Economy & Industry Triggers

Tracking Macro Trends. Understanding Market Impact.

This group is designed for investors, analysts, financial professionals, and media to follow and discuss the macro and regulatory events that shape market sentiment and sectoral shifts.

-What You’ll Find Here:

GDP, Inflation & Employment Data – Timely updates and expert takes on key macro indicators

Central Bank Policies – RBI & US Fed rate actions, commentary, and their market implications

Union Budget & Policy Announcements – Sectoral impact, allocation trends, and capital market response

SEBI, RBI & Government Regulations – Important changes affecting market intermediaries, companies, and investors

Industry Commentary & Expert Reactions – Insights from economists, fund managers, and sector leaders

>Why Join?

To stay ahead of economic and policy events, understand their implications across industries, and engage in insightful conversations with market-aware professionals.

Follow the triggers. Shape your strategy.

> No noise. Just value.

Be part of the Economy & Industry Triggers group on VRight Exchange.

-

Public

-

41

Posts -

82

Members

-

-

-

-

VRIGHT Exchange | Research & Strategy Desk posted an update in the group Economy & Industry Triggers

3 weeks, 2 days agoTrillions Lost, Lessons Gained — The Story of October 11, 2025

By VRIGHT Exchange Research Desk

October 11, 2025, will be remembered as the day global financial markets hit the reset button. Within hours, trillions in market value were wiped out, leaving investors stunned and portfolios deep in the red. Yet, in this chaos lay profound l…[Read more]

-

VRIGHT Exchange | Research & Strategy Desk posted an update in the group Economy & Industry Triggers

3 weeks, 5 days agoFund Flow Activity – NSE & BSE | 8th October 2025

Market Turnover (₹ Crore)

Cash Segment: NSE ₹89,602.56 + BSE ₹7,644.04 → Total ₹97,246.6 Cr

F&O Segment: NSE ₹1,44,038.37 + BSE ₹25,36,615.62 → Total ₹2,55,07,653.99 Cr

Provisional Cash Flow (₹ Crore)

FII / FPI: Net Buy +81.28 (₹10,286.98 – ₹10,205.70)

DII: Net Buy +329.96 (₹11,733.48 – ₹11,4…[Read more]

-

VRIGHT Exchange | Research & Strategy Desk posted an update in the group Economy & Industry Triggers

3 weeks, 5 days agoSwadeshi 2.0

The Government of India is accelerating self-reliance across critical sectors, creating massive import substitution opportunities for domestic companies.

Key Sectoral Import Dependence:

Minerals & Ores: >40% imported

Organic Chemicals: >50% imported

Fertilizers (DAP & MOP): >60% imported

Medical Devices: >80% imported

Crude…[Read more]

-

VRIGHT Exchange | Research & Strategy Desk posted an update in the group Economy & Industry Triggers

4 weeks, 1 day agoBig Move from RBI: NBFCs Get Global Wings!

The Reserve Bank of India has unlocked a game-changing reform — NBFCs can now borrow unlimited dollars from global markets.

What’s Changed?

No cap on foreign borrowings

No end-use restrictions

Fully market-determined interest rates

In short: NBFCs just got the freedom to raise funds globally — w…[Read more]

-

VRIGHT Exchange | Research & Strategy Desk posted an update in the group Economy & Industry Triggers

4 weeks, 1 day agoGlobal Stock Markets Q3 2025 — Winners & Laggards

The first nine months of 2025 have delivered some striking shifts in global equity performance — with Europe stealing the spotlight.

Top Performers

Central and Eastern Europe are leading the global rally, with multiple markets gaining over 50% YTD.Czech Republic: +55.4%

Greece: +53.4%

Pol…[Read more]

-

VRIGHT Exchange | Research & Strategy Desk posted an update in the group Economy & Industry Triggers

1 month agoNikkei 225 — The Breakout Story

Why the Rally?

Corporate Reforms: Stronger governance, higher shareholder returns, and record buybacks.

Ultra-Loose BOJ Policy: Negative rates and aggressive QE kept liquidity abundant.

Yen Weakness: A boon for exporters, driving earnings growth.

Valuation Reset: Japan Inc. re-rated from “cheap” to “attr…[Read more]

-

VRIGHT Exchange | Research & Strategy Desk posted an update in the group Economy & Industry Triggers

1 month agoREGULATORY & APPROVALS

Lupin: USFDA nod for pediatric Rivaroxaban oral suspension.

PTC India Financial Services: BSE seeks clarification on board exits, governance.

RBI: Issues draft norms extending gold metal loan repayment to 270 days.

PRODUCT LAUNCHESEpack Durable: Rolls out new domestic vacuum cleaner line.

CORPORATE…[Read more]

-

OmniScience Capital posted an update in the group Economy & Industry Triggers

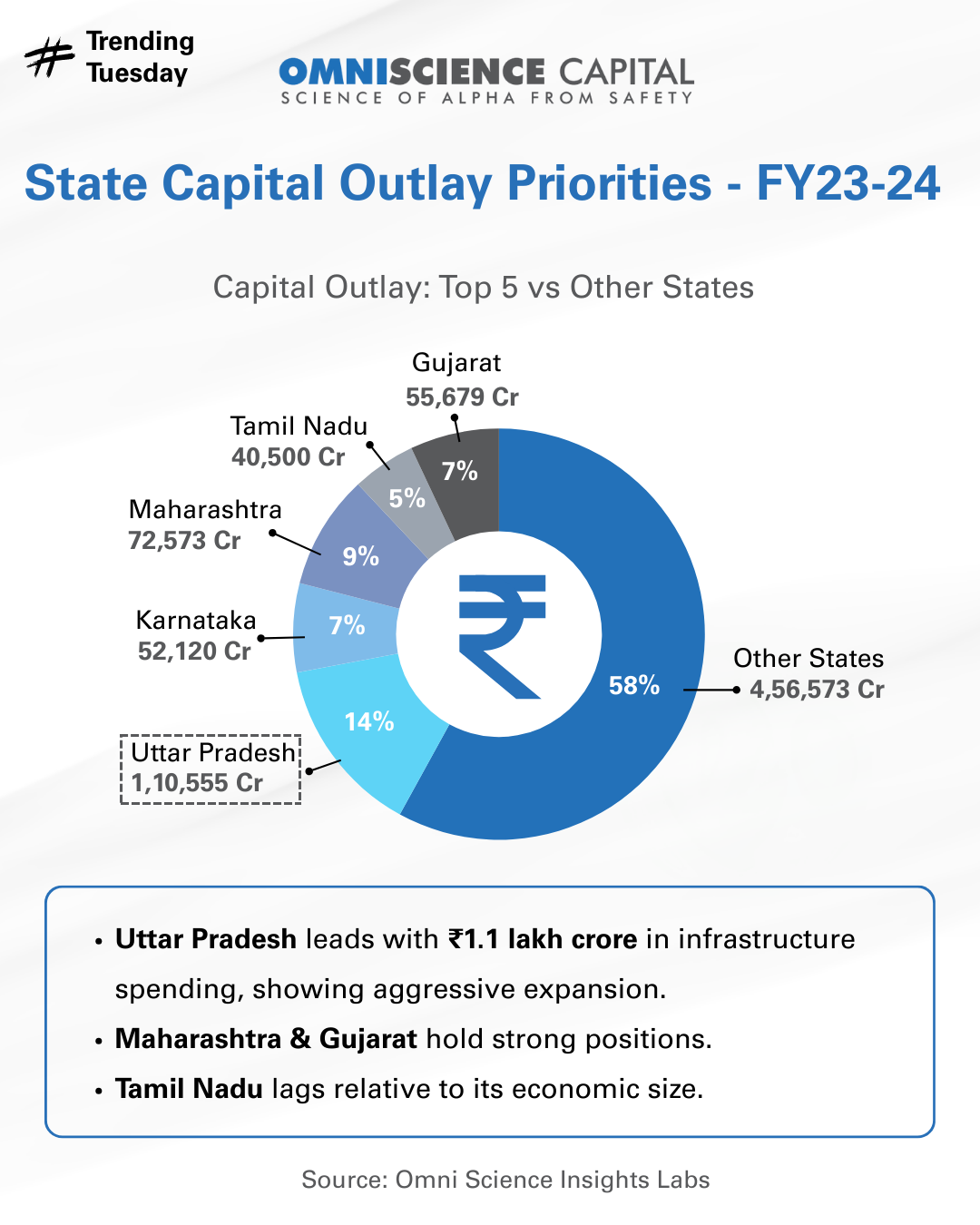

1 month ago#TrendingTuesday

India’s Infrastructure Drive: FY23-24 Capital Outlay

States have allocated Rs 7.9 lakh crore for capital outlay in FY24, with Uttar Pradesh and Maharashtra leading the way.

The bulk of spending comes from a diverse set of states, reflecting India’s decentralized approach to infrastructure growth. -

OmniScience Capital posted an update in the group Economy & Industry Triggers

1 month ago⚓ India is going full steam ahead!

By 2035, the Indian Navy will command a fleet of 200+ warships and submarines, defending our seas and boosting indigenous defense manufacturing.#MacroMonday #DefenceManufacturing #DefenceSector

-

OmniScience Capital posted an update in the group Economy & Industry Triggers

1 month, 1 week agoH-1B fee hike adds pressure on Indian IT.

Our Scientific Investing framework flagged risks early – we fully exited IT stocks in Jan 2025. Evidence > noise is how we protect & grow wealth.

#ScientificInvesting #IT #H1BDisclaimer: https://www.omnisciencecapital.com/disclosures/

-

OmniScience Capital posted an update in the group Economy & Industry Triggers

1 month, 2 weeks ago#SunnySunday

India’s Services Sector is Having a Moment!

With record demand, rising exports, and 15-year high growth, the backbone of India’s economy is stronger than ever.

Here’s to a Sunday full of sunshine – and service-driven success! -

OmniScience-Spotlight posted an update in the group Economy & Industry Triggers

1 month, 2 weeks agoFOMC Rate Cut Analysis and Market Implications

By Ashwini Shami, Executive Vice President and Portfolio Manager, OmniScience Capital

The Federal Open Market Committee (FOMC) has adopted a neutral-to-accommodative monetary policy stance, carefully balancing labor market conditions with inflation dynamics.

Notably, the US core Personal…[Read more]

-

OmniScience Capital posted an update in the group Economy & Industry Triggers

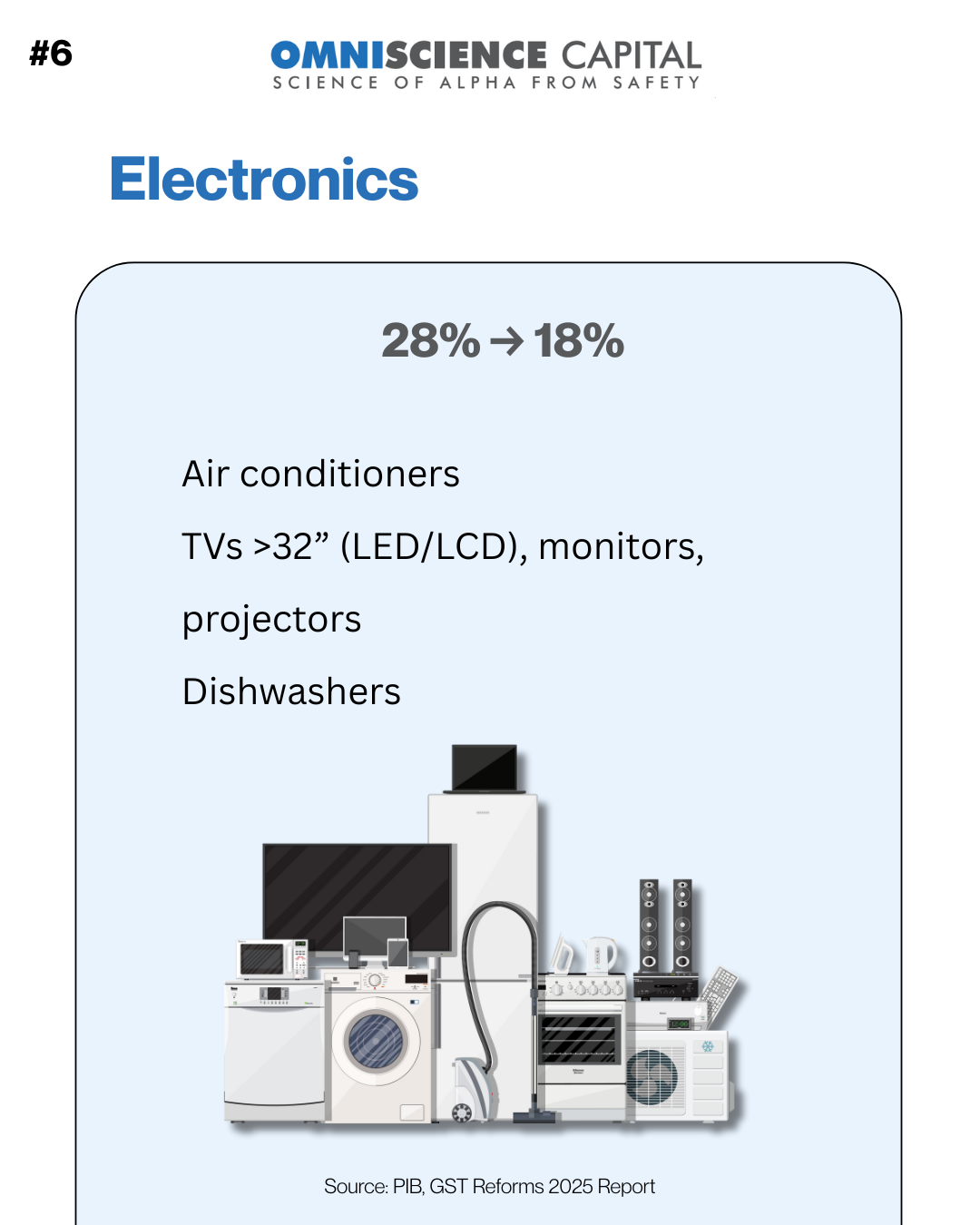

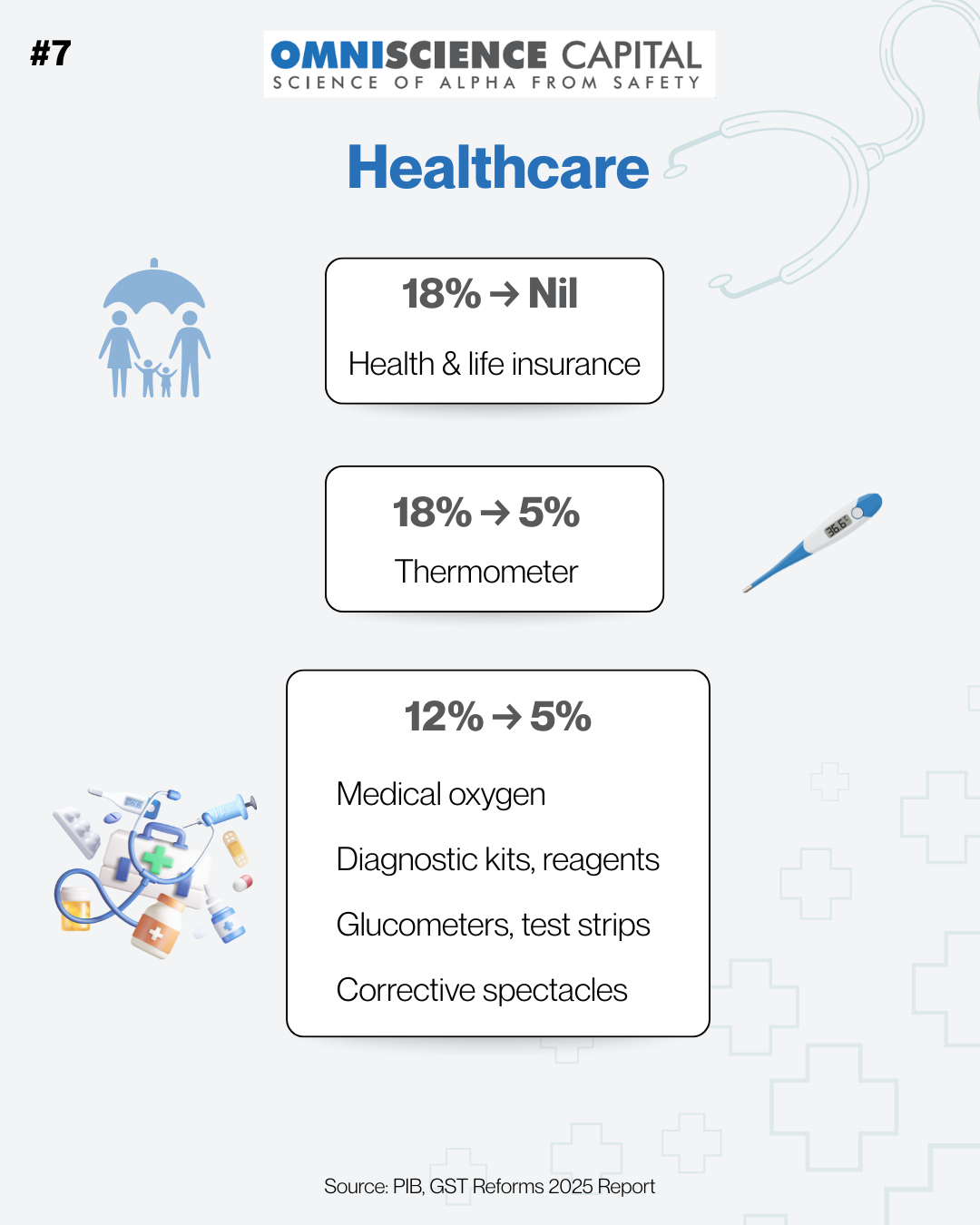

1 month, 2 weeks agoGST 2.0 = Growth, Simplicity, Relief

From household essentials to healthcare and housing, GST 2.0 brings real savings and ease of doing business.

A citizen-first, business-friendly reform that powers India’s next economic leap.#ThrivingThursday #GSTReform #GSTIndia

-

VRIGHT Exchange | Research & Strategy Desk posted an update in the group Economy & Industry Triggers

1 month, 2 weeks agoGlobal Policy Signals: Fed Rate Cut and Implications for India and Emerging Markets

The U.S. Federal Reserve’s recent 25 bps rate cut marks the start of an easing cycle, reflecting concerns over slowing labor markets and persistent inflation pressures. Chair Jerome Powell emphasized that future policy decisions remain data-dependent, h…[Read more]

-

OmniScience Capital posted an update in the group Economy & Industry Triggers

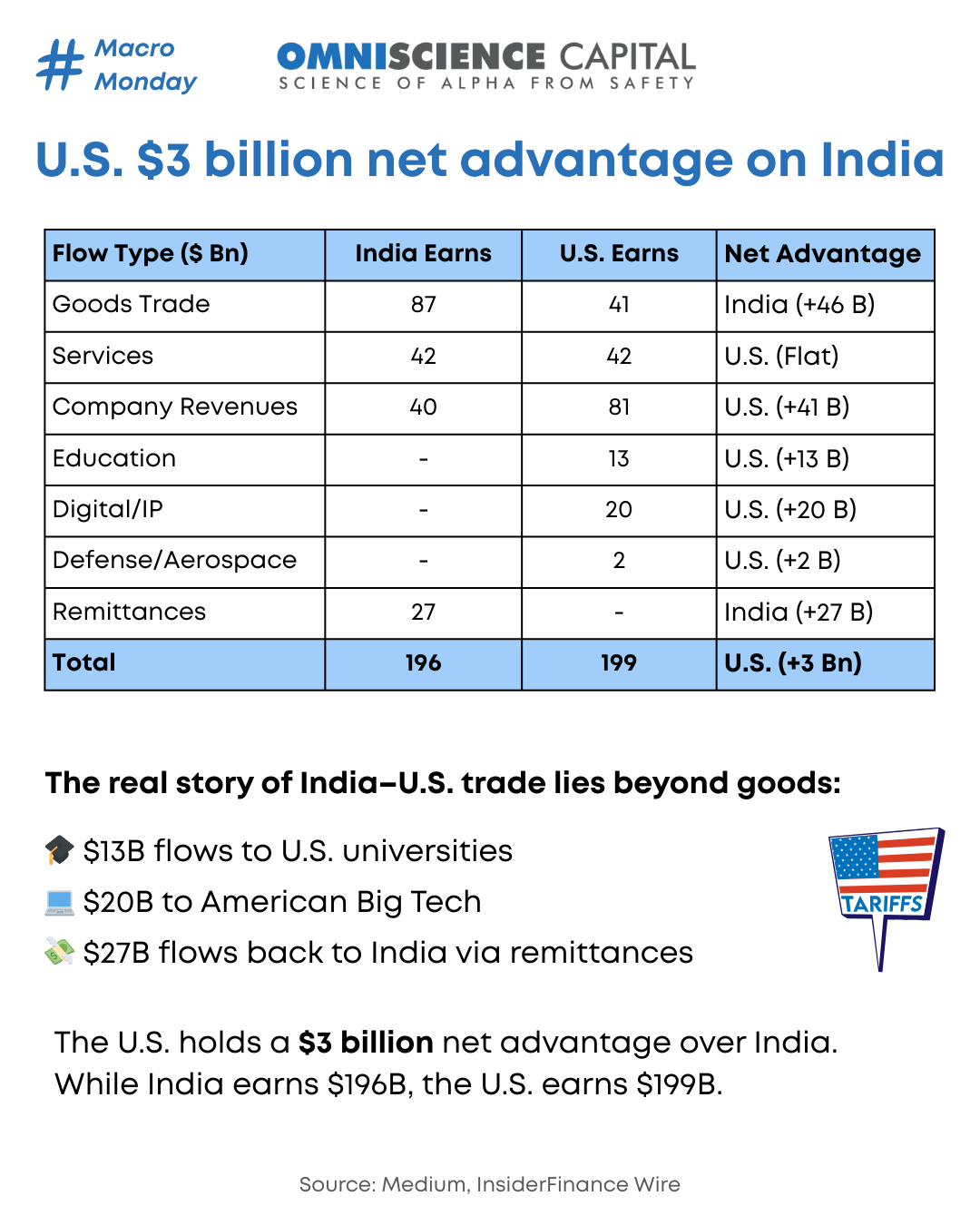

1 month, 2 weeks agoIndia – U.S. Trade Deficit? Not So Fast.

Everyone’s talking about India’s goods surplus and U.S. concerns – but the full picture shows a near-balanced flow. U.S. companies, platforms, and universities earn big from India. Net gap? Just $3B.Reacted by OmniScience Capital -

-

OmniScience Capital posted an update in the group Economy & Industry Triggers

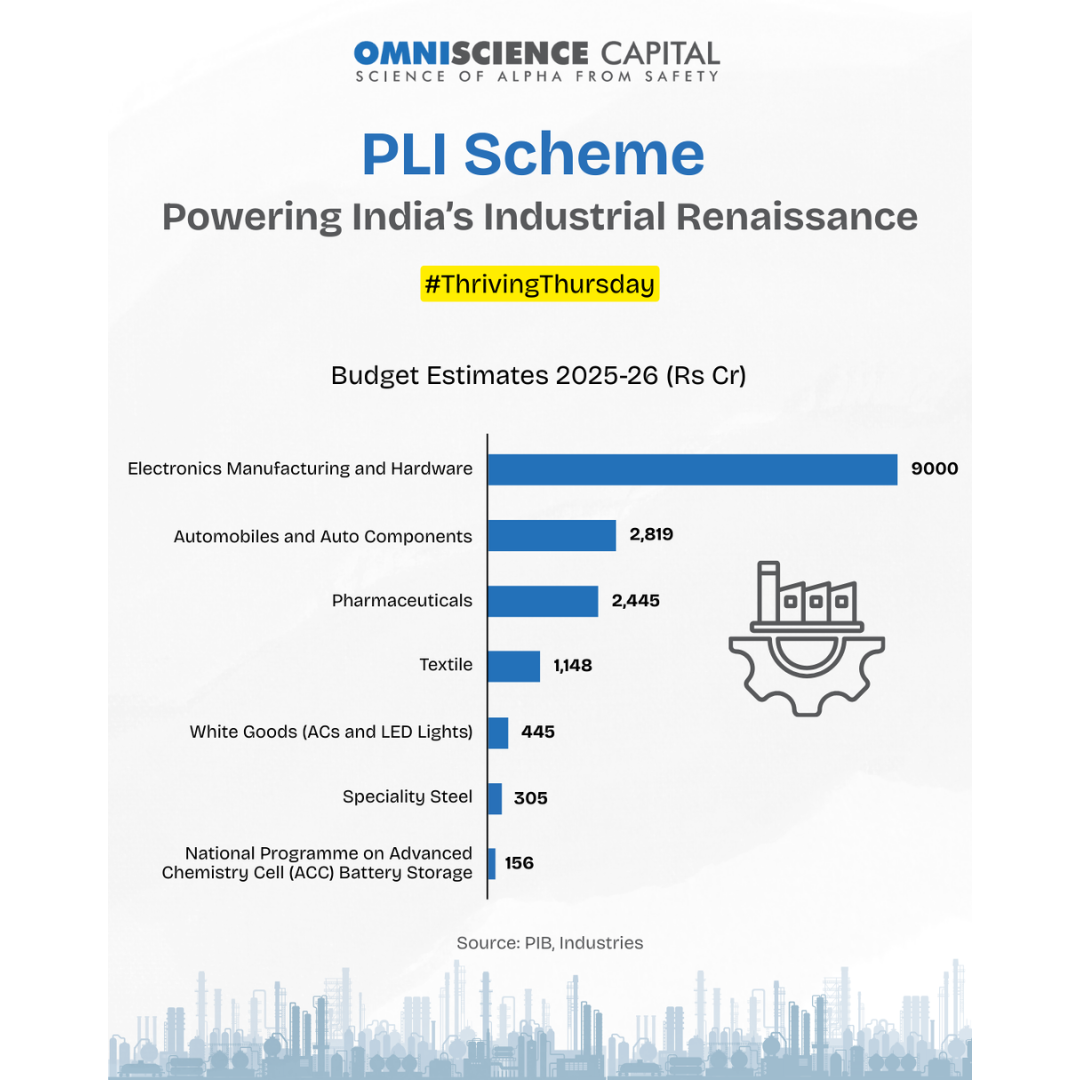

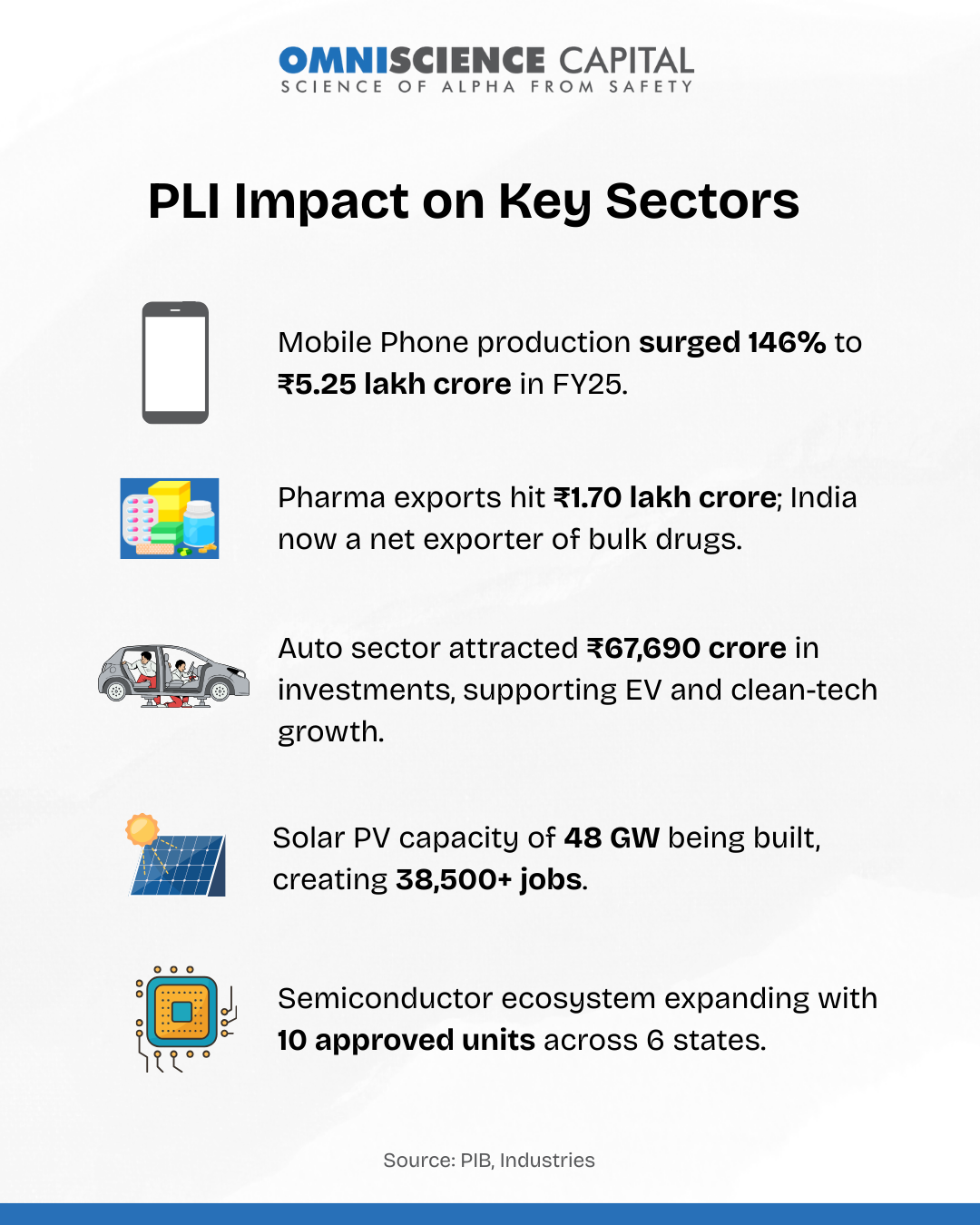

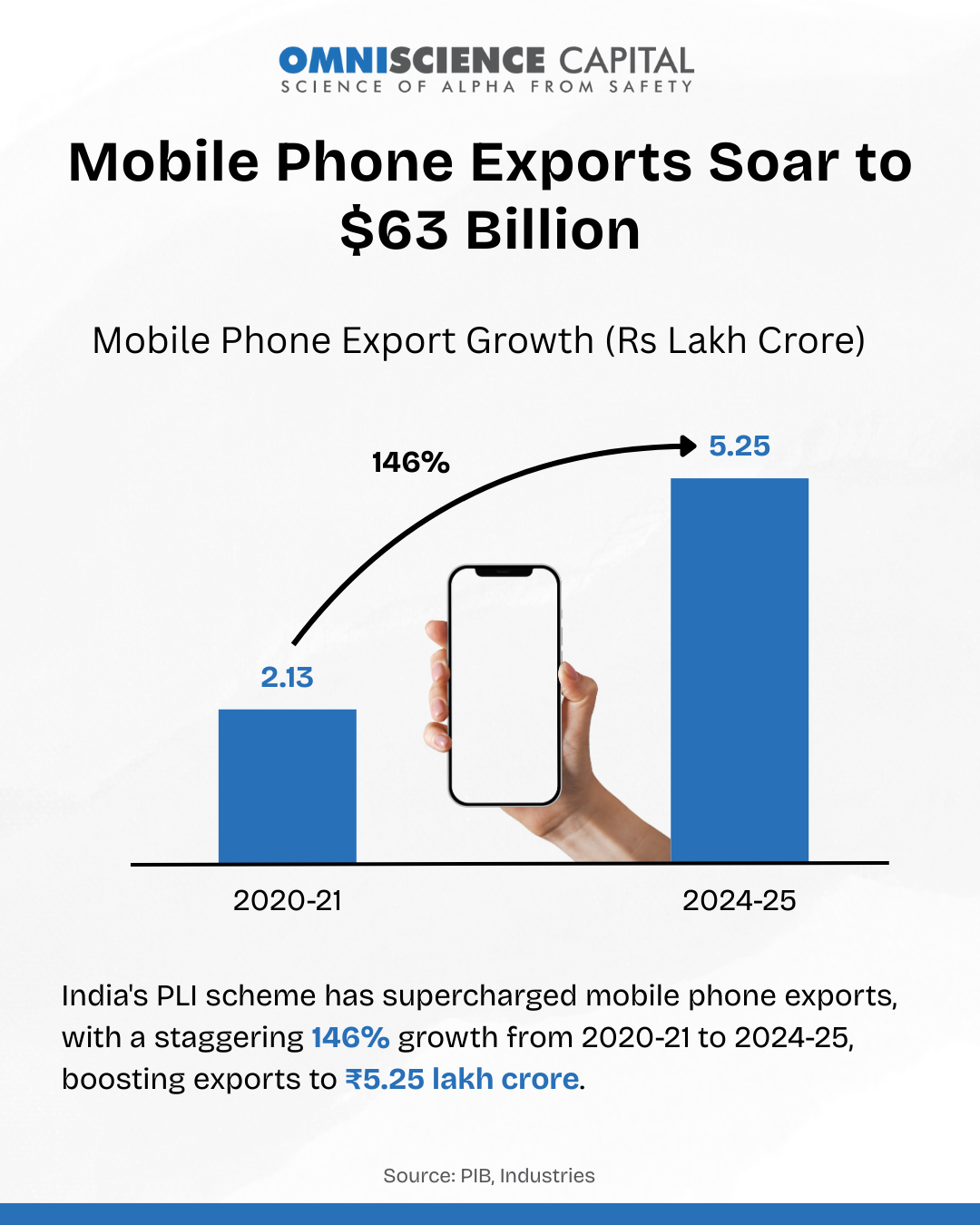

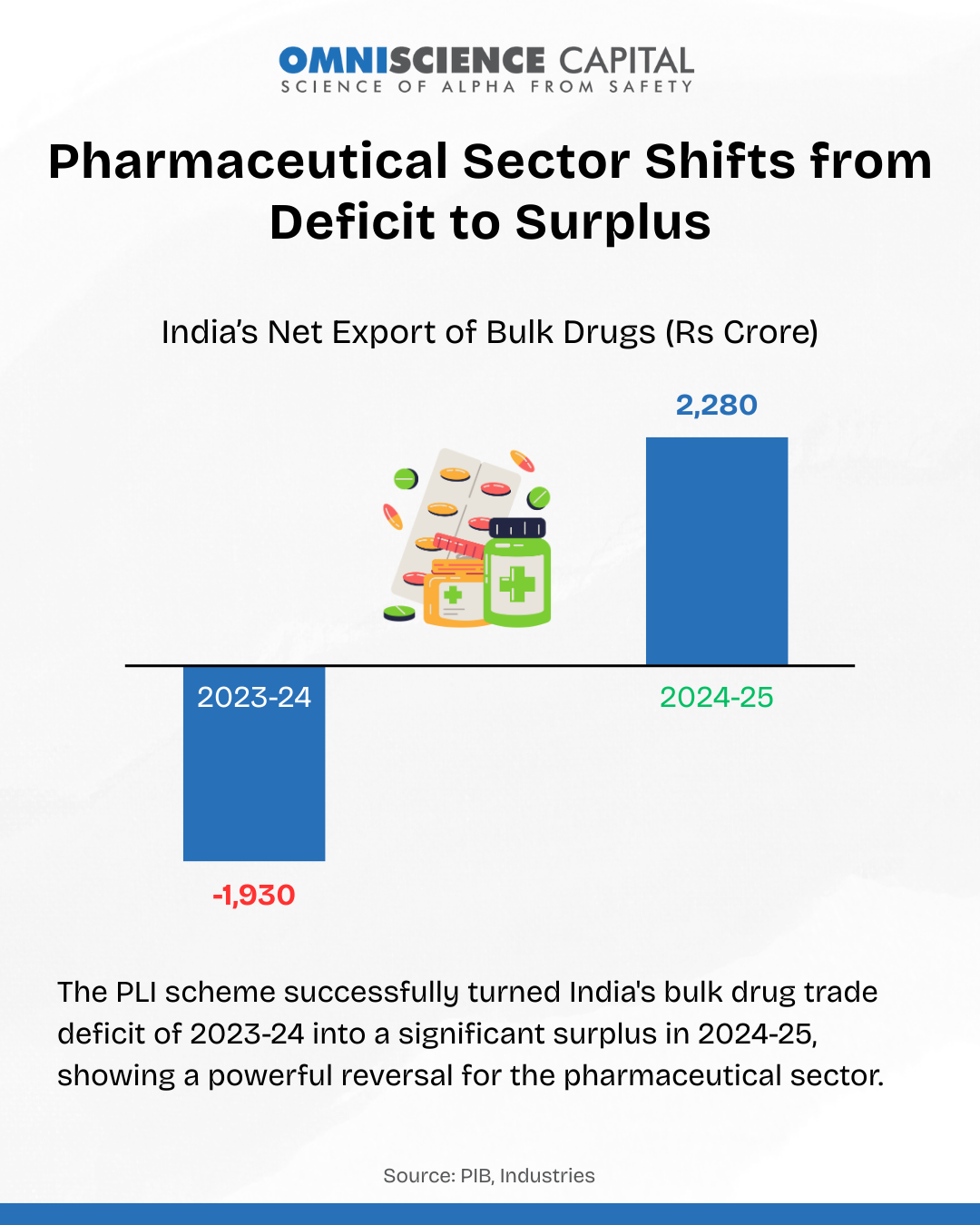

2 months agoIndia’s Manufacturing Momentum is Unstoppable!

The Production Linked Incentive (PLI) Scheme is transforming India into a global manufacturing powerhouse.

From innovation labs to factory floors, India is writing a new chapter in industrial excellence.#ThrivingThursday #PLIScheme #ManufacturingIndia

-

OmniScience-Spotlight posted an update in the group Economy & Industry Triggers

2 months agoGST Rationalisation: Implications for India’s Consumption and Growth Cycle-Ashwini Shami

Executive Vice President & Portfolio ManagerThe GST Council’s 56th meeting has delivered the most comprehensive overhaul of India’s indirect tax structure since its inception in 2017.

Beyond technical simplification, this reform signals a delib…[Read more]