VRIGHT Exchange | Daily Digest: Corporate & Economy

Stay informed. Stay ahead.

This group curates and discusses key developments from the world of business, finance, and markets — all in one place. From corporate news, government policies, and global economic indicators to major industry moves and market trends, get timely updates and share insights that matter.

What to expect:

Breaking news impacting Indian and global markets

Key announcements from listed companies

Macroeconomic data (GDP, inflation, RBI/Fed policies)

Sectoral updates and earnings snapshots

Media coverage, opinion pieces, and market commentary

Whether you’re an investor, analyst, journalist, or executive — this group helps you stay sharp and responsive in a fast-moving environment.

No noise. Just signal.

-

Public

-

145

Posts -

85

Members

-

-

-

-

VRIGHT Exchange | Research & Strategy Desk posted an update in the group VRIGHT Exchange | Daily Digest: Corporate & Economy

3 weeks agoResults Today

Tech Mahindra, ICICI Lombard General Insurance Company, ICICI Prudential Life Insurance Company, Aditya Birla Money, Cyient DLM, GTPL Hathway, Indian Renewable Energy Development Agency, Bank of Maharashtra, Persistent Systems, Leela Palaces Hotels & Resorts, and Thyrocare Technologies will announce their quarterly earnings today.

-

VRIGHT Exchange – Daily Digest posted an update in the group VRIGHT Exchange | Daily Digest: Corporate & Economy

3 weeks agoVRIGHT EXCHANGE | Daily Market Update — 14 October 2025

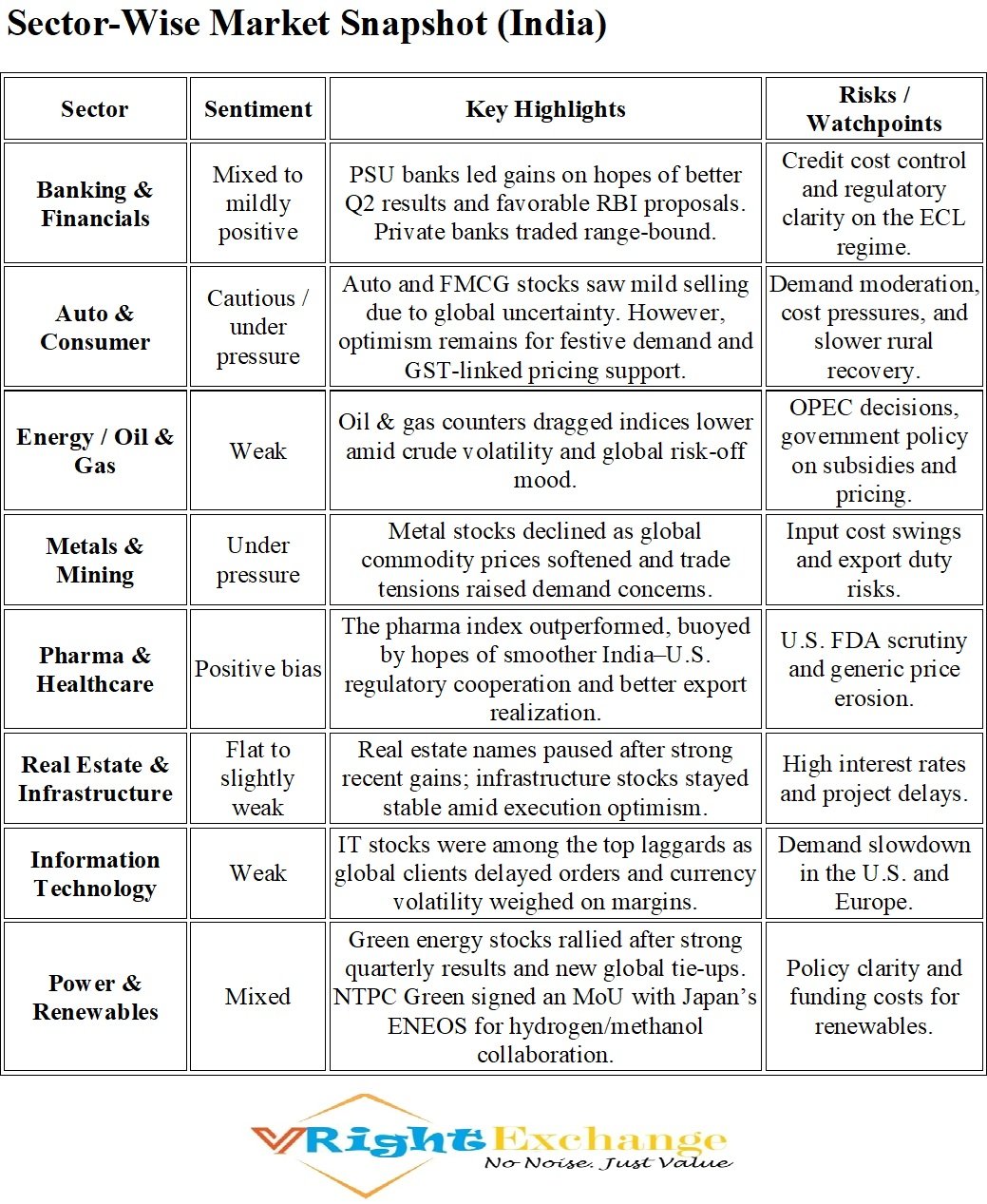

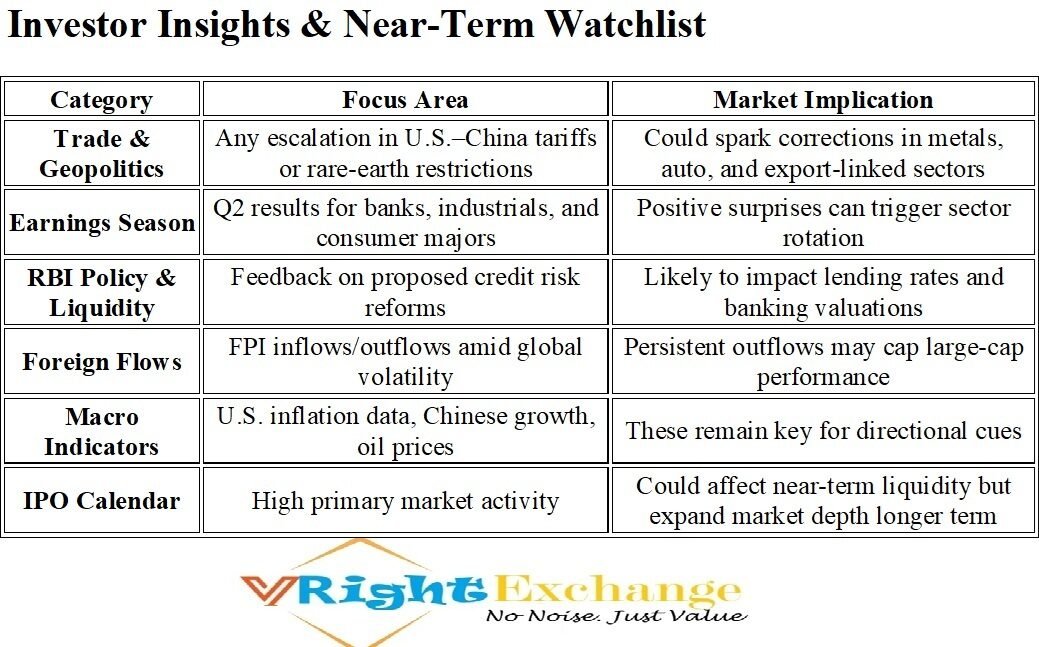

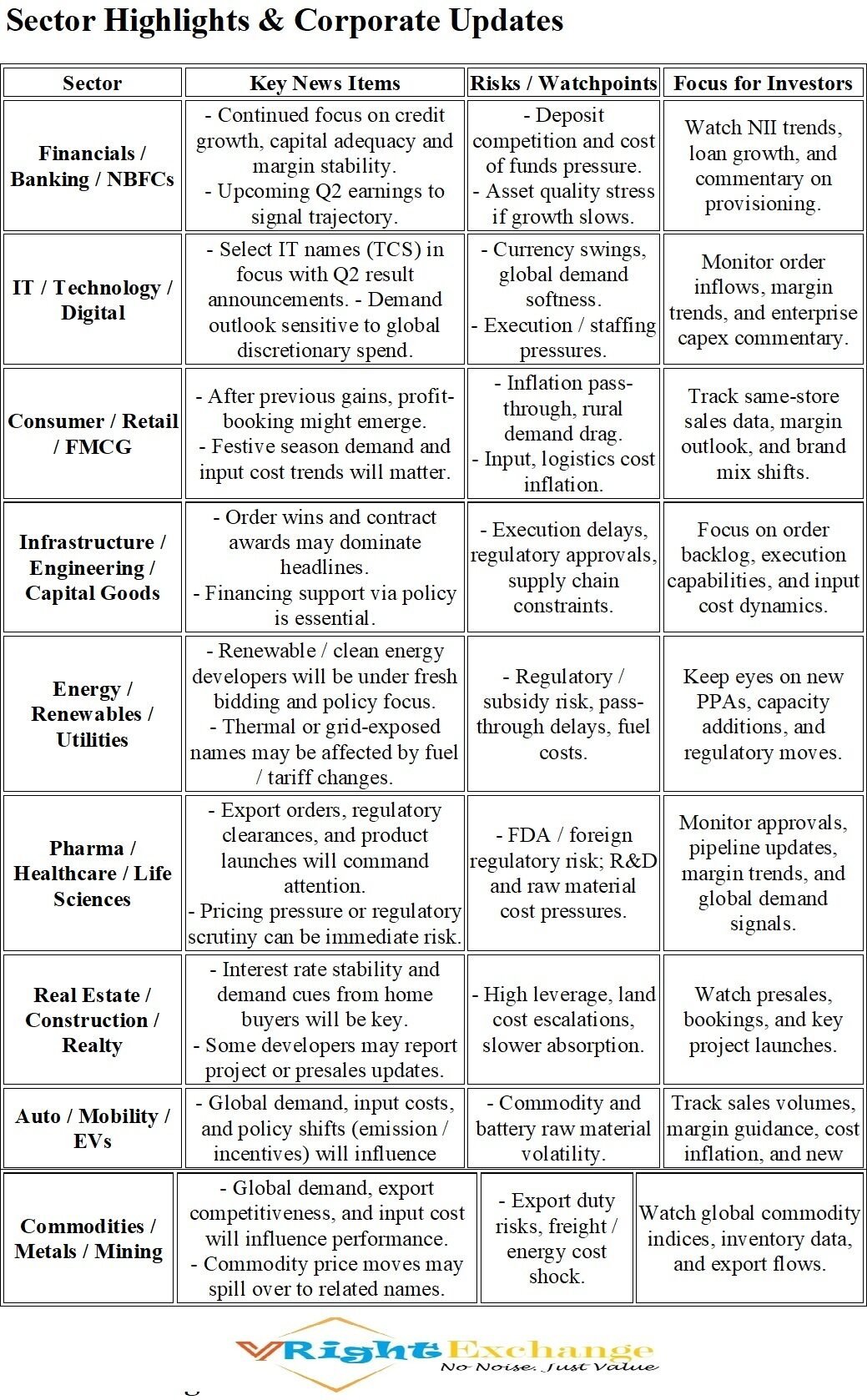

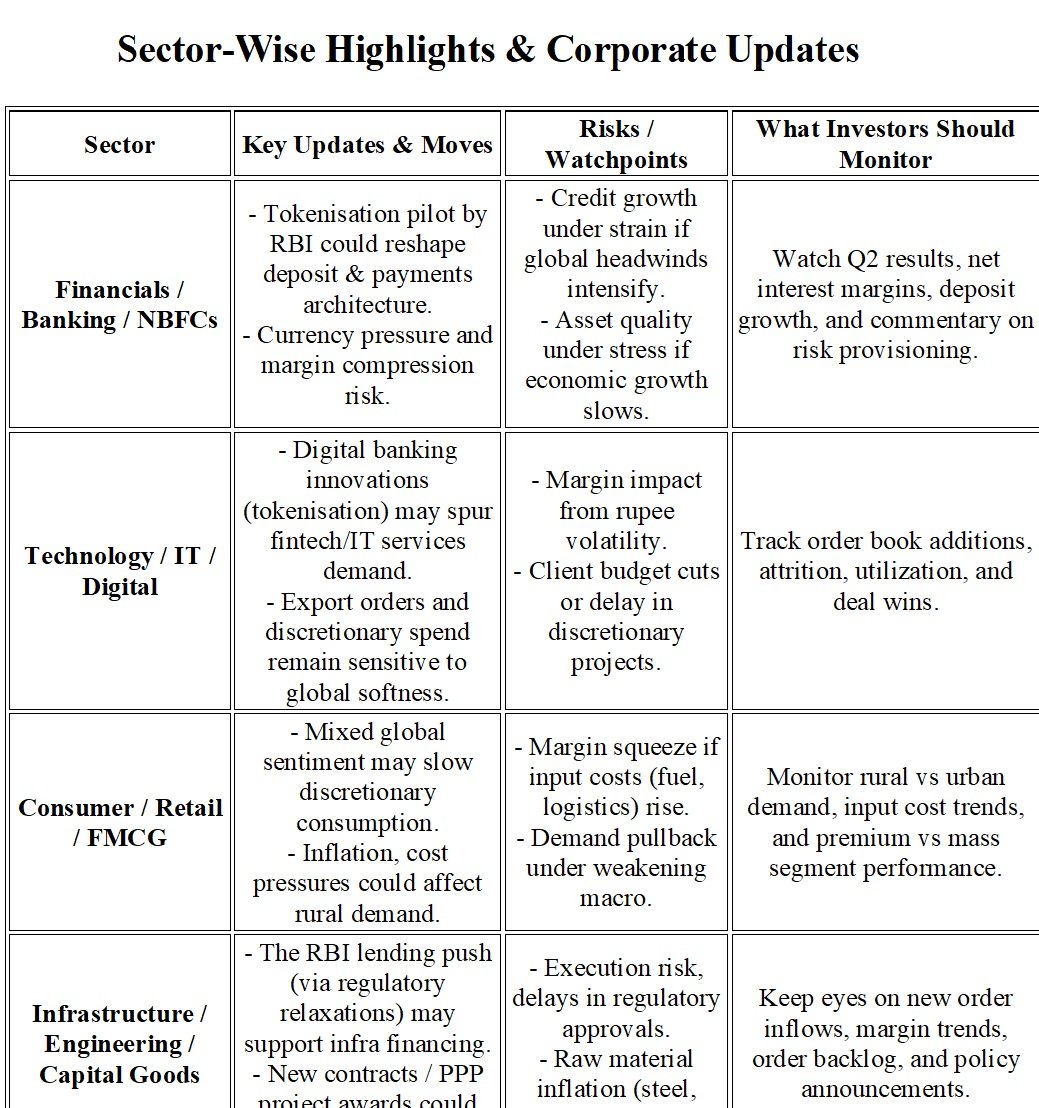

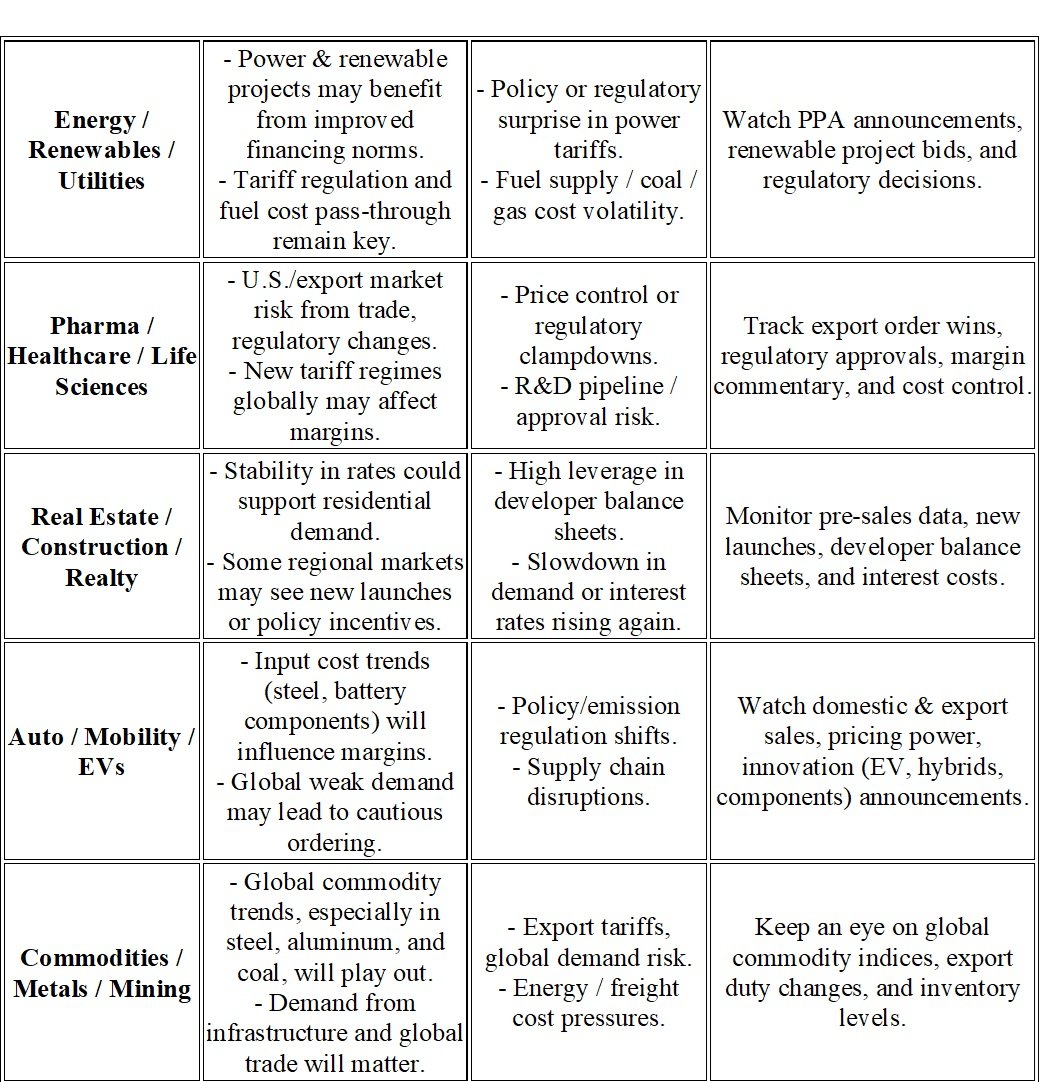

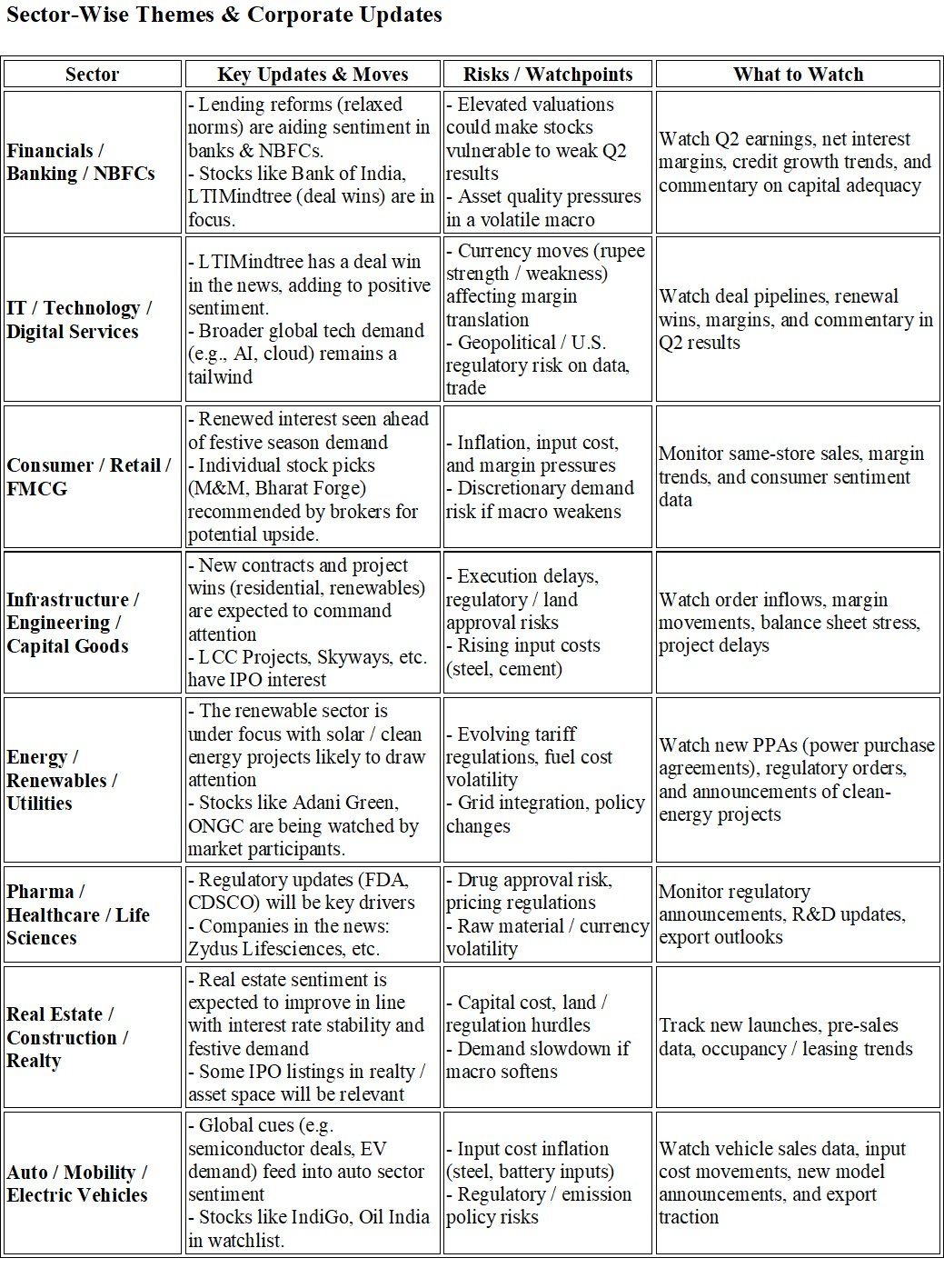

Sector-Wise Overview | Corporate, Macro & Investor Insights

Global & Macro Trends

• U.S.–China Trade Tensions: Renewed frictions over rare-earth export controls and reciprocal port fees have heightened global supply chain concerns. Manufacturing, tech, and logistics sectors are seeing senti…[Read more] -

VRIGHT Exchange – Daily Digest posted an update in the group VRIGHT Exchange | Daily Digest: Corporate & Economy

3 weeks, 1 day agoMacro & Global Overview

Global Trade & Economy

• The U.S.–China trade war has flared up again, with Washington threatening to impose 100% tariffs on Chinese imports from November 1. Beijing’s export controls on rare earth elements have heightened global supply chain concerns.

• Asian markets declined nearly 2% (excluding Japan), while U.S. fu…[Read more] -

VRIGHT Exchange – Daily Digest posted an update in the group VRIGHT Exchange | Daily Digest: Corporate & Economy

3 weeks, 1 day agoMacro & Global Overview

Global Trade & Economy

• The U.S.–China trade war has flared up again, with Washington threatening to impose 100% tariffs on Chinese imports from November 1. Beijing’s export controls on rare earth elements have heightened global supply chain concerns.

• Asian markets declined nearly 2% (excluding Japan), while U.S. fu…[Read more] -

VRIGHT Exchange | Research & Strategy Desk posted an update in the group VRIGHT Exchange | Daily Digest: Corporate & Economy

3 weeks, 2 days agoGLOBAL SHOCK: OCTOBER 11, 2025

On October 11, 2025, President Donald Trump announced 100% tariffs on all Chinese imports and export restrictions on critical U.S. software, retaliating against China’s rare earth mineral export ban.

The decision triggered a global market meltdown:

Global equities lost $1.6 trillion in value in a single trading s…[Read more]

-

VRIGHT Exchange | Research & Strategy Desk posted an update in the group VRIGHT Exchange | Daily Digest: Corporate & Economy

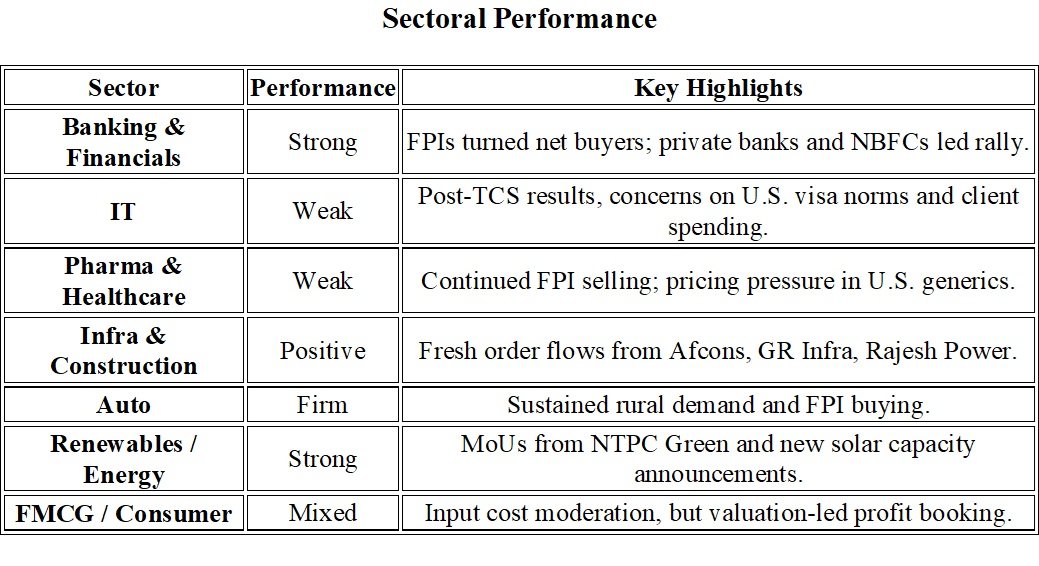

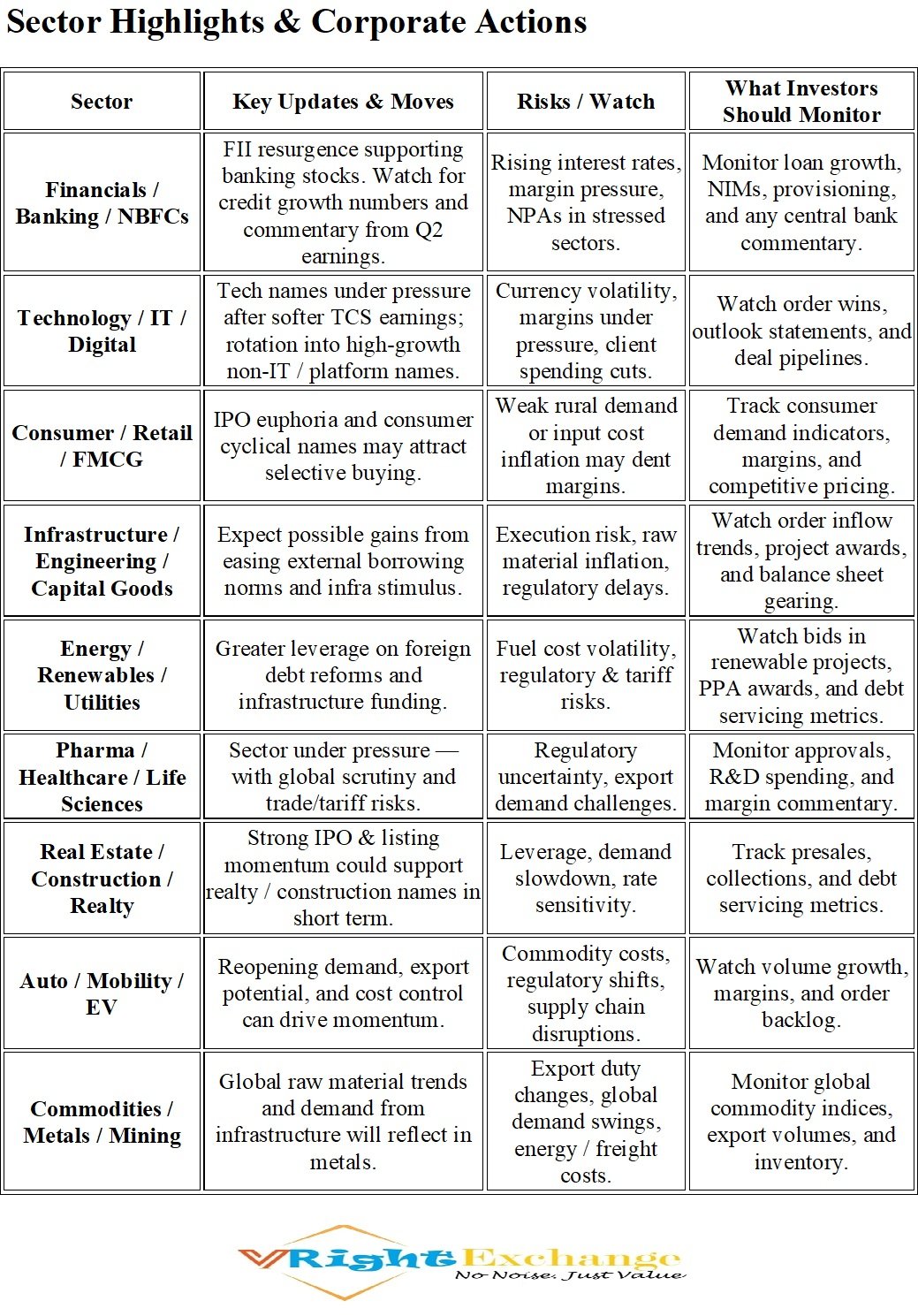

3 weeks, 3 days agoWeekly Market Review: Oct 6 – 10, 2025

Market Overview

Indian equities posted a steady performance through the week, with the Nifty50 hovering around the 25,200 mark and the Sensex near 82,700, supported by renewed FPI inflows, strong domestic liquidity, and selective buying in financials and infrastructure.

The market absorbed global v…[Read more]

-

VRIGHT Exchange – Daily Digest posted an update in the group VRIGHT Exchange | Daily Digest: Corporate & Economy

3 weeks, 4 days agoMacro & Market Overview

• Mixed Global Cues & IPO Buzz: Indian markets opened with mixed tone. The LG Electronics India IPO saw strong subscription interest, reflecting appetite for marquee listings.

• FII Return & Cautious Optimism: Foreign institutional investors have resumed buying over the past few sessions, helping benchmarks regain foo…[Read more]

-

VRIGHT Exchange – Daily Digest posted an update in the group VRIGHT Exchange | Daily Digest: Corporate & Economy

3 weeks, 5 days agoVRIGHT Exchange – Daily Digest | Corporate & Economy Analysis for Oct 9, 2025

Macro & Market Overview

• Global cues are mostly favorable today, driving expectations of a green opening for Indian equities. GIFT-Nifty futures point to a positive start.

• The rupee might get mild support from a softer U.S. dollar, but interventions by the RBI r…[Read more]

-

VRIGHT Exchange | Research & Strategy Desk posted an update in the group VRIGHT Exchange | Daily Digest: Corporate & Economy

3 weeks, 6 days agoUPDATES’

ORDER WINS

Sarveshwar Foods Ltd: Secures a major export order worth ₹266 million from Delaware, USA–based Agri Services & Trade LLC. Total export orders now stand at ₹1,226 million over the past two months.

AIA Engineering Ltd: Subsidiary Vega Industries Chile SpA wins a $32.9 million (~₹291 crore) order from a Chilean copper mine fo…[Read more]

-

VRIGHT Exchange – Daily Digest posted an update in the group VRIGHT Exchange | Daily Digest: Corporate & Economy

3 weeks, 6 days agoMacro & Market Context

Macro & External Developments

• The rupee is under pressure, nearing record lows (~₹88.78–88.82 per USD), prompting RBI intervention in spot and swap markets to defend currency stability.

• The RBI is launching a deposit tokenisation pilot today (Oct 8), marking a notable push into fintech and digital banking infrast…[Read more]

-

VRIGHT Exchange – Daily Digest posted an update in the group VRIGHT Exchange | Daily Digest: Corporate & Economy

4 weeks agoMacro & Market Snapshot -7th Oct 2025

Global / External Developments

• Mixed global cues ahead of U.S. data and central bank insights are likely weighing slightly on market opens. Indian markets may open with softness.

• India’s trade strategy came under scrutiny: a government think-tank cautioned that without stronger engagement with China…[Read more]

-

VRIGHT Exchange – Daily Digest posted an update in the group VRIGHT Exchange | Daily Digest: Corporate & Economy

4 weeks, 1 day agoDaily Corporate & Economy Report — 6 October 2025

Key Corporate Developments

Bondada Engineering: Received sanction from Bank of Baroda for enhanced credit facilities to support project execution. The company reported an order book of ₹5,044 crore (as of April 1, 2025) and expects new orders worth ₹6,250–7,000 crore, targeting a closing order b…[Read more]

-

VRIGHT Exchange – Daily Digest posted an update in the group VRIGHT Exchange | Daily Digest: Corporate & Economy

4 weeks, 1 day agoDaily Market Update — 6 October 2025

Macro & Market Overview

RBI Policy: The central bank maintained the repo rate at 5.5%, signaling continued vigilance on inflation but confidence in India’s growth trajectory.

Rupee & Currency Flows: The rupee remained under mild pressure due to global tariff tensions, though RBI intervention in offshore mar…[Read more]

-

VRIGHT Exchange | Research & Strategy Desk posted an update in the group VRIGHT Exchange | Daily Digest: Corporate & Economy

4 weeks, 1 day agoPreview: 6–11 Oct 2025

What Will Drive Markets

Q2 Earnings Kickoff

o TCS is expected to report Oct 9 — this will set the tone for IT and export names.

o Banks, NBFCs, and consumer staples will follow — guidance, margins, and credit trends will be scrutinized.

IPO Debut / Subscription Trends

o Tata Capital’s IPO is expected to dominat…[Read more]

-

VRIGHT Exchange | Research & Strategy Desk posted an update in the group VRIGHT Exchange | Daily Digest: Corporate & Economy

4 weeks, 1 day agoWeekly Review: 29 Sept – 4 Oct 2025

Market Snapshot & Trend

• After several volatile sessions in late September, the equity markets staged a modest rebound. The Sensex rose ~224 points (≈ 0.28%) on Oct 3, while the Nifty gained ~58 points (≈ 0.23%) to close around 24,894.

• Over the week, indices were up ~0.97% (both Sensex & Nifty) on a holi…[Read more]

-

VRIGHT Exchange – Daily Digest posted an update in the group VRIGHT Exchange | Daily Digest: Corporate & Economy

1 month agoVRIGHT Exchange – Daily Digest | Corporate & Economy Analysis for Oct 3, 2025

Macro & Market Sentiment

• Markets opened positive tracking global cues but faced volatility ahead of a heavy IPO pipeline next week (~₹27,000 crore).

• RBI’s reform push continues to drive optimism, especially in financials and manufacturing-linked names.

•…[Read more] -

VRIGHT Exchange – Daily Digest posted an update in the group VRIGHT Exchange | Daily Digest: Corporate & Economy

1 month agoKey Context & Market Status

Holiday Notice: Equity markets (NSE, BSE) are shut today for Gandhi Jayanti & Dussehra.

With markets closed, today’s session is a “rest day” — but macro, global, and regulatory moves could shape momentum when trading resumes.

FIIs on Oct 1 logged net outflows of ~₹1,605 Cr while DIIs bought ~₹2,916 Cr.

Key re…[Read more]

-

VRIGHT Exchange | Research & Strategy Desk posted an update in the group VRIGHT Exchange | Daily Digest: Corporate & Economy

1 month agoORDER WINS

Atlanta: Bags ₹2,485 Cr Maharashtra expressway sub-contract from IRCON.

Adani Green Energy: Commences 408.1 MW Khavda (Gujarat) power project; total capacity now 16,486 MW.

Innovators Facade: Wins ₹93.77 Cr order from DLF for Chennai Downtown façade project.

CFF Fluid Control: Secures ₹11.69 Cr defence order for Navy’s P75 submarin…[Read more]

-

VRIGHT Exchange | Research & Strategy Desk posted an update in the group VRIGHT Exchange | Daily Digest: Corporate & Economy

1 month agoCORPORATE Update

Indian Renewable Energy Development Agency (IREDA)

Q2 YoY: Loan sanctions jump 86% to ₹33,148 Cr vs ₹17,860 Cr.

Loan disbursements up 54% to ₹15,043 Cr vs ₹9,787 Cr.

Pfizer

Secures a three-year reprieve from US tariffs on pharmaceutical imports imposed by former President Trump.

Pharmaceutical Sector

Trump’s 100% tari…[Read more]

-

VRIGHT Exchange – Daily Digest posted an update in the group VRIGHT Exchange | Daily Digest: Corporate & Economy

1 month agoMarket snapshot -1 Oct 2025

Global risk tone mixed-to-cautious: US political noise (funding/standoff), central-bank caution and fresh trade/tariff headlines kept sentiment choppy.

India: markets are watching today’s RBI/MPC window and the corporate earnings calendar; breadth tilted slightly negative early in the session and FIIs remain net s…[Read more]