-

VRIGHT Exchange – Daily Digest posted an update in the group VRIGHT Exchange | Daily Digest: Corporate & Economy

3 weeks, 4 days agoMacro & Market Overview

• Mixed Global Cues & IPO Buzz: Indian markets opened with mixed tone. The LG Electronics India IPO saw strong subscription interest, reflecting appetite for marquee listings.

• FII Return & Cautious Optimism: Foreign institutional investors have resumed buying over the past few sessions, helping benchmarks regain footing.

• Tech Weakness in Focus: Weakness in IT and Pharma stocks after TCS’ modest Q2 results is weighing sentiment in the broader market.

• Credit & Borrowing Reforms on Radar: The RBI’s proposals to ease external commercial borrowing (ECB) rules and scrap cost caps on most foreign debt could benefit borrowers and infra/energy sectors.• Fresh Foreign Investment in Digital Space: Prosus is acquiring a ~10% stake in Ixigo for $146 million, underscoring continued interest in India’s digital / travel tech segment.

Key Corporate Developments

• Afcons Infrastructure – Secures a ₹576 crore order for civil and allied infrastructure works.

• Tata Consultancy Services (TCS) – Approves the incorporation of a wholly owned subsidiary in India to establish multiple AI and sovereign data centers, reinforcing its leadership in digital infrastructure.

• Jana Small Finance Bank – Board approves fundraise of up to ₹250 crore via NCDs on a private placement basis.

• NTPC Green Energy – Subsidiary signs an MoU with the Gujarat Government to set up large-scale solar and wind projects.

• Blue Dart – Launches an instant digital account opening platform to enhance customer convenience and efficiency.

• Muthoot Microfin – Allots 1,500 bonds worth $15 million on a private placement basis to strengthen funding.

• Star Cement – To meet on October 14 to consider a fundraise proposal.

• Lemon Tree Hotels – Expands portfolio with a new 50-room property in Rajasthan.

• RailTel Corporation – Receives a Letter of Intent worth ₹18.2 crore from a Karnataka government body.

• Natco Pharma – Delhi High Court dismisses an appeal by F. Hoffmann-La Roche AG, allowing Natco to launch a generic version of Risdiplam at ₹15,900 per unit.

• Sri Lotus Developers – Approves the formation of five new subsidiaries with ₹100 crore investment each for business expansion.

• Adani Enterprises – Allots 1 lakh NCDs worth ₹1,000 crore on a private placement basis.

• NIIT Ltd. – Approves a scheme of amalgamation of two wholly owned subsidiaries.

• Sammaan Capital – Approves issuance of $450 million senior secured social bonds (7.5%, due 2030) to fund sustainable lending.

• NTPC Ltd. – Signs MoU with the Gujarat Government to explore collaboration opportunities across the energy value chain.

• Fortis Healthcare – IHH Healthcare Berhad announces an open offer to acquire a 26.1% stake in the company.

• Rajesh Power Services – Signs an MoU with the Gujarat Government for ₹4,754 crore projects expected to create over 33,000 jobs in the state.

• MedPlus Health – Subsidiary receives a suspension order for one drug license in Andhra Pradesh.

• ACME Solar Holdings – Clarifies that recent reports relate to unlisted promoter entity MKU Holdings; appointment of Jitendra Agrawal pertains to its renewable equipment manufacturing business.

• Crest Ventures – Incorporates a new subsidiary, Crest Prime Projects, to expand its real estate development footprint.

• Amber Enterprises – Subsidiary ILJIN Electronics (India) acquires 56 lakh shares of Unitronics via ILJIN Holding for NIS 156 million (New Israeli Shekel).

• Tata Motors – Announces demerger of its commercial vehicle business into TMLCV, while the passenger vehicle segment stands amalgamated. The scheme is effective from October 1, 2025.

Commodity Market Update

Gold: $2,400.22 (+0.70%}

Silver : $47.59 (0.04%)

Crude Oil (Brent): $65.31 (0.03%)

Natural Gas: $5.08 (+0.91%)

Source: in.investing.com, as of 8:10 AM ISTInvestor Insights

1. Market breadth remains neutral-to-positive, with focus shifting to corporate earnings and policy triggers.2. Fundraising and infra project momentum continue to signal economic recovery in core sectors.

3. AI and renewable energy themes gaining institutional traction post recent announcements by TCS, NTPC Green, and Adani Group.

4. Investors should watch for upcoming CPI data and quarterly earnings as near-term sentiment drivers.

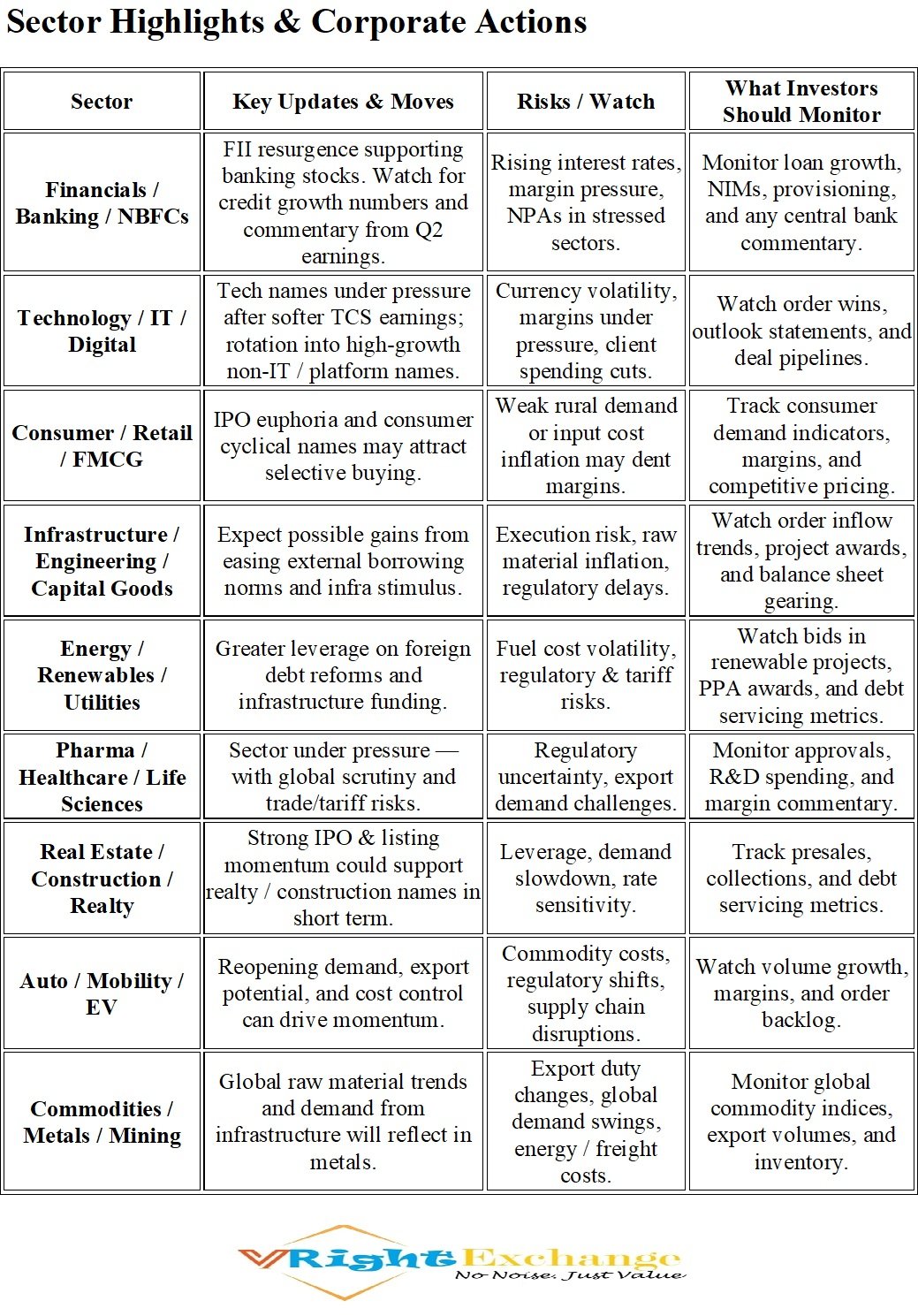

5. Rotation Looks Real

After the underperformance of IT / Pharma, money is shifting toward sectors like Infrastructure, Real Estate, and Renewables. Weak tech earnings are accelerating this rotation.6. Policy Signals Matter

The RBI’s reforms on external borrowing and credit access may prove a catalyst for leveraged sectors like infra, energy, and industrials.7. Quality Stocks Gain

In volatile conditions, companies with strong balance sheets, healthy cash flows, and clear order books will attract capital.8. Be Selective in Tech

Even within IT, names with AI / cloud orientation, margin improvement stories, or exposure beyond outsourcing may outperform.9. Watch IPO & Listing Activity

The strong reception to LG India’s IPO underscores that marquee listings can energize market sentiment.10. Risk of Overvaluation

Some growth sectors may be richly priced — sudden negative surprises in margins, regulation, or demand could lead to sharp corrections.