Mahesh M. Ojha

-

0

Posts -

0

Comments -

209

Views

-

-

-

-

VRIGHT Exchange – Daily Digest posted an update in the group VRIGHT Exchange | Daily Digest: Corporate & Economy

3 weeks, 4 days agoMacro & Market Overview

• Mixed Global Cues & IPO Buzz: Indian markets opened with mixed tone. The LG Electronics India IPO saw strong subscription interest, reflecting appetite for marquee listings.

• FII Return & Cautious Optimism: Foreign institutional investors have resumed buying over the past few sessions, helping benchmarks regain foo…[Read more]

-

VRIGHT Exchange – IPO Pulse posted an update in the group VRIGHT Exchange-IPO Tracker

3 weeks, 4 days agoInvestor Update: LG Electronics India IPO — A Record-Breaking ₹11,607 Crore Listing

Overview

LG Electronics India Ltd’s ₹11,607 crore initial public offering (IPO) has made history as one of India’s largest and most heavily subscribed equity issues to date. The appliance and consumer electronics major attracted an astonishing ₹4.4 trillion (U…[Read more]

-

VRIGHT Exchange – IPO Pulse posted an update in the group VRIGHT Exchange-IPO Tracker

3 weeks, 4 days agoLISTING UPDATE

WEWORK

IPO PRICE: 648

LOT SIZE – RETAIL: 23

LOT SIZE – HNI: 322

LOT SIZE – HNI: 1564LISTING PRICE: 650(+2₹,+0.31%)

LISTING GAIN – RETAIL: 46/-

LISTING GAIN – HNI: 644/-

LISTING GAIN – HNI: 3128/- -

VRIGHT Exchange – IPO Pulse posted an update in the group VRight Exchange Capital Connect | Analyst & Investor Events

3 weeks, 4 days agoIPO Brokers and Analysts meet | Midwest Limited

Date -Friday, 10th October 2025, 04:00 PM.

Venue: St Regis (Imperial Room), Lower Parel, Mumbai

Company Spokesperson:

Mr. Ramachandra Kollareddy, Promoter & CEO

Ms. Uma Kollareddy, Promoter &w DirectorBLRMS

DAM Capital Advisors

Intensive Fiscal Services

Motilal Investment Advisors -

VRIGHT Exchange | Research & Strategy Desk posted an update in the group Economy & Industry Triggers

3 weeks, 5 days agoFund Flow Activity – NSE & BSE | 8th October 2025

Market Turnover (₹ Crore)

Cash Segment: NSE ₹89,602.56 + BSE ₹7,644.04 → Total ₹97,246.6 Cr

F&O Segment: NSE ₹1,44,038.37 + BSE ₹25,36,615.62 → Total ₹2,55,07,653.99 Cr

Provisional Cash Flow (₹ Crore)

FII / FPI: Net Buy +81.28 (₹10,286.98 – ₹10,205.70)

DII: Net Buy +329.96 (₹11,733.48 – ₹11,4…[Read more]

-

VRIGHT Exchange | Research & Strategy Desk posted an update in the group Economy & Industry Triggers

3 weeks, 5 days agoSwadeshi 2.0

The Government of India is accelerating self-reliance across critical sectors, creating massive import substitution opportunities for domestic companies.

Key Sectoral Import Dependence:

Minerals & Ores: >40% imported

Organic Chemicals: >50% imported

Fertilizers (DAP & MOP): >60% imported

Medical Devices: >80% imported

Crude…[Read more]

-

VRIGHT Exchange | Research & Strategy Desk posted an update in the group Research and Investment Spot

3 weeks, 5 days agoPEG < 1 – Actively Bought by FIIs

These stocks offer potential value opportunities, with a Price/Earnings-to-Growth (PEG) ratio below 1, indicating undervaluation relative to earnings growth, while foreign institutional investors (FIIs) are accumulating:

Sigachi Industries

Karnataka Bank

PNB Housing Finance

Aptus Value Housing F…[Read more]

-

VRIGHT Exchange | Research & Strategy Desk posted an update in the group Research and Investment Spot

3 weeks, 5 days agoPromising SMEs Poised for Strong FY26 Growth

(Select companies with market cap above ₹1,000 crore)

India’s SME ecosystem continues to demonstrate strong earnings visibility and expansion momentum, led by companies capitalizing on structural themes such as clean energy, defence, cooling, and electronics manufacturing. Supported by policy inc…[Read more]

-

VRIGHT Exchange | Research & Strategy Desk posted an update in the group VRIGHT Exchange | Market Movers

3 weeks, 5 days agoStocks in Radar – 9 Oct 2025

Positive Developments

HFCL – Secures export orders worth ₹303.35 crore for optical fiber cables via its overseas subsidiary.

Garuda Construction – Bags civil work order worth ₹144 crore for a redevelopment project in Mumbai.

Asahi India Glass – CRISIL upgrades rating on the company’s bank facilities.…[Read more]

-

VRIGHT Exchange | Research & Strategy Desk posted an update in the group VRIGHT Exchange | Market Movers

3 weeks, 5 days agoStocks in Focus – 9 October 2025

• Adani Power: Seeks consent for approval of an additional ₹2,000 crore for an already approved material related-party transaction.

• Oswal Agro Mills: Announces resignation of Narinder Kumar as CEO and Whole-Time Director.

• Paradeep Phosphates: Board approves the NCLT-sanctioned merger scheme between Mangalore…[Read more]

-

VRIGHT Exchange | Research & Strategy Desk posted an update in the group VRIGHT Exchange | Market Movers

3 weeks, 5 days agoStocks to Watch

IRB InvIT Fund

The infrastructure investment trust launched its Qualified Institutions Placement (QIP) on October 8 with a floor price of ₹62.69 per unit. According to market sources, the QIP size is expected to be around ₹3,000 crore, with an additional upsize option of ₹250 crore.GR Infraprojects

The company has received a Let…[Read more] -

VRIGHT Exchange – IPO Pulse posted an update in the group VRIGHT Exchange-IPO Tracker

3 weeks, 5 days agoLISTING UPDATE

GREENLEAF – SME

IPO PRICE: 136

LOT SIZE – INDIVIDUAL: 2000

LOT SIZE – HNI: 3000LISTING PRICE: 134.90(-1.10₹,-0.81%)

LISTING LOSS – INDIVIDUAL: 2200/-

LISTING LOSS – HNI: 3300/-DSM FRESH FOODS- SME

IPO PRICE: 100

LOT SIZE – INDIVIDUAL: 2400

LOT SIZE – HNI: 3600LISTING PRICE: 120(+20₹,+20%)

LISTING GAIN – INDIVIDUAL: 48,…[Read more] -

VRIGHT Exchange – IPO Pulse posted an update in the group VRIGHT Exchange-IPO Tracker

3 weeks, 5 days agoLISTING UPDATE -Oct 8

https://vrightexchange.com/activity/p/2268

Oct IPO Report by Axis Capital

https://vrightexchange.com/activity/p/2265

FUNDRAISING

https://vrightexchange.com/activity/p/2267 -

VRIGHT Exchange – Capital Connect posted an update in the group VRight Exchange Capital Connect | Analyst & Investor Events

3 weeks, 5 days agoEarnings Calls | 9 Oct 2025

4:00 PM- Madhya Bharat Agro

7:00 PM TCS

8:00 PM Tata Elxsi -

VRIGHT Exchange – Capital Connect posted an update in the group VRight Exchange Capital Connect | Analyst & Investor Events

3 weeks, 5 days agoBoard Meetings Scheduled – 9 Oct 2025

Company Agenda

5PAISA – Rights Issue of Equity Shares; General Matters

AFIL- General Matters

ALSTONE- General Matters

ASHIS- Quarterly & Audited Results

ASTALLTD- Preferential Issue; Increase in Authorised Capital; General

COVIDH- Rights Issue; General Matters

EIMCOELECO- Quarterly Results; G…[Read more] -

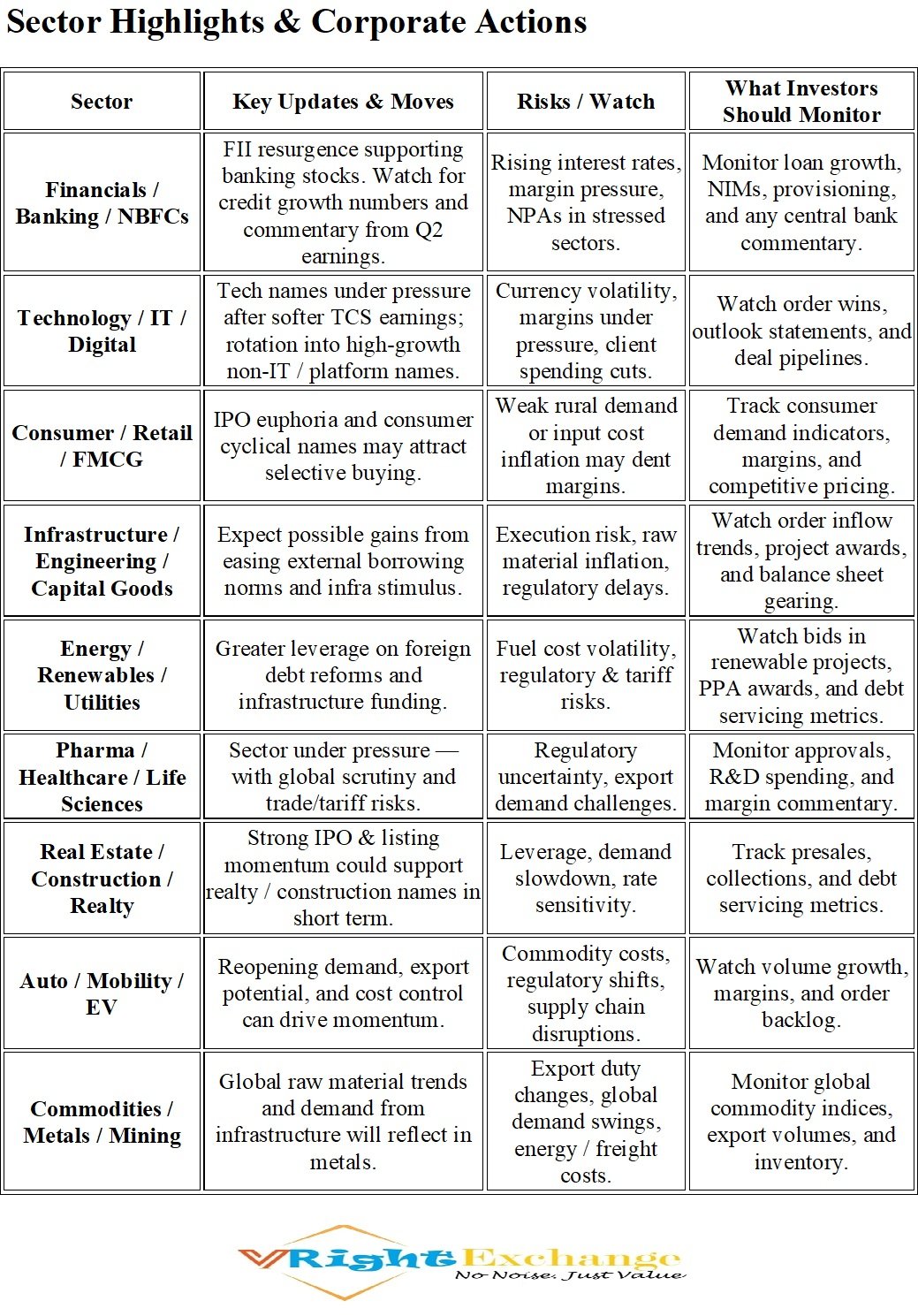

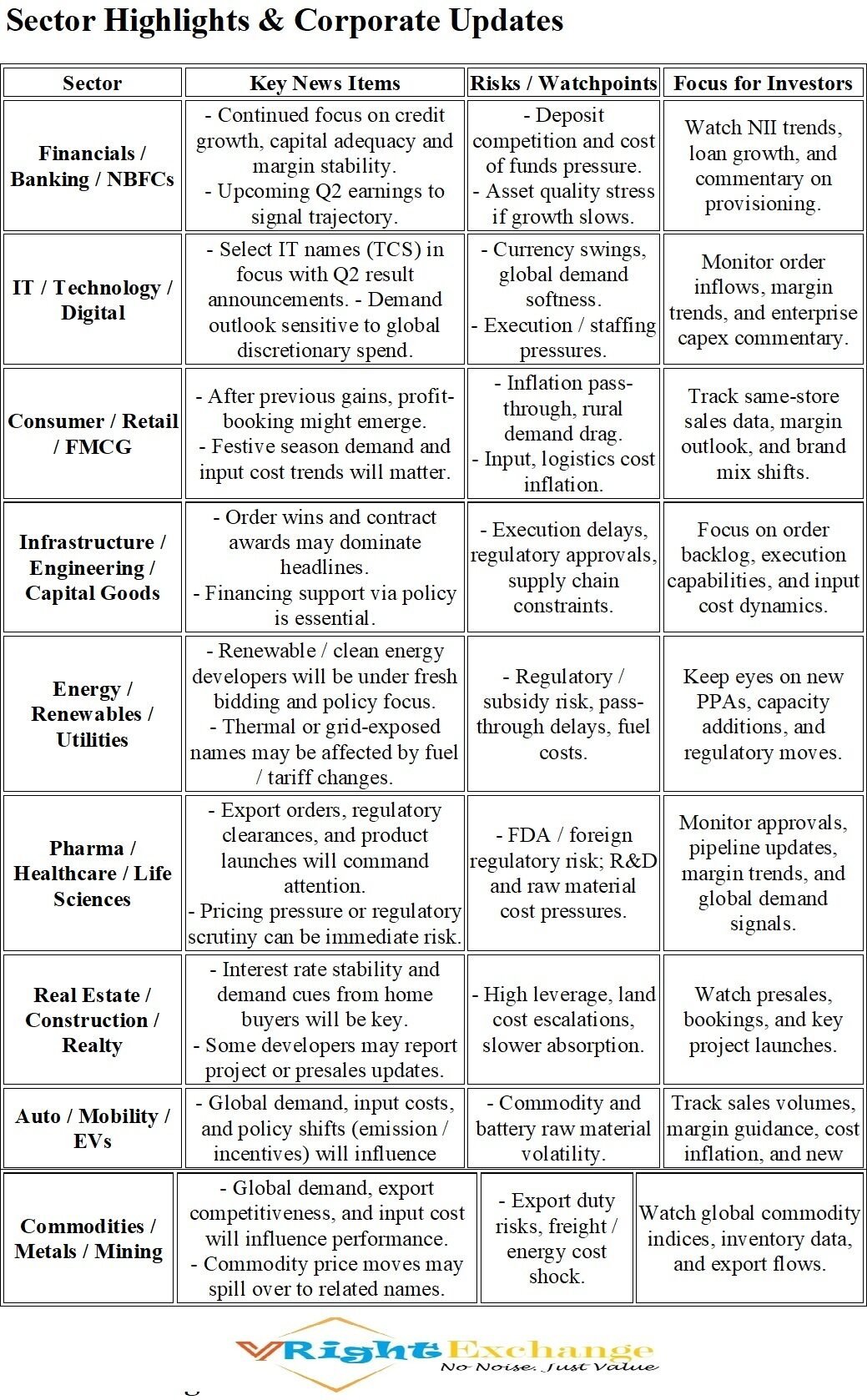

VRIGHT Exchange – Daily Digest posted an update in the group VRIGHT Exchange | Daily Digest: Corporate & Economy

3 weeks, 5 days agoVRIGHT Exchange – Daily Digest | Corporate & Economy Analysis for Oct 9, 2025

Macro & Market Overview

• Global cues are mostly favorable today, driving expectations of a green opening for Indian equities. GIFT-Nifty futures point to a positive start.

• The rupee might get mild support from a softer U.S. dollar, but interventions by the RBI r…[Read more]

-

VRIGHT Exchange | Research & Strategy Desk posted an update in the group Research and Investment Spot

3 weeks, 6 days agoFund Houses’ Recommendations

🔹 Positive / Bullish Views

UBS on Canara Bank: Buy — Target Price: ₹150/share

UBS on IGL: Buy — Target Price: ₹250/share

Investec on Petronet LNG: Buy — Target Price: ₹400/share

Jefferies on Lodha Developers: Buy — Target Price: ₹1,625/share

Nomura on Lodha Developers: Buy — Target Price: ₹1,450/share

Morga…[Read more]

-

VRIGHT Exchange | Research & Strategy Desk posted an update in the group VRIGHT Exchange | Market Movers

3 weeks, 6 days agoStocks in News — October 8, 2025

Positive Developments

Saatvik Green: Received an order worth ₹488 crore for the supply of solar PV modules from leading independent power producers.

Dishman Carbogen Amcis (DCAL): Signed an agreement with Celonic Group to deliver a fully integrated antibody-drug conjugate (ADC) development platform.

Salzer Ele…[Read more]

-

VRIGHT Exchange | Research & Strategy Desk posted an update in the group VRIGHT Exchange | Daily Digest: Corporate & Economy

3 weeks, 6 days agoUPDATES’

ORDER WINS

Sarveshwar Foods Ltd: Secures a major export order worth ₹266 million from Delaware, USA–based Agri Services & Trade LLC. Total export orders now stand at ₹1,226 million over the past two months.

AIA Engineering Ltd: Subsidiary Vega Industries Chile SpA wins a $32.9 million (~₹291 crore) order from a Chilean copper mine fo…[Read more]

-

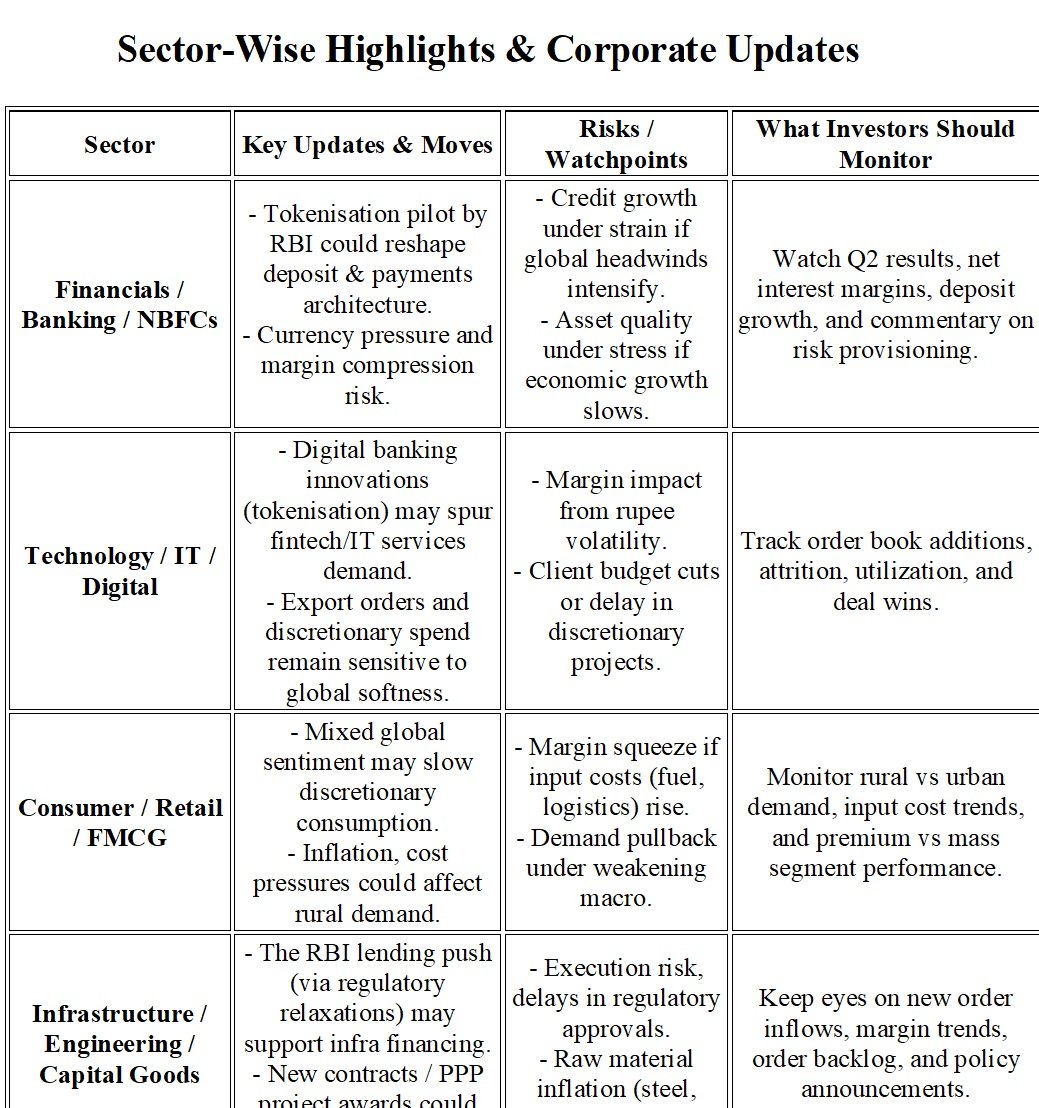

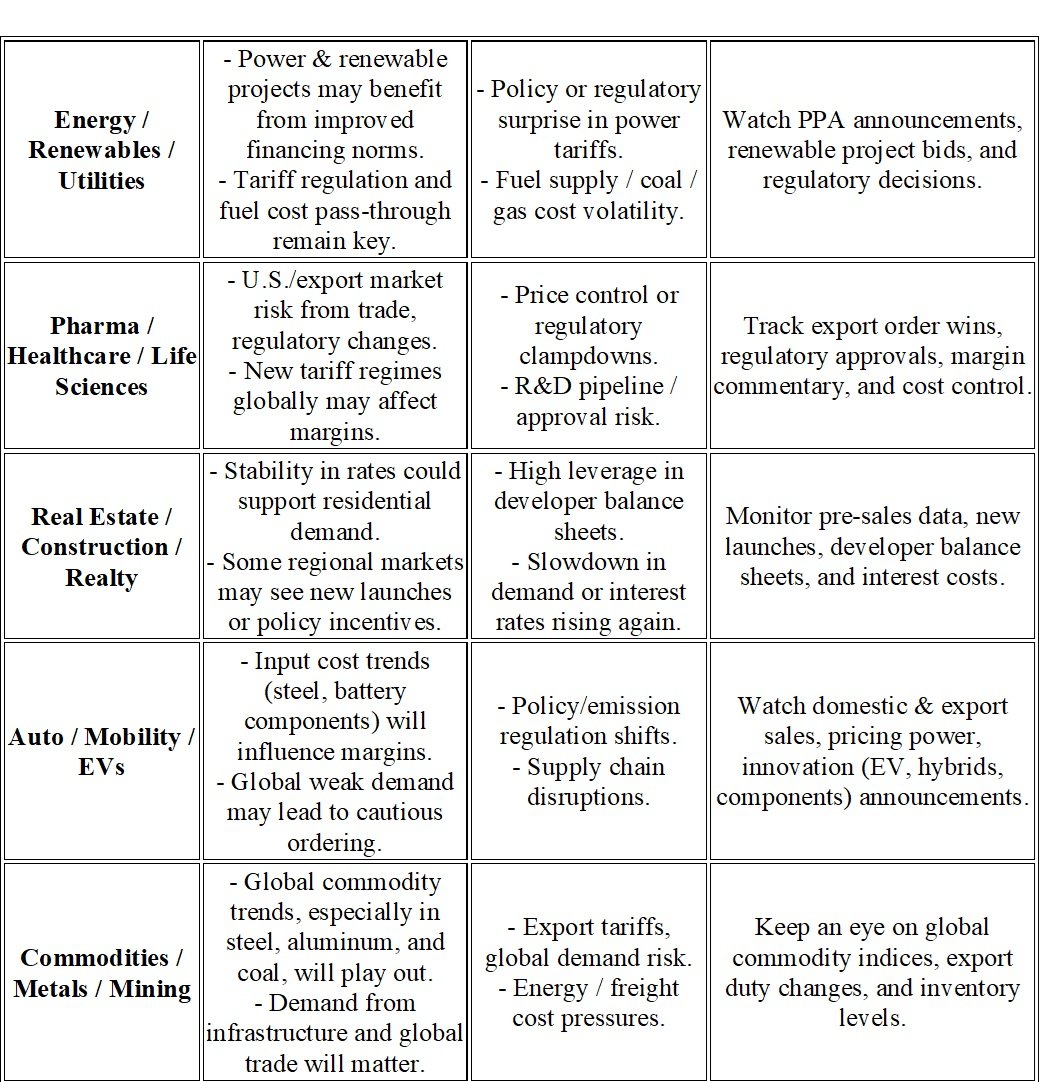

VRIGHT Exchange – Daily Digest posted an update in the group VRIGHT Exchange | Daily Digest: Corporate & Economy

3 weeks, 6 days agoMacro & Market Context

Macro & External Developments

• The rupee is under pressure, nearing record lows (~₹88.78–88.82 per USD), prompting RBI intervention in spot and swap markets to defend currency stability.

• The RBI is launching a deposit tokenisation pilot today (Oct 8), marking a notable push into fintech and digital banking infrast…[Read more]