Economy & Industry Triggers

Tracking Macro Trends. Understanding Market Impact.

This group is designed for investors, analysts, financial professionals, and media to follow and discuss the macro and regulatory events that shape market sentiment and sectoral shifts.

-What You’ll Find Here:

GDP, Inflation & Employment Data – Timely updates and expert takes on key macro indicators

Central Bank Policies – RBI & US Fed rate actions, commentary, and their market implications

Union Budget & Policy Announcements – Sectoral impact, allocation trends, and capital market response

SEBI, RBI & Government Regulations – Important changes affecting market intermediaries, companies, and investors

Industry Commentary & Expert Reactions – Insights from economists, fund managers, and sector leaders

>Why Join?

To stay ahead of economic and policy events, understand their implications across industries, and engage in insightful conversations with market-aware professionals.

Follow the triggers. Shape your strategy.

> No noise. Just value.

Be part of the Economy & Industry Triggers group on VRight Exchange.

-

Public

-

41

Posts -

82

Members

-

-

-

-

Ice Make Refrigeration Ltd posted an update in the group Economy & Industry Triggers

2 months agoGST Council’s Rate Rationalisation: A Strategic Boost for Cold Chain Growth- Says Mr. Chandrakant P. Patel, Chairman & Managing Director, Ice Make Refrigeration Ltd.

The GST Council’s decision to rationalise tax rates marks a pivotal moment for India’s cold chain and refrigeration industry.

By streamlining the tax structure and reducing rates…[Read more]

-

VRIGHT EXCHANGE posted an update in the group Economy & Industry Triggers

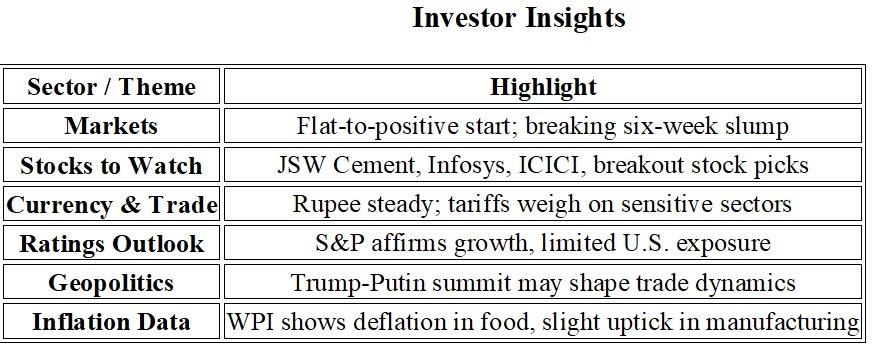

2 months ago#MondayPlan

Morning Market Note | Monday, Sept 1, 2025

Markets open the week on a cautious but constructive note with corporate activity heating up, regulatory decisions pending, and global cues turning mixed. Domestically, fund-raising and boardroom moves dominated headlines across financials, infra, and auto ancillaries. Globally, investors…[Read more]

-

Aryan Rana posted an update in the group Economy & Industry Triggers

2 months, 2 weeks agoDII vs FII – The game has changed!

Domestic Institutional Investors (DIIs) has emerged as a more resilient and confident force in India’s growth story compared to Foreign Institutional Investors (FIIs). Their consistent support reflects a deep trust in the strength of the Indian economy. This shift highlights the maturing of India’s domes…[Read more] -

VRight AARYANA posted an update in the group Economy & Industry Triggers

2 months, 3 weeks agoEquity Markets & Sector News Update -14 Aug, 2025

Markets & Equities

• Indian indices opened flat to modest gains:

o Nifty 50 marginally up to ~24,648–24,650,

o Sensex hovered near 80,600, up about 0.1%.• Markets poised to break six-week losing streak, supported by positive FY25 earnings and optimism around US-Russia diplo…[Read more]

-

VRIGHT Exchange – CEO’s Desk posted an update in the group Economy & Industry Triggers

2 months, 3 weeks agoGlobal Economic Data & Sector Impact Map for the week of 11 Aug 2025

1. United States

Inflation (Jul) – Tuesday 12 AugustSectors Impacted: Equity markets broadly, FMCG, Retail, Banking & Financial Services.

Rationale: Higher inflation could delay rate cuts, pressuring consumer spending and corporate borrowing.

Crude Oil Stock Change – Wed…[Read more]

-

Janardhan Chavan posted an update in the group Economy & Industry Triggers

2 months, 4 weeks agoEquity Markets & Sector News Update -8 Aug, 2025

Market & Macro Trends

• Indian markets opened on a weak note, slipping as U.S.-India trade tensions escalated:

o Sensex tumbled over 500 points, while Nifty fell below 24,450 amid fears of reduced export competitiveness due to steep tariffs.

o IT & Pharmaceutical sectors led losses, with d…[Read more] -

VRight AARYANA posted an update in the group Economy & Industry Triggers

2 months, 4 weeks agoPolicy update for 7 August 2025

RBI / Monetary Policy

Key Highlights

• Repo rate: Held steady at 5.50% (unanimous MPC decision)

• Policy stance: Maintained as “Neutral”, indicating neither tightening nor easing immediately

• GDP forecast: Kept at 6.5% for FY26, with stable inflation projection (CPI ~3.1%, core inflation ~4%)

• CRR cu…[Read more] -

Janardhan Chavan posted an update in the group Economy & Industry Triggers

3 months agoSector wise new updates for August 2, 2025

Economy & Trade

• The U.S. has imposed a sweeping 25% tariff on all Indian exports, effective August 7, putting around $85 billion worth of exports at risk Key sectors exposed include IT/software services, pharmaceuticals, textiles, auto parts, and engineering goods India’s GST collections rose 7.5% y…[Read more]

-

Janardhan Chavan posted an update in the group Economy & Industry Triggers

3 months agoSector-wise top stories and market developments -August 1, 2025:

Macro & Markets

• U.S. enforces 25% tariffs on Indian goods, effective August 1, unexpectedly widening to $87 billion in exports amid unresolved trade negotiations. This move cast a shadow over export-linked sectors.

• FII outflows continue, with net selling of ₹55,8…[Read more] -

VRIGHT Exchange – Daily Digest posted an update in the group Economy & Industry Triggers

3 months agoMarket Update: SME IPO Listing Cap & Key Upcoming IPOs

🔹 NSE Regulatory Move – SME IPO Special Preopen Session

NSE introduces a 20% lower circuit cap for SME IPOs during the Special Preopen Session.

Implication: SME IPOs cannot list below 20% of the issue price, potentially reducing steep listing day losses.

-

VRIGHT EXCHANGE posted an update in the group Economy & Industry Triggers

3 months agoRegulatory actions by SEBI, RBI, and major global regulators up to July 31, 2025:

SEBI

Market Manipulation & Surveillance

• Jane Street case expansion: SEBI widened its probe into alleged index manipulation. Exchanges (BSE, NSE) are required to supply detailed trading data from Jan 2023 to May 2025, including mark-to-market P/L, positions…[Read more] -

VRIGHT Exchange – CEO’s Desk posted an update in the group Economy & Industry Triggers

3 months, 1 week agoChina’s Rare Earth Magnet Ban Spurs India’s ₹18,000 Cr Critical Mineral Mission Amid Rising Sectoral Risks

India’s dependence on China for rare earth magnets — critical components in high-tech and green tech industries — means that China’s export restrictions could significantly affect several listed Indian companies, especially those in sectors…[Read more]

-

VRIGHT Exchange – CEO’s Desk posted an update in the group Economy & Industry Triggers

3 months, 1 week agoChina’s Rare Earth Magnet Ban Triggers India’s Critical Mineral Mission

Investor Summary:

China’s restrictions on rare earth magnet exports have disrupted global supply chains, significantly impacting India. In response, India has launched the National Critical Mineral Mission (NCMM) with a focus on domestic exploration, strategic procu…[Read more]

-

VRight AARYANA posted an update in the group Economy & Industry Triggers

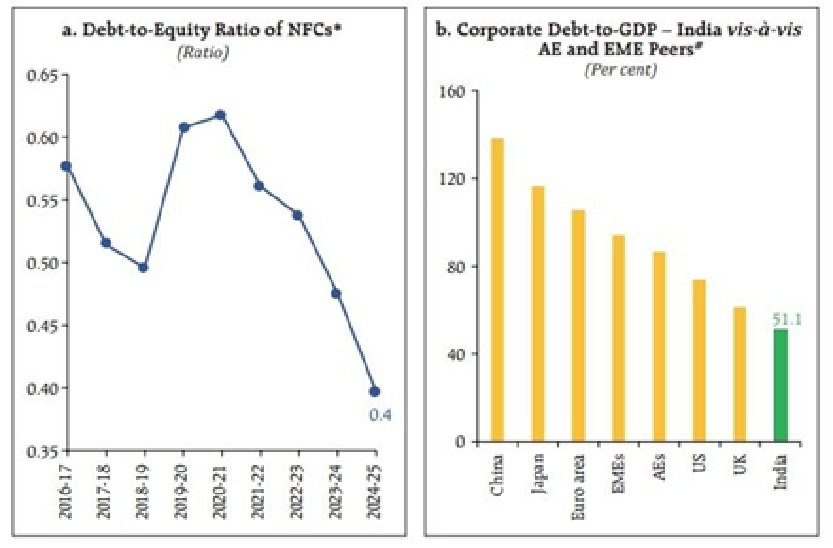

3 months, 2 weeks agoCorporate India: Battle-Tested, Lean, and Ready for the Next Growth Cycle

After a tough post-2008 period, Corporate India has emerged stronger and more resilient.

-Debt-to-equity ratios have declined sharply, and we now have one of the lowest corporate debt-to-GDP ratios among major economies.

-Between FY21 and FY25, corporate debt grew at just…[Read more]