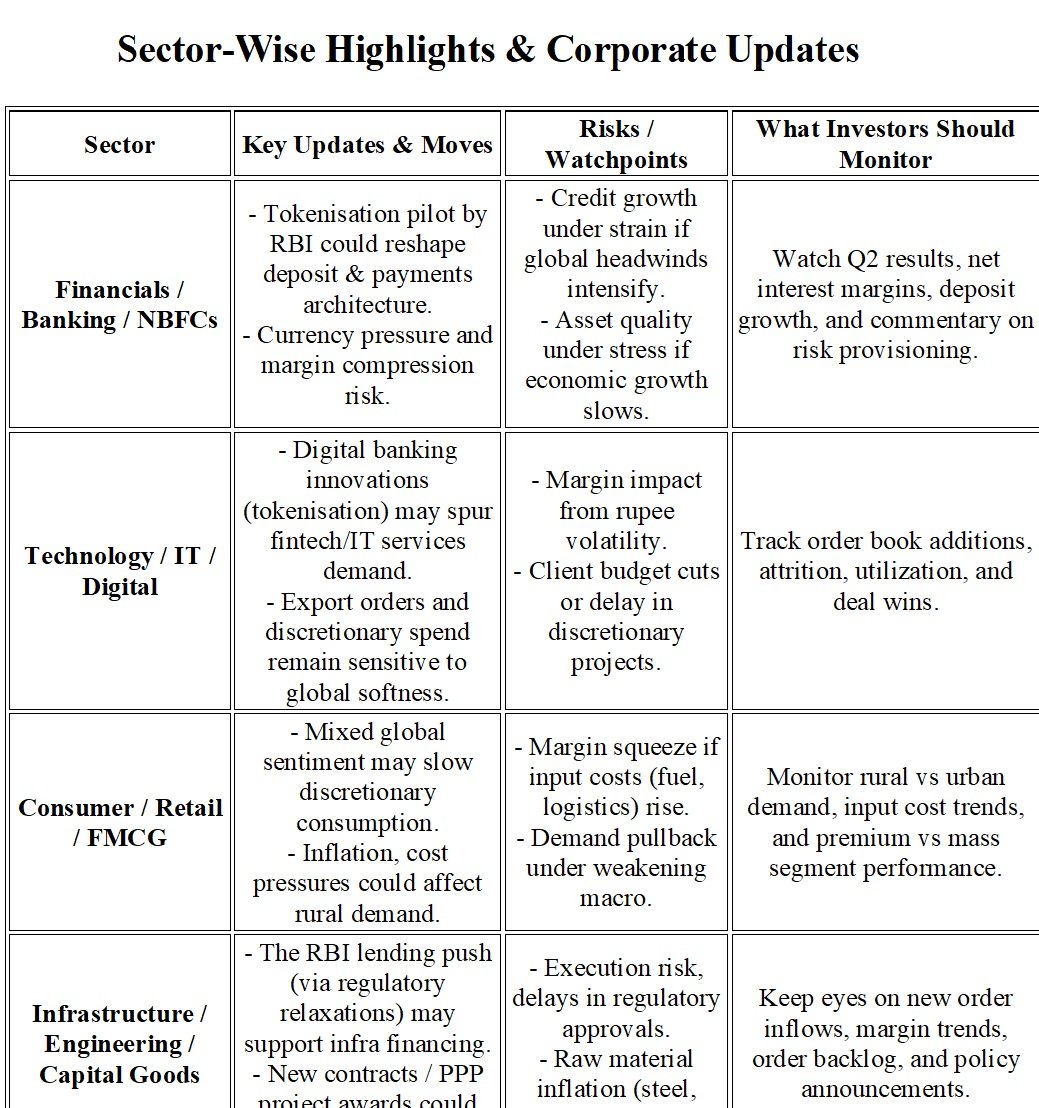

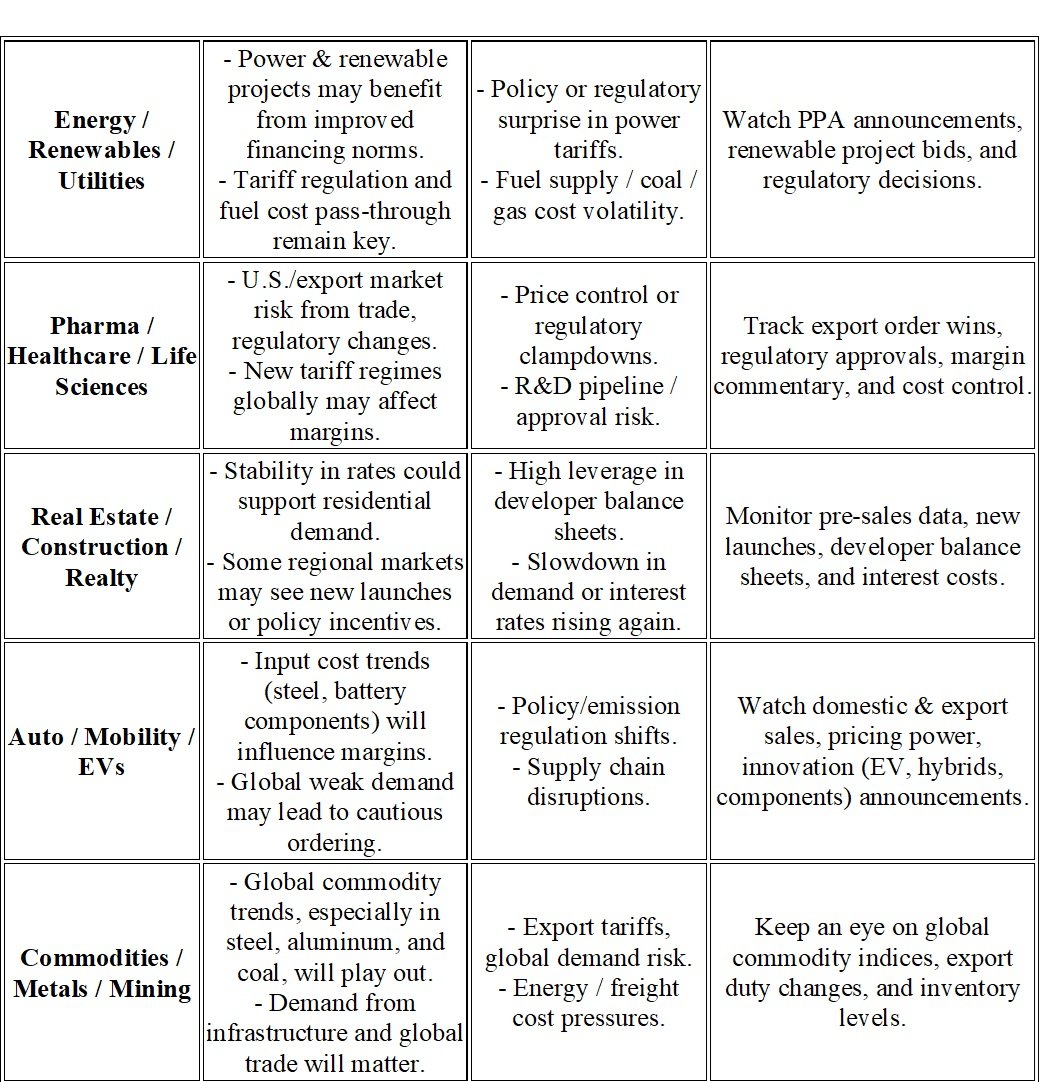

Cautious optimism with selectivity: Markets may remain choppy amid global uncertainty. But structurally supported segments (financials, infra, renewables) could outperform.

1. Currency risk is real: With the rupee under pressure, companies with unhedged foreign exposure (imports, raw materials, debt) should be watched closely.

2. Fintech / digital push is accelerating: Tokenisation and continued financial innovation may create new tech demand pockets.

3. Watch policy signals closely: RBI actions, tariff announcements, and regulatory reforms could shift flows abruptly.

4. Use support / resistance zones rigorously: Avoid overextending — with Nifty support ~25,000 and resistance ~25,200–25,300, trade accordingly.

5. Balance between growth & margin preservation: Companies with strong margins and balance sheets will be better positioned to ride volatility.