-

VRIGHT Exchange | Research & Strategy Desk posted an update in the group VRIGHT Exchange-IPO Tracker

3 weeks, 1 day agoInvestor Update | Retail Participation in IPOs Sees Sharp Dip

Key Insight:

Retail investor participation in India’s primary markets has slowed sharply in 2025 as listing gains and subscription enthusiasm moderate after two years of robust activity.Market Overview

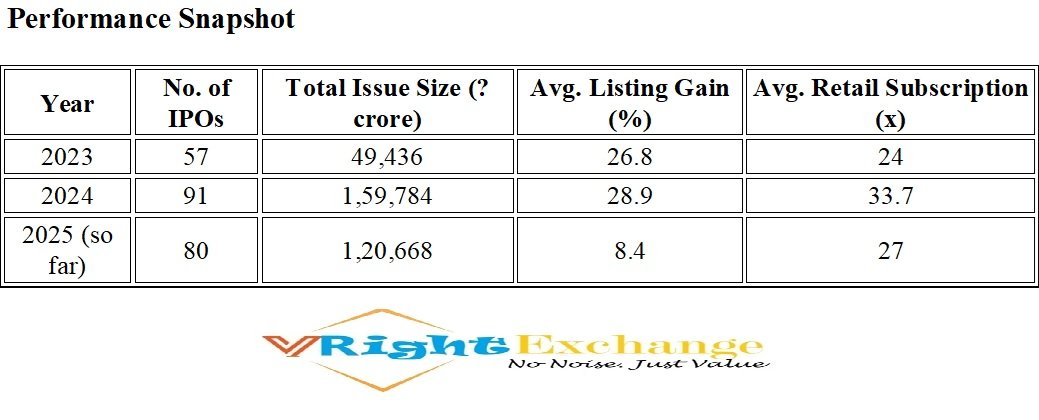

According to data from Prime Database, retail investors’ average subscription in IPOs has fallen to 26.99 times so far in 2025, compared to 33.71 times in 2024. The decline reflects cooling sentiment amid subdued post-listing performance and limited near-term returns.Investor Sentiment

• The average listing gain has dropped sharply to 8.41% in 2025 versus 28.9% last year, eroding the short-term appeal for retail investors.

• While 80 IPOs have already been launched this year with an aggregate issue size exceeding ₹1.2 lakh crore, investor participation has shifted towards institutional and high-net-worth categories, indicating more selective risk appetite.

• Analysts suggest this moderation signals a healthy market normalization after two exuberant years, aligning valuations more closely with fundamentals.Outlook

Despite the near-term slowdown in retail participation, the strong pipeline of new-age and mid-cap offerings in sectors like energy, manufacturing, and technology may rekindle interest in the coming quarters. Improved secondary market performance and sustained corporate earnings momentum will be key triggers for a revival in retail IPO enthusiasm.