-

VRIGHT Exchange | Research & Strategy Desk posted an update in the group VRIGHT Exchange | Daily Digest: Corporate & Economy

3 weeks, 3 days agoWeekly Market Review: Oct 6 – 10, 2025

Market Overview

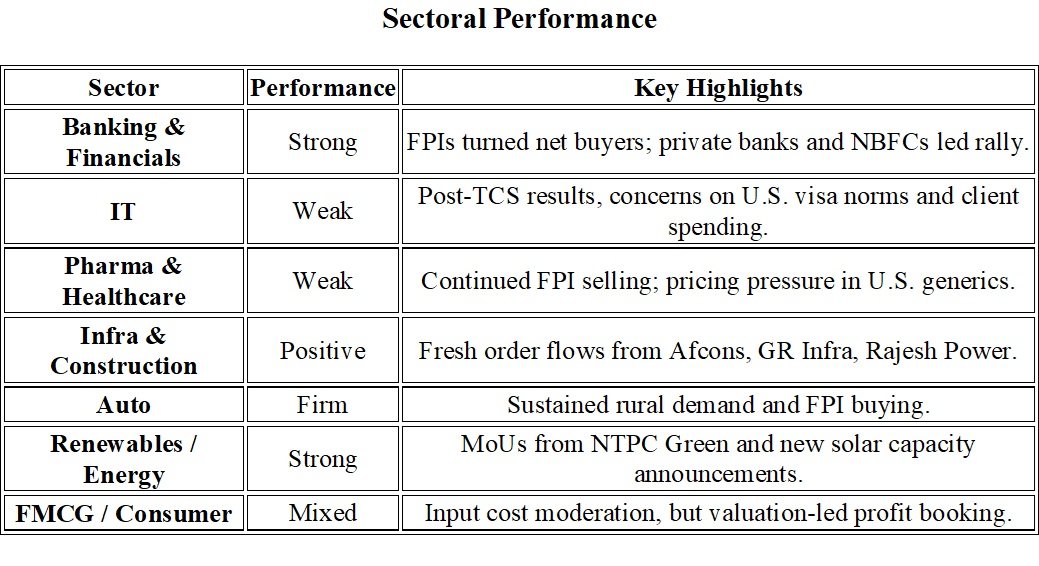

Indian equities posted a steady performance through the week, with the Nifty50 hovering around the 25,200 mark and the Sensex near 82,700, supported by renewed FPI inflows, strong domestic liquidity, and selective buying in financials and infrastructure.

The market absorbed global volatility well despite mixed cues from U.S. indices and concerns around China’s economic slowdown.

While the broader sentiment remained constructive, profit booking was visible in IT and pharma — sectors that witnessed continued foreign institutional selling through September due to global regulatory uncertainty and U.S. policy risks.The Rupee remained stable around 88.75 per USD, supported by RBI intervention and ongoing capital inflows from recent and upcoming IPOs.

Macroeconomic & Policy Highlights

• India’s industrial activity remained strong, with core sector growth sustaining above 8%, led by steel, power, and cement.

• GST collections in September crossed ₹1.73 lakh crore, marking the 10th consecutive month above ₹1.7 lakh crore.

• The government is pushing “Swadeshi 2.0” with aggressive import substitution across sectors like organic chemicals, fertilizers, rare earths, medical devices, and chips — a major medium-term domestic manufacturing catalyst.

• Bond yields remained range-bound as markets anticipate steady RBI policy, though traders are eyeing U.S. inflation data for global yield direction.

Global Developments

• U.S. markets ended the week mixed, with tech stocks rebounding on easing bond yields but energy names underperforming as crude slipped below $62/barrel.

• Europe posted gains, supported by lower inflation readings and hopes of monetary easing in early 2026.

• Japan’s Nikkei surged on continued yen weakness, aiding export sentiment.

• China’s economic data remained weak, though fresh stimulus measures are expected to be announced post the National Day holidays.

Key Corporate Developments

• TCS: Q2 revenue beat estimates; margins impacted by one-time severance costs.

• NTPC Green: Signed MoU with Gujarat Govt for large-scale solar & wind projects.

• Afcons Infrastructure: Won ₹576 crore civil work order.

• Rajesh Power Services: Announced ₹4,754 crore Gujarat projects creating 33,000 jobs.

• Adani Enterprises: Raised ₹1,000 crore via NCD issue.

• Fortis Healthcare: IHH Healthcare launched open offer for 26.1% stake.

• Tata Motors: Completed demerger of CV business; PV arm amalgamated into TMLCV.

• Amber Enterprises: Subsidiary acquired Unitronics stake worth NIS 156 million.

FPI & DII Flows (Week Ending Oct 10)

• FPIs: Net buyers of ~₹1,200 crore after heavy outflows in September.

• DIIs: Continued strong domestic support, adding ~₹3,800 crore.

• Fund Activity: Renewed accumulation seen in large-cap banks, infra, and select consumer stocks; trimming in pharma and IT continued.

Weekly Preview: Oct 13 – 17, 2025

Key Events to Watch

1. Q2 Earnings Season in Full Swing – Major results from Infosys, HDFC Bank, Wipro, and Hindustan Unilever to set tone.

2. Macro Data Releases – India CPI, IIP data and U.S. inflation numbers to influence rate outlook.

3. FPI Flow Trend – Whether inflows sustain or revert amid global uncertainty.

4. Regulatory Announcements – Watch for SEBI updates on SME listings and fintech norms.

5. IPO Calendar – Strong activity expected; could absorb secondary market liquidity.

6. Commodity Watch – Brent crude near $65 remains a key risk for oil importers; gold and silver steady.

Market Outlook

• Nifty Support: 24,950 – 25,050

• Nifty Resistance: 25,400 – 25,600

• Bias: Range-bound with positive undertone

• Key drivers: Bank earnings, FPI trend, global yieldsInvestor Insights

• Stay selective in IT and pharma until visibility improves.

• Accumulate financials, green energy, infra on dips — strong Q2 guidance and order pipelines provide visibility.

• Monitor consumption stocks for festive-season traction.

• Watch midcap volatility, especially in over-owned SME names.

• Defensive allocation in utilities and select PSUs recommended for short-term balance.