VRIGHT Exchange | Research & Strategy Desk

-

100

Posts -

0

Comments -

174

Views

-

-

-

-

VRIGHT Exchange | Research & Strategy Desk posted an update in the group VRIGHT Exchange | Daily Digest: Corporate & Economy

3 weeks agoResults Today

Tech Mahindra, ICICI Lombard General Insurance Company, ICICI Prudential Life Insurance Company, Aditya Birla Money, Cyient DLM, GTPL Hathway, Indian Renewable Energy Development Agency, Bank of Maharashtra, Persistent Systems, Leela Palaces Hotels & Resorts, and Thyrocare Technologies will announce their quarterly earnings today.

-

VRIGHT Exchange | Research & Strategy Desk posted an update in the group VRIGHT Exchange | Market Movers

3 weeks agoStocks to Watch | October 14, 2025

1. RBL Bank

Middle East banking major Emirates NBD is in advanced discussions to acquire over 51% stake in RBL Bank, as per multiple industry sources. The proposed $3 billion deal, if finalized, will mark one of the largest cross-border investments in India’s private banking sector and could significantly r…[Read more]

-

VRIGHT Exchange | Research & Strategy Desk posted an update in the group VRIGHT Exchange | Market Movers

3 weeks agoVRIGHT EXCHANGE | Corporate & Market Action Report — 14 October 2025

Corporate Earnings & Business Highlights

HCL Technologies (Q2 FY26 – Consolidated)

• Revenue: ₹31,942 crore, up 10.7% YoY and 5.2% QoQ

• EBIT: ₹5,550 crore, up 3.5% YoY; EBIT margin down to 17.4% (vs 18.6%)

• Net Profit: ₹4,235 crore (flat YoY, +10.2% QoQ)

• Revenue…[Read more] -

VRIGHT Exchange | Research & Strategy Desk posted an update in the group Financial Services Group

3 weeks agoStock In Focus : RBL Bank Ltd

Media reports that the Middle East bank Emirates NBD is in advanced talks to acquire a majority stake in the company. The report stated that both parties have been in talks for the last few months and Emirates NBD is keen on picking up more than 51% stake in RBL Bank. RBL Bank’s current market capitalisation is at…[Read more]

-

VRIGHT Exchange | Research & Strategy Desk posted an update in the group Movers and Shakers -Opportunities in Finance & Markets Group

3 weeks, 1 day agoCorporate Leadership update

• Quess Corp: CFO Sushanth Pai resigns, effective Oct 17.

• Mahalaxmi Rubtech: CFO Rajendra Mehta resigns effective Nov 30.

• Hind Rectifiers: Appoints Manoj Nair as CEO. -

VRIGHT Exchange | Research & Strategy Desk posted an update in the group Research and Investment Spot

3 weeks, 1 day ago -

VRIGHT Exchange | Research & Strategy Desk posted an update in the group Research and Investment Spot

3 weeks, 1 day agoMultibagger Tracker — 9 Stocks That Soared Over 5,000% in 5 Years

While these returns appear phenomenal, few investors actually entered early or held through market volatility.

Top 5-Year Performers (as of Oct 11, 2025):

1) Jindal Photo – +11,465%

2) TARIL – +10,136%

3) Pondy Oxide – +8,428%

4) Xpro India – +7,811%

5) Lotus Chocolate…[Read more] -

VRIGHT Exchange | Research & Strategy Desk posted an update in the group VRIGHT Exchange | Market Movers

3 weeks, 1 day agoStocks in Radar — October 13, 2025

Industrial & Infrastructure

• Elecon Engineering: Open order book stands at ₹1,226 crore as of Sept 2025.

• Welspun Enterprises: Board meet on Oct 15 to consider fundraising via warrants or preferential issue. Bags ₹7,300 crore Pune–Shirur highway and ₹3,145 crore Panjrapur WTP projects with Veolia.

• HCC…[Read more] -

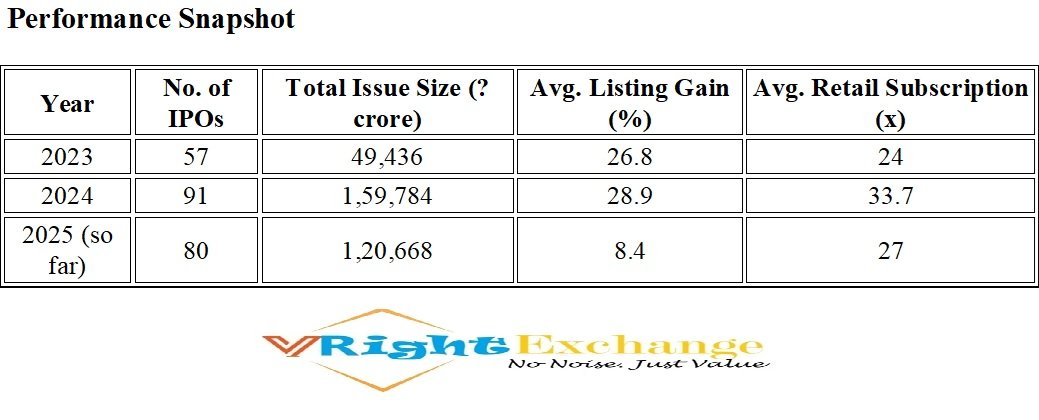

VRIGHT Exchange | Research & Strategy Desk posted an update in the group VRIGHT Exchange-IPO Tracker

3 weeks, 1 day agoInvestor Update | Retail Participation in IPOs Sees Sharp Dip

Key Insight:

Retail investor participation in India’s primary markets has slowed sharply in 2025 as listing gains and subscription enthusiasm moderate after two years of robust activity.Market Overview

According to data from Prime Database, retail investors’ average subscription in…[Read more] -

VRIGHT Exchange | Research & Strategy Desk posted an update in the group VRIGHT Exchange | Daily Digest: Corporate & Economy

3 weeks, 2 days agoGLOBAL SHOCK: OCTOBER 11, 2025

On October 11, 2025, President Donald Trump announced 100% tariffs on all Chinese imports and export restrictions on critical U.S. software, retaliating against China’s rare earth mineral export ban.

The decision triggered a global market meltdown:

Global equities lost $1.6 trillion in value in a single trading s…[Read more]

-

VRIGHT Exchange | Research & Strategy Desk posted an update in the group Economy & Industry Triggers

3 weeks, 2 days agoTrillions Lost, Lessons Gained — The Story of October 11, 2025

By VRIGHT Exchange Research Desk

October 11, 2025, will be remembered as the day global financial markets hit the reset button. Within hours, trillions in market value were wiped out, leaving investors stunned and portfolios deep in the red. Yet, in this chaos lay profound l…[Read more]

-

VRIGHT Exchange | Research & Strategy Desk posted an update in the group VRIGHT Exchange | Daily Digest: Corporate & Economy

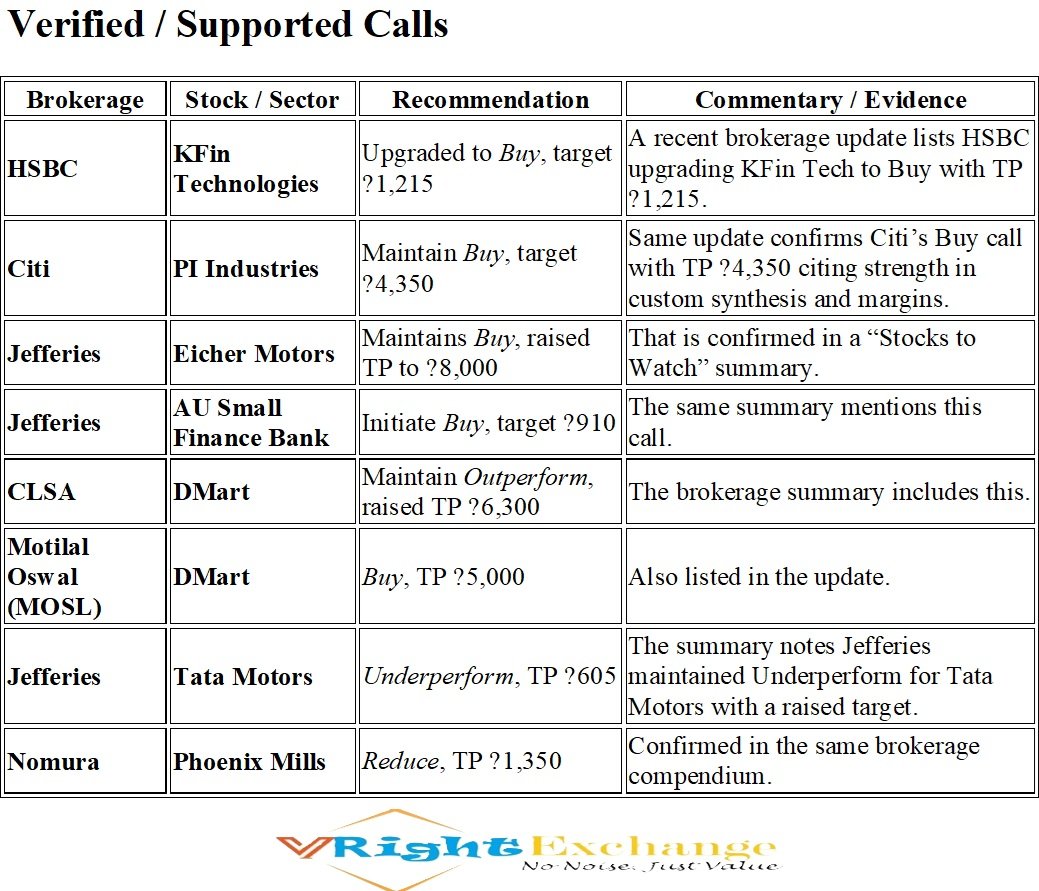

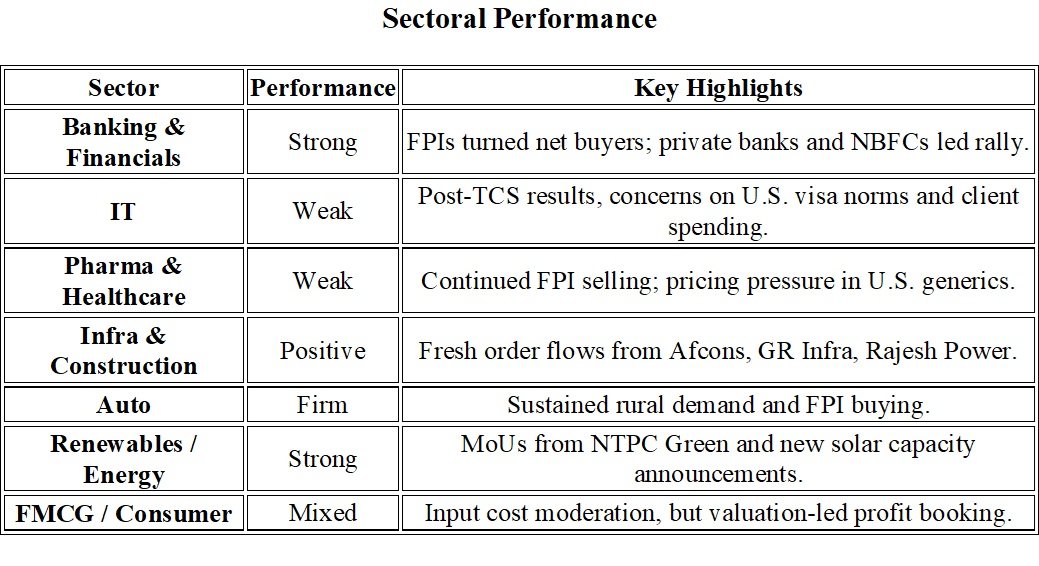

3 weeks, 3 days agoWeekly Market Review: Oct 6 – 10, 2025

Market Overview

Indian equities posted a steady performance through the week, with the Nifty50 hovering around the 25,200 mark and the Sensex near 82,700, supported by renewed FPI inflows, strong domestic liquidity, and selective buying in financials and infrastructure.

The market absorbed global v…[Read more]

-

VRIGHT Exchange | Research & Strategy Desk posted an update in the group Economy & Industry Triggers

3 weeks, 5 days agoFund Flow Activity – NSE & BSE | 8th October 2025

Market Turnover (₹ Crore)

Cash Segment: NSE ₹89,602.56 + BSE ₹7,644.04 → Total ₹97,246.6 Cr

F&O Segment: NSE ₹1,44,038.37 + BSE ₹25,36,615.62 → Total ₹2,55,07,653.99 Cr

Provisional Cash Flow (₹ Crore)

FII / FPI: Net Buy +81.28 (₹10,286.98 – ₹10,205.70)

DII: Net Buy +329.96 (₹11,733.48 – ₹11,4…[Read more]

-

VRIGHT Exchange | Research & Strategy Desk posted an update in the group Economy & Industry Triggers

3 weeks, 5 days agoSwadeshi 2.0

The Government of India is accelerating self-reliance across critical sectors, creating massive import substitution opportunities for domestic companies.

Key Sectoral Import Dependence:

Minerals & Ores: >40% imported

Organic Chemicals: >50% imported

Fertilizers (DAP & MOP): >60% imported

Medical Devices: >80% imported

Crude…[Read more]

-

VRIGHT Exchange | Research & Strategy Desk posted an update in the group Research and Investment Spot

3 weeks, 5 days agoPEG < 1 – Actively Bought by FIIs

These stocks offer potential value opportunities, with a Price/Earnings-to-Growth (PEG) ratio below 1, indicating undervaluation relative to earnings growth, while foreign institutional investors (FIIs) are accumulating:

Sigachi Industries

Karnataka Bank

PNB Housing Finance

Aptus Value Housing F…[Read more]

-

VRIGHT Exchange | Research & Strategy Desk posted an update in the group Research and Investment Spot

3 weeks, 5 days agoPromising SMEs Poised for Strong FY26 Growth

(Select companies with market cap above ₹1,000 crore)

India’s SME ecosystem continues to demonstrate strong earnings visibility and expansion momentum, led by companies capitalizing on structural themes such as clean energy, defence, cooling, and electronics manufacturing. Supported by policy inc…[Read more]

-

VRIGHT Exchange | Research & Strategy Desk posted an update in the group VRIGHT Exchange | Market Movers

3 weeks, 5 days agoStocks in Radar – 9 Oct 2025

Positive Developments

HFCL – Secures export orders worth ₹303.35 crore for optical fiber cables via its overseas subsidiary.

Garuda Construction – Bags civil work order worth ₹144 crore for a redevelopment project in Mumbai.

Asahi India Glass – CRISIL upgrades rating on the company’s bank facilities.…[Read more]

-

VRIGHT Exchange | Research & Strategy Desk posted an update in the group Movers and Shakers -Opportunities in Finance & Markets Group

3 weeks, 5 days agoEPL Ltd: Anand Kripalu to retire as Managing Director and Global CEO effective December 31, 2025

Hemant Bakshi appointed CEO Designate effective October 13, 2025

-

VRIGHT Exchange | Research & Strategy Desk posted an update in the group VRIGHT Exchange | Market Movers

3 weeks, 5 days agoStocks in Focus – 9 October 2025

• Adani Power: Seeks consent for approval of an additional ₹2,000 crore for an already approved material related-party transaction.

• Oswal Agro Mills: Announces resignation of Narinder Kumar as CEO and Whole-Time Director.

• Paradeep Phosphates: Board approves the NCLT-sanctioned merger scheme between Mangalore…[Read more]

-

VRIGHT Exchange | Research & Strategy Desk posted an update in the group Movers and Shakers -Opportunities in Finance & Markets Group

3 weeks, 5 days agoOswal Agro Mills

Narinder Kumar has resigned from the position of Whole-Time Director and Chief Executive Officer due to personal reasons, effective October 8.