Research and Investment Spot

Group Type: Fund Manager Circles

Empowering Investors

A dedicated space for India’s growing community of investors to access verified insights, wealth creation strategies, and actionable knowledge on stocks, mutual funds, and financial instruments — all in one trusted environment.

This forum is designed to help you make informed investment decisions, free from clutter and noise.

✅ Track earnings calls and investor meetings

✅ Ask questions and share informed views

✅ Learn from verified analysts and financial experts

✅ Engage in polls, discussions, and company updates

No speculation. No spam. Only meaningful, value-led engagement.

Join the VRight movement for clean and credible market conversations.

-

Public

-

55

Posts -

51

Members

-

-

-

-

VRIGHT Exchange | Research & Strategy Desk posted an update in the group Research and Investment Spot

1 month, 1 week agoFund Houses’ Recommendations (22 Sept 2025)

Autos & Mobility

• Maruti (Nuvama): Buy, TP ₹18,200 (Positive)

• TVS Motor (Nuvama): Buy, TP ₹4,100 (Positive)

• M&M (Nuvama): Buy, TP ₹4,200 (Positive)

• Hero MotoCorp (Nuvama): Buy, TP ₹6,200 (Positive)

• Eicher & Bajaj Auto (Nuvama): Downgrade to Hold (Neutral)

• Hyundai (Goldman Sachs): Neut…[Read more] -

VRIGHT Exchange | Research & Strategy Desk posted an update in the group Research and Investment Spot

1 month, 2 weeks agoFund House & Brokerage Calls

Adani Group

• MS on Adani Power: Initiate Overweight, TP ₹818. Sees 2.5x capacity & 3x EBITDA rise by FY33; new coal PPAs to improve earnings visibility.

• Jefferies on Adani Green: Buy, TP ₹1,300. Capacity expansion to 50 GW by 2030; 4.5–6.3 GW additions in FY26–27; valuations ~63% below peak multiples.…[Read more]

-

VRIGHT Exchange | Research & Strategy Desk posted an update in the group Research and Investment Spot

1 month, 2 weeks agoFund Houses Recommendations -16 September 2025

Sector & Thematic Positives

OMCs: Government support underpins steady performance despite global volatility.

Capital Goods: Transmission order pipeline remains strong.

Non-Ferrous Metals: Prices firm due to geopolitics, low inventory, and weak USD.

Data Centres: India’s capacity expected to r…[Read more]

-

VRIGHT Exchange | Research & Strategy Desk posted an update in the group Research and Investment Spot

1 month, 2 weeks agoFund House Recommendations – September 15, 2025

Alcobev Sector – Structural Premiumisation Play

• Radico Khaitan (Jefferies: Buy, TP ₹3,500)

Premiumisation in IMFL portfolio and consistent market share gains position Radico as a long-term compounding story.VRIGHT View: Beneficiary of premium liquor demand, especially in Tier-1/Tier-2 cities.…[Read more]

-

VRIGHT Exchange | Street Calls posted an update in the group Research and Investment Spot

1 month, 3 weeks agoStreet Calls | Fund Houses Recommendations

Positive Calls

Morgan Stanley on ABFRL: Upgraded to Overweight; target price ₹131/share.

Morgan Stanley on ABLBL: Initiated coverage with Overweight; target price ₹175/share.

Jefferies on HUL: Maintained Buy; target price ₹3,000/share.

BofA on HUL: Maintained Neutral; raised target price to ₹2,84…[Read more]

-

VRIGHT Exchange | Street Calls posted an update in the group Research and Investment Spot

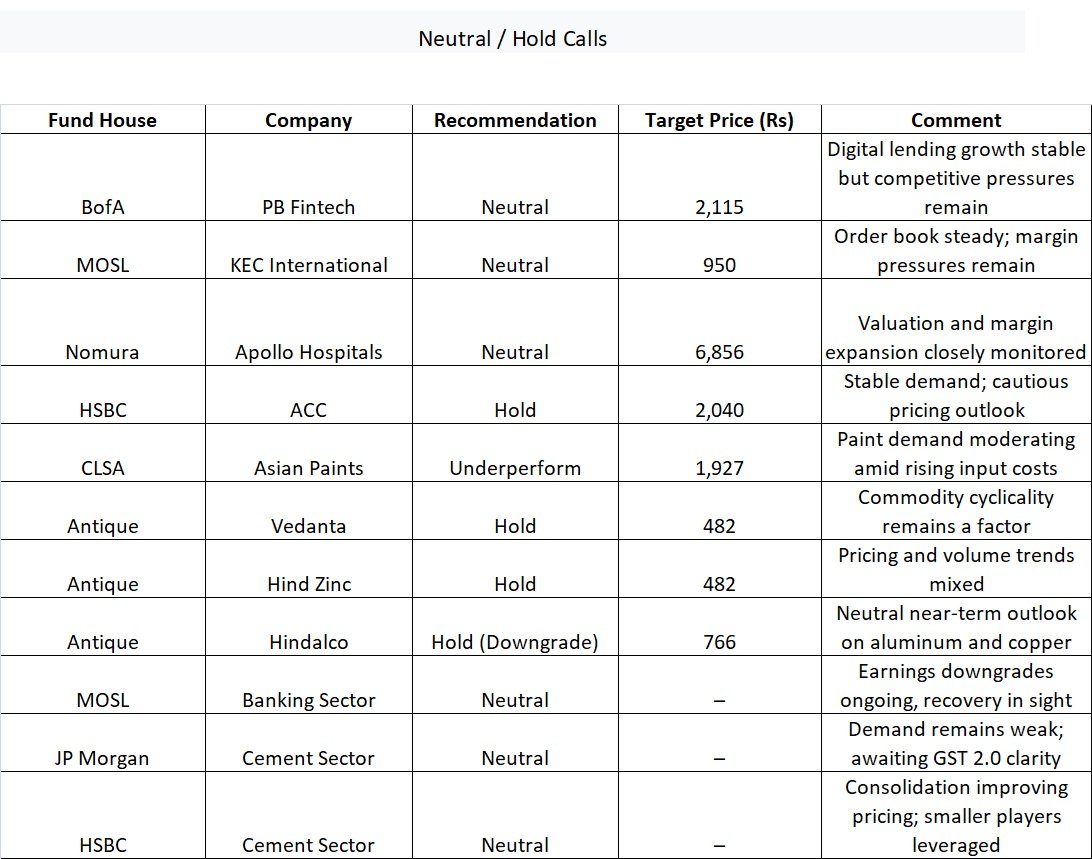

2 months agoFund Houses Recommendations – September 5, 2025

🔹 Positive Recommendations

DLF | Jefferies: Buy; Target ₹1,000/sh.

Voltas | UBS: Buy; Target ₹1,770/sh.

Cholamandalam Finance | HSBC: Buy; Target ₹1,670/sh.

Inox Wind | Nuvama: Buy; Target ₹190/sh.

NALCO | Antique: Buy; Target ₹262/sh.

Ola Electric | Goldman Sachs: Buy; Target ₹72/sh (rai…[Read more]

-

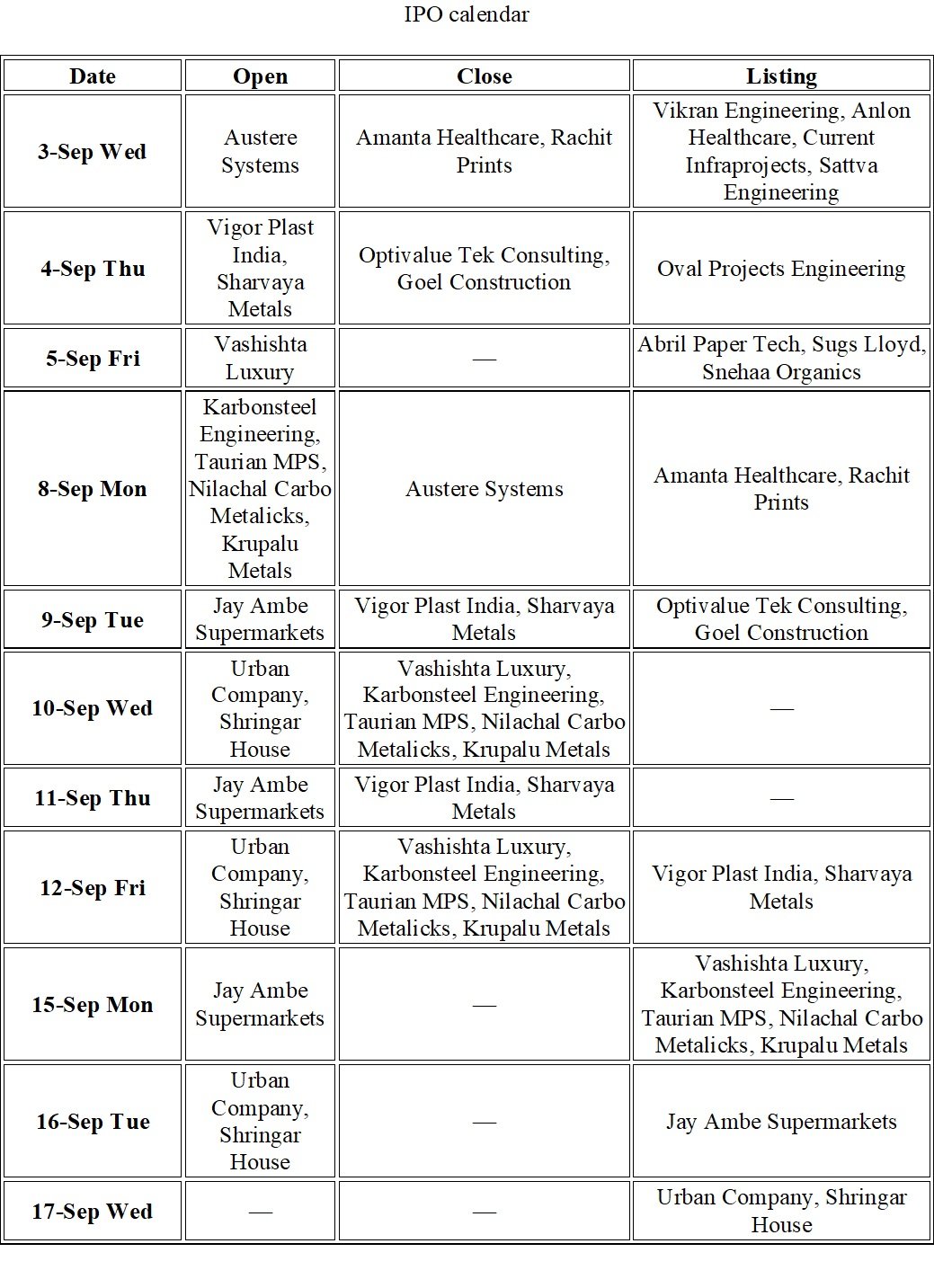

VRIGHT Exchange – IPO Pulse posted an update in the group Research and Investment Spot

2 months, 1 week agoBrokerage Updates – August 29, 2025

Jefferies – Greed & Fear

US Tariffs: India faces a $55–60 bn direct hit due to new US tariffs.

Sectors most impacted: Textiles, footwear, jewellery & gems — all highly employment-intensive.

Geopolitical angle: Conversations in New Delhi suggest tariffs stem from President Trump’s exclusion from mediating…[Read more]

-

VRIGHT Exchange – IPO Pulse posted an update in the group Research and Investment Spot

2 months, 1 week agoStocks in Radar-Aug 29

Hexaware Technologies: Company partnered with Replit to enable secure Vibe Coding for enterprises. 👍🏼

RBL Bank: Societe Generale bought 32.78 lakh shares at Rs 250.57 per share. 👍🏼

Lemon Tree: Company signed a 98-room property in Dehradun. 👍🏼

Belrise Industries: Company incorporated Belrise Defence & Aerospace.…[Read more]

-

VRIGHT EXCHANGE posted an update in the group Research and Investment Spot

2 months, 1 week agoFund Houses Recommendations

Jefferies on Polycab: Maintain Buy on Company, target price at Rs 8180/Sh (Positive)

MOSL on Coforge: Maintain Buy on Company, target price at Rs 2240/Sh (Positive)

Nuvama on Maruti: Maintain Buy on Company, target price at Rs 14300/Sh (Positive)

Investec on RBL Bank: Maintain Buy on Bank, target price at Rs 300/Sh…[Read more]

-

VRIGHT Exchange – Daily Digest posted an update in the group Research and Investment Spot

2 months, 2 weeks agoFund Houses & Brokerage Recommendations ( Aug 21)

Positive / Buy Calls

• Jefferies on Bajaj Finserv: Initiated Buy, Target Price: ₹2,420/share.

• MOSL on JSW Infrastructure: Maintained Buy, Target Price: ₹380/share.• Nuvama on Hexaware: Maintained Buy, Target Price: ₹950/share.

• JP Morgan on Syrma SGS: Maintained Overweight, Target Price:…[Read more] -

VRIGHT EXCHANGE posted an update in the group Research and Investment Spot

2 months, 2 weeks agoFund Houses Recommendations (August 20)

Power & Utilities

• CLSA on NTPC: Outperform, TP ₹459 (Positive)Automobiles & Auto Sector

• Nomura on Auto Sector: GST benefit likely larger for 4W OEMs vs. 2W OEMs (Positive)

• BofA on India Strategy: Autos & Consumer Durables key beneficiaries of potential GST cuts (Positi…[Read more] -

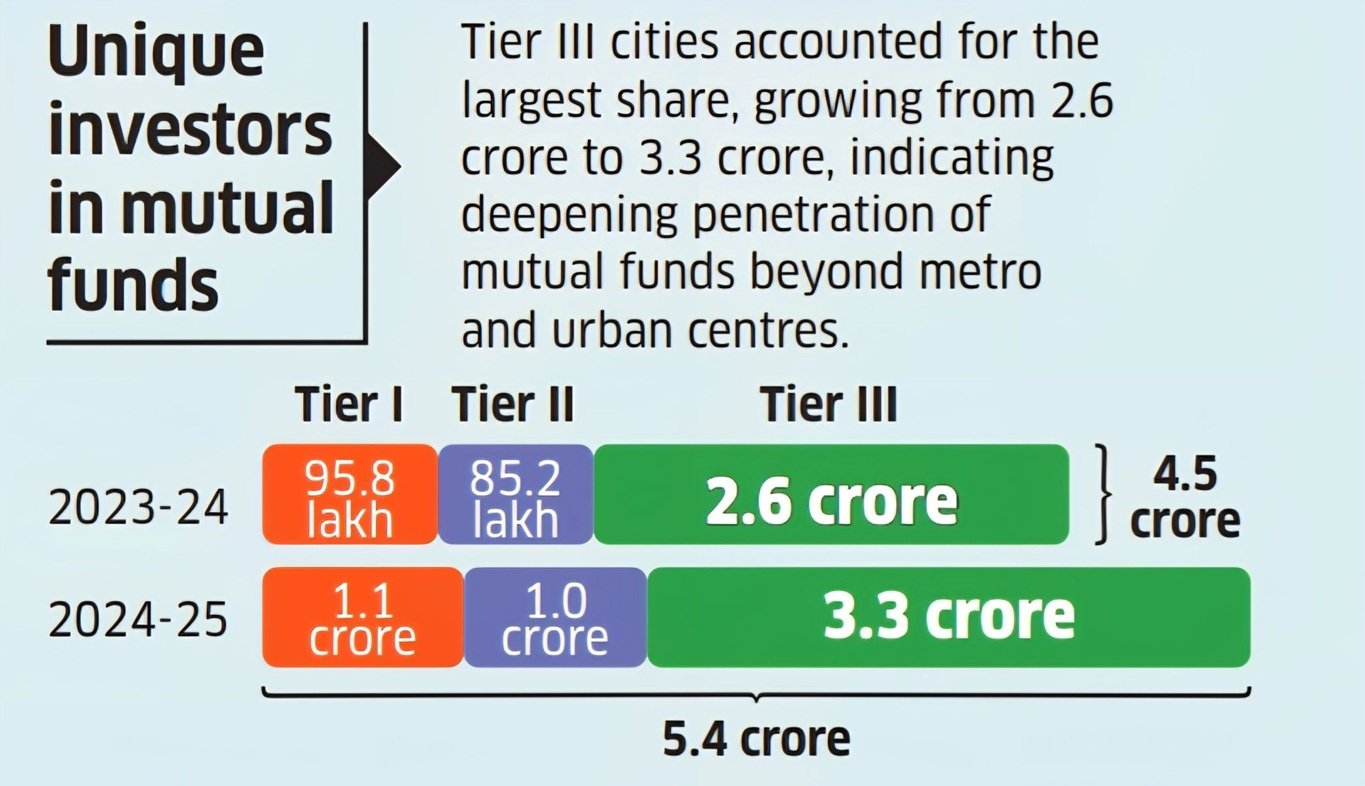

VRight AARYANA posted an update in the group Retail Investor Forum

2 months, 2 weeks agoMove over FIIs… Bharat’s SIP Army is running the show!

India is witnessing a financial revolution—and it’s being driven by investors from Tier II and III towns, backed by low-cost, high-impact SIPs.

Key Metrics & Momentum:

Unique mutual fund investors surged to 5.4 crore in FY 2024–25, powered largely by Tier III city participation.

SIP fol…[Read more]

-

Ayesha Aryan Rana posted an update in the group Research and Investment Spot

2 months, 2 weeks agoOmniScience की Scientific Investing – डॉ. विकास गुप्ता (CEO एवं Chief Investment Strategist) द्वारा स्पष्ट रूप से परिभाषित और समझाया गया ढाँचा

OmniScience Capital – वैज्ञानिक निवेश फ्रेमवर्क

1. निवेश ब्रह्मांड (Investment Universe)

• भारतीय शेयर बाज़ार में लगभग 5,000 सूचीबद्ध कंपनियाँ हैं।

• इनमें से करीब 1,500 कंपनियाँ ₹1,000…[Read more]-

इस पेज को फॉलो करें और जानें OmniScience के Scientific Investing Framework तथा अनुशासित, शोध-आधारित निवेश दृष्टिकोण से जुड़े इनसाइट्स। https://vrightexchange.com/groups-2/omniscience-capital-enhance-safety-enhance-growth-enhance-returns/

like like

like dislike

dislike angry

angry funny

funny happy

happy love

love wow

wow

-

-

VRIGHT EXCHANGE posted an update in the group Research and Investment Spot

2 months, 2 weeks agoFund Houses Recommendations

– Automobiles & Auto Components

Nomura on M&M: Buy, TP ₹3,736 (Positive)

BofA on Ashok Leyland: Buy, TP ₹146 (Positive)

Avendus on Ashok Leyland: Buy, TP ₹140 (Positive)

MOSL on Ashok Leyland: Buy, TP ₹141 (Positive)

Jefferies on Ashok Leyland: Buy, TP ₹120 (Neutral)

MS on Auto Sector: 14% of GST collections…[Read more]

-

VRIGHT EXCHANGE posted an update in the group Research and Investment Spot

2 months, 4 weeks agoResearch Recommendations – August 8

Consumer & Retail

Titan Company (Jewellery, Watches)

Jefferies: Buy | TP ₹3800

Strong growth across segments, margin gain aided by 1-offs

CLSA: Outperform | TP ₹4394

21% YoY growth; jewellery margin (ex-bullion) at 11.5%

Citi: Buy | TP ₹3900

Growth in-line; cautious on margins due to competition, high go…[Read more]