-

VRIGHT Exchange – Daily Digest posted an update in the group VRIGHT Exchange | Daily Digest: Corporate & Economy

4 weeks agoMacro & Market Snapshot -7th Oct 2025

Global / External Developments

• Mixed global cues ahead of U.S. data and central bank insights are likely weighing slightly on market opens. Indian markets may open with softness.

• India’s trade strategy came under scrutiny: a government think-tank cautioned that without stronger engagement with China and tariff rationalization, export competitiveness could suffer.

• India is expected to see a flush of IPO activity in Q4 2025 (~USD 8 billion), with marquee offerings from Tata Capital, LG Electronics India, etc.

Domestic & Policy Signals

• The recent RBI reforms around lending and relaxed norms for borrowings have bolstered sentiment, especially toward financials.

• Market watchers view Oct 6, 7, and 9 as high-volatility days due to the start of Q2 earnings, global data releases, and policy announcements.

• Technicals: The Nifty 50 has formed a higher high / higher low structure. Support around 25,000 is critical; upside targets in 25,100–25,250 zone.

• According to economists, foreign investors may start turning more positive on Indian equities by late 2025 / early 2026, driven by stable fundamentals and improving macro.

Flow & Sentiment

• Domestic institutional investors (DIIs) continue to anchor flows, buying even as foreign institutional investors (FIIs) showed modest selling.

• Retail and thematic interest remains elevated ahead of new IPOs and earnings season.

• Market breadth in recent sessions showed healthy participation, especially in financials and midcaps.

Investor Insights

Cautious optimism prevails — the combination of policy clarity, strong flows from DIIs, and healthy earnings expectations supports upside, though volatility will remain high.

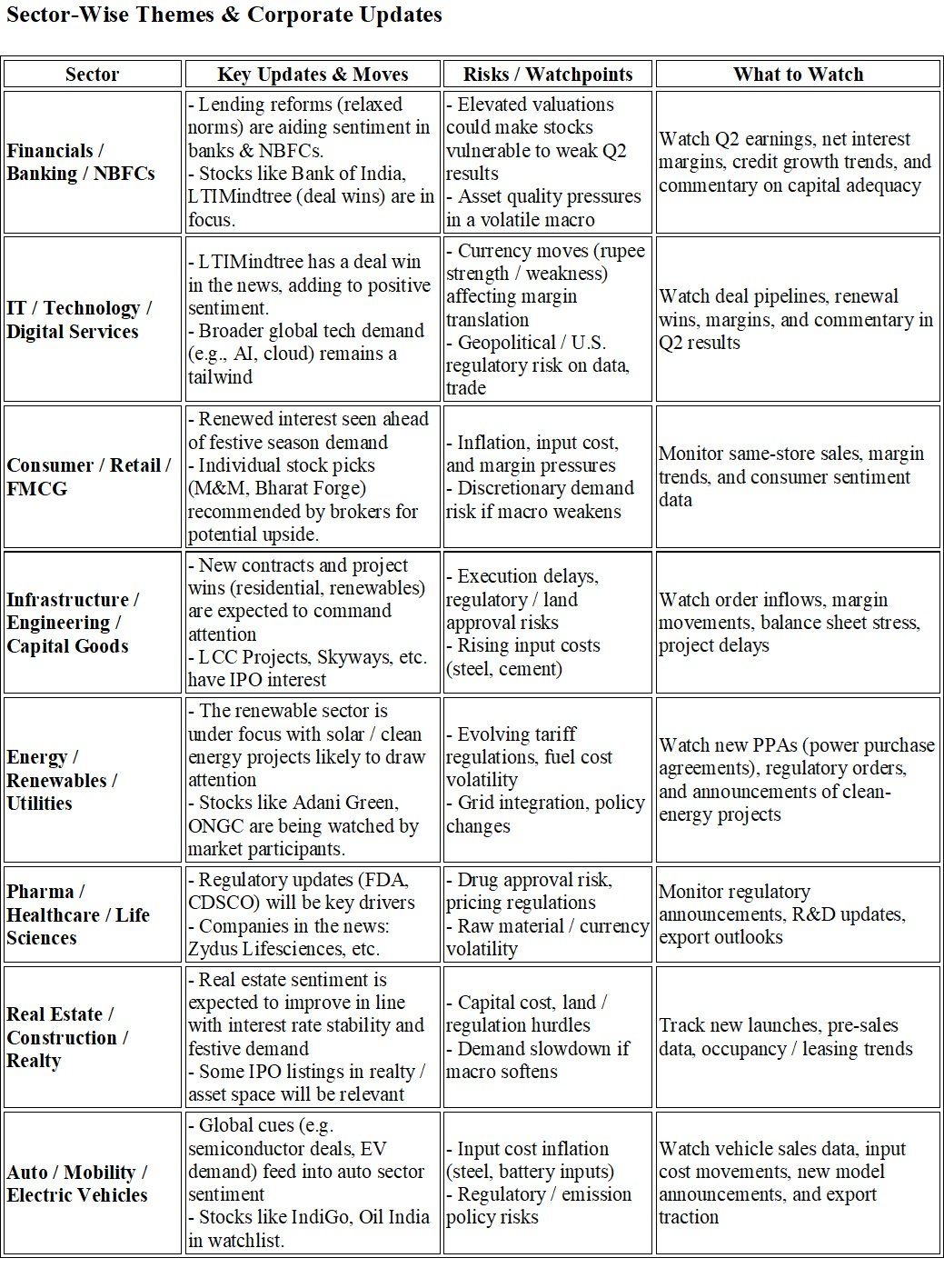

1. Financials sector remains a pivot — the recent lending reforms improve the operating backdrop; banks & NBFCs may lead gains in this phase.

2. Be selective in tech & consumer — strong underlying tailwinds, but margin pressures and global demand sensitivity call for picking winners.

3. Watch IPO / primary markets closely — large upcoming issues (Tata Capital, LG Electronics, etc.) will absorb liquidity and influence flow dynamics.

4. Volatility windows are real — with Oct 6–9 flagged as days of heightened risk, use stops, size judiciously, and stay nimble.

5. Global cues will matter — U.S. Fed decisions, China policy, and trade developments (especially India-China, India-EU) may swing sentiment.