Research and Investment Spot

Group Type: Fund Manager Circles

Empowering Investors

A dedicated space for India’s growing community of investors to access verified insights, wealth creation strategies, and actionable knowledge on stocks, mutual funds, and financial instruments — all in one trusted environment.

This forum is designed to help you make informed investment decisions, free from clutter and noise.

✅ Track earnings calls and investor meetings

✅ Ask questions and share informed views

✅ Learn from verified analysts and financial experts

✅ Engage in polls, discussions, and company updates

No speculation. No spam. Only meaningful, value-led engagement.

Join the VRight movement for clean and credible market conversations.

-

Public

-

55

Posts -

51

Members

-

-

-

-

Ayesha Rana posted an update in the group Retail Investor Forum

3 months agoWant Rs 3 Cr By 60? Here’s The Right 12-Year SIP Strategy For A 48-Year-Old Earning Rs 4 Lakh

Dr Vikas Gupta, CEO and Chief Investment Strategist, OmniScience Capital says to reach a target of Rs 3 crores in 12 years, you need to invest approximately Rs 1 lakh per month in equity mutual funds, assuming a 12% annual return. Starting at age 48, t…[Read more]

-

Ayesha Aryan Ranareplied 3 months ago

To Follow OmniScience Capital Page -please visit https://vrightexchange.com/groups-2/omniscience-capital-enhance-safety-enhance-growth-enhance-returns/

like like

like dislike

dislike angry

angry funny

funny happy

happy love

love wow

wow

-

-

VRIGHT EXCHANGE posted an update in the group Research and Investment Spot

3 months, 1 week agoStocks-in-focus and key updates with sentiment indicators (👍🏼 Positive | 🤞🏼 Neutral | 👎🏿 Negative):

Infrastructure, EPC & Construction

PNC Infratech: Bags ₹2,956 Cr mining services order from SECL. 👍🏼Omaxe Ltd: Gets ₹500 Cr investment from Oaktree for large-scale projects. 👍🏼

HG Infra: Acquires Angul Sundargarh Transmission, enabling fur…[Read more]

-

VRIGHT EXCHANGE posted an update in the group Research and Investment Spot

3 months, 1 week agoBrokers recommendations:

Capital Goods / Defence

Bharat Electronics Ltd (BEL)UBL: Maintain Buy, Target ₹450 ( Positive)

JP Morgan: Maintain Overweight, Target ₹490 (Positive)

Nomura: Maintain Buy, Target raised to ₹2,388 ( Positive)

Pharmaceuticals & Healthcare

Ajanta PharmaJefferies: Maintain Buy, Target raised to ₹3,320 ( Positiv…[Read more]

-

VRIGHT Exchange – Daily Digest posted an update in the group Research and Investment Spot

3 months, 1 week agoFund House stock recommendations

Technology & IT

Mphasis: Morgan Stanley upgraded to Overweight, raising its target price to ₹3,500/share, citing strong deal momentum in Q1 and sustainable growth potential.Business Upturn Retail

V-Mart Retail: Motilal Oswal upgraded the stock to Buy, increasing its target price to ₹1,035/share (up from pre…[Read more] -

VRIGHT EXCHANGE posted an update in the group Research and Investment Spot

3 months, 1 week agoPromoter Huge Buying SmallCap & MicroCap Stocks!

1. Cosmic CRF Ltd.

2. ABS Marine Services Ltd.

3. Enviro Infra Ltd.

4. Prizor Viztech Ltd.

5. Insolation Energy Ltd.

6. Man Infra-construction Ltd.

7. VVIP Infratech Ltd.

8. Mach Conferences Ltd.

9. Kore Digital Ltd.

10. Teerth Gopicon Ltd. -

Ayesha Rana posted an update in the group Retail Investor Forum

3 months, 1 week agoInvesting article by Dr Vikas Gupta published by Moneycontrol.com

For wise investing, build on Warren Buffett guru Graham’s bond playbook

Investing in bonds and stocks can be guided by similar principles—focusing on a company’s financial strength, debt coverage and valuation to minimise risk and to generate alpha.

Investment strategy for equit…[Read more]

-

VRIGHT EXCHANGE posted an update in the group Research and Investment Spot

3 months, 1 week agoFund House Recommendations – July 24, 2025

🔹 Tech & IT

🟢 PositiveMacquarie on Persistent: Outperform, TP raised to ₹7,330

MOSL on Persistent: Outperform, TP at ₹6,800

Jefferies on Infosys: Buy, TP raised to ₹1,860 (from ₹1,660)

Centrum on Infosys: Buy, TP raised to ₹1,942 (from ₹1,917)

Axis on Infosys: Add, TP raised to ₹1,720 (from…[Read more]

-

VRight AARYANA posted an update in the group Retail Investor Forum

3 months, 3 weeks agoStocks recommendations -July 16, 2025

Retail & Lifestyle

Vishal Mega Mart (MOSL – Buy, TP ₹165)

• A unique retail play on Tier 2+ India’s rising aspirations.

• Operates in a ₹70T+ opportunity with 73% revenues from private labels.

• Focused on value retail across apparel (44%), GM (28%), and FMCG (28%).

• Double-digit growth across revenue/…[Read more] -

VRight AARYANA posted an update in the group Retail Investor Forum

3 months, 3 weeks agoStocks to Watch – Sentiment Overview

Positive Sentiment Stocks

1. Rallis India – Q1 net profit doubled year-on-year; strong growth across segments.

2. Power Mech Projects – Secured new orders worth ₹551 crore, including power and infra contracts.

3. RailTel Corporation – Bagged an order worth ₹264 crore from East Central Railway.

-

VRight AARYANA posted an update in the group Retail Investor Forum

3 months, 3 weeks agoGlobal & Institutional Commentary update for July 15, 2025:

Institutional Views

JM Financial

• On Kalyan Jewellers: Initiates Buy, TP ₹700

o Strong moats, unorganised market opportunity

o Expect Revenue/EBITDA/PAT CAGR of 25%/23%/31% over FY25–28E

• On Ventive Hospitality: Initiates Buy, TP ₹890

o Exposure to India & Maldives tailwinds…[Read more] -

VRight AARYANA posted an update in the group Retail Investor Forum

3 months, 3 weeks agoStocks in the news from the Kunvarji India Daybook

INFRASTRUCTURE & RAILWAYS

RVNL: Secured ₹447 Cr contract from Delhi Metro for Phase-IV construction. FY26 turnover guidance at ₹22,000 Cr. (Positive)Power Mech Projects: Bagged ₹551 Cr orders from SJVN Thermal & Jhabua Power. (Positive)

RailTel Corporation: Won ₹264 Cr order from East Central…[Read more]

-

Ayesha Aryan Rana posted an update in the group Research and Investment Spot

3 months, 3 weeks agoDr Vikas Gupta , CEO and Chief Investment Strategist explains…

What is Scientific Investing? How to invest through analytics and a data-driven approach?

View the full interview

-

VRight AARYANA posted an update in the group Retail Investor Forum

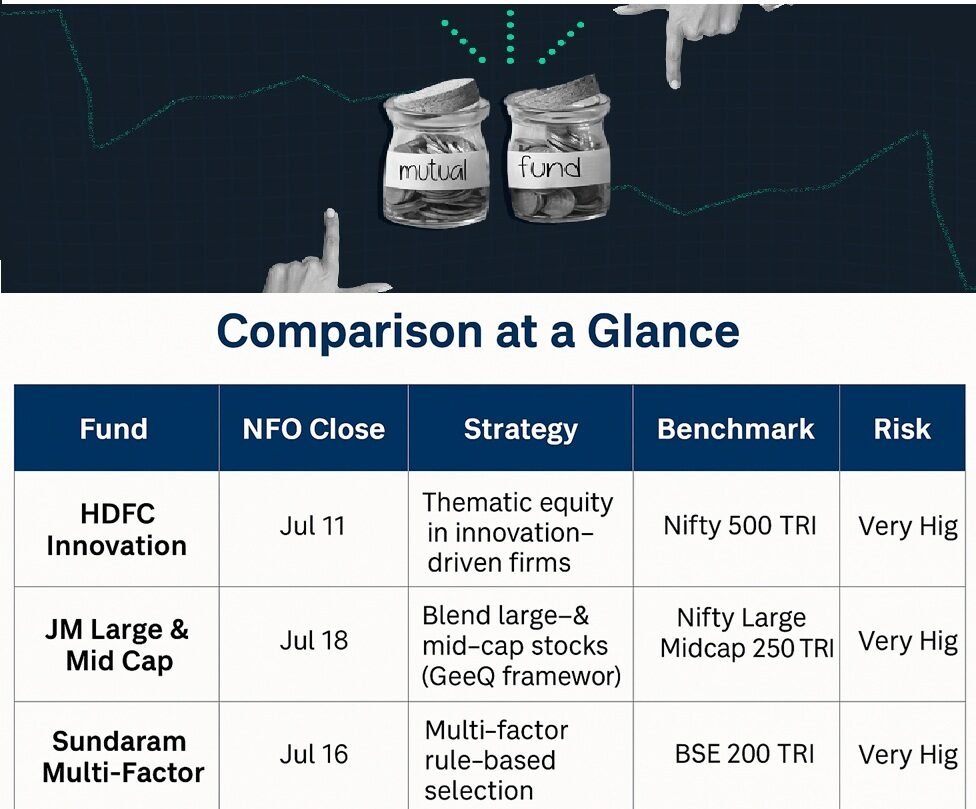

4 months agosummary of the three New Fund Offers (NFOs) closing on July 16–18, 2025:

1. HDFC Innovation Fund (Equity – Thematic)

NFO Period: June 27 – July 11, 2025Fund Focus: Thematically invests in companies across sectors driving innovation—across products, processes, and business models

Benchmark: Nifty 500 Total Return Index

Risk Profile:…[Read more]

-

Janardhan Chavan posted an update in the group Retail Investor Forum

4 months, 1 week agoTurn Rs 2 Crore Into Rs 6.8 Crore: The Early Retirement Blueprint

As per Mr Vivek Goel, Joint Managing Director, Tailwind Financial Services, you’ve got a Rs 2 crore head start—impressive. But the key question is.

Can this fund support 40-50 years of retirement?

Not yet. But here’s how soon you can retire, depending on your next steps:To r…[Read more]

-

Ayesha Rana posted an update in the group Retail Investor Forum

4 months, 2 weeks agoWe are delighted to share some exciting news with you —

Mr Navin Jain, Co-Founder & CEO, NeoNest Finserve has ventured into investment advisory . Along with Mr Santosh Singh and Ms Ritu Jhingran he has co-founded a next-generation wealth advisory firm committed to redefining the financial landscape in India.

With a client-first philosophy, t…[Read more]

-

Ayesha Rana posted an update in the group Retail Investor Forum

4 months, 2 weeks agoHow To Build A Rs 50 Lakh Equity Portfolio By Age 50 If You Start At 35 — Even With A Modest Salary

“Begin by investing just Rs 10,000 per month in equity mutual funds or index funds. With a disciplined annual step-up of 5-7%-aligned with your salary growth-and assuming long-term equity returns of 11-12%, you’re on track to reach Rs 50 lakhs in 1…[Read more]