VRIGHT Exchange -Insight Hooks

-

6

Posts -

0

Comments -

158

Views

-

-

-

-

VRIGHT Exchange | Research & Strategy Desk posted an update in the group VRIGHT Exchange | Daily Digest: Corporate & Economy

3 weeks agoResults Today

Tech Mahindra, ICICI Lombard General Insurance Company, ICICI Prudential Life Insurance Company, Aditya Birla Money, Cyient DLM, GTPL Hathway, Indian Renewable Energy Development Agency, Bank of Maharashtra, Persistent Systems, Leela Palaces Hotels & Resorts, and Thyrocare Technologies will announce their quarterly earnings today.

-

VRIGHT Exchange | Research & Strategy Desk posted an update in the group VRIGHT Exchange | Market Movers

3 weeks agoStocks to Watch | October 14, 2025

1. RBL Bank

Middle East banking major Emirates NBD is in advanced discussions to acquire over 51% stake in RBL Bank, as per multiple industry sources. The proposed $3 billion deal, if finalized, will mark one of the largest cross-border investments in India’s private banking sector and could significantly r…[Read more]

-

VRIGHT Exchange | Research & Strategy Desk posted an update in the group VRIGHT Exchange | Market Movers

3 weeks agoVRIGHT EXCHANGE | Corporate & Market Action Report — 14 October 2025

Corporate Earnings & Business Highlights

HCL Technologies (Q2 FY26 – Consolidated)

• Revenue: ₹31,942 crore, up 10.7% YoY and 5.2% QoQ

• EBIT: ₹5,550 crore, up 3.5% YoY; EBIT margin down to 17.4% (vs 18.6%)

• Net Profit: ₹4,235 crore (flat YoY, +10.2% QoQ)

• Revenue…[Read more] -

VRIGHT Exchange – Daily Digest posted an update in the group VRIGHT Exchange | Daily Digest: Corporate & Economy

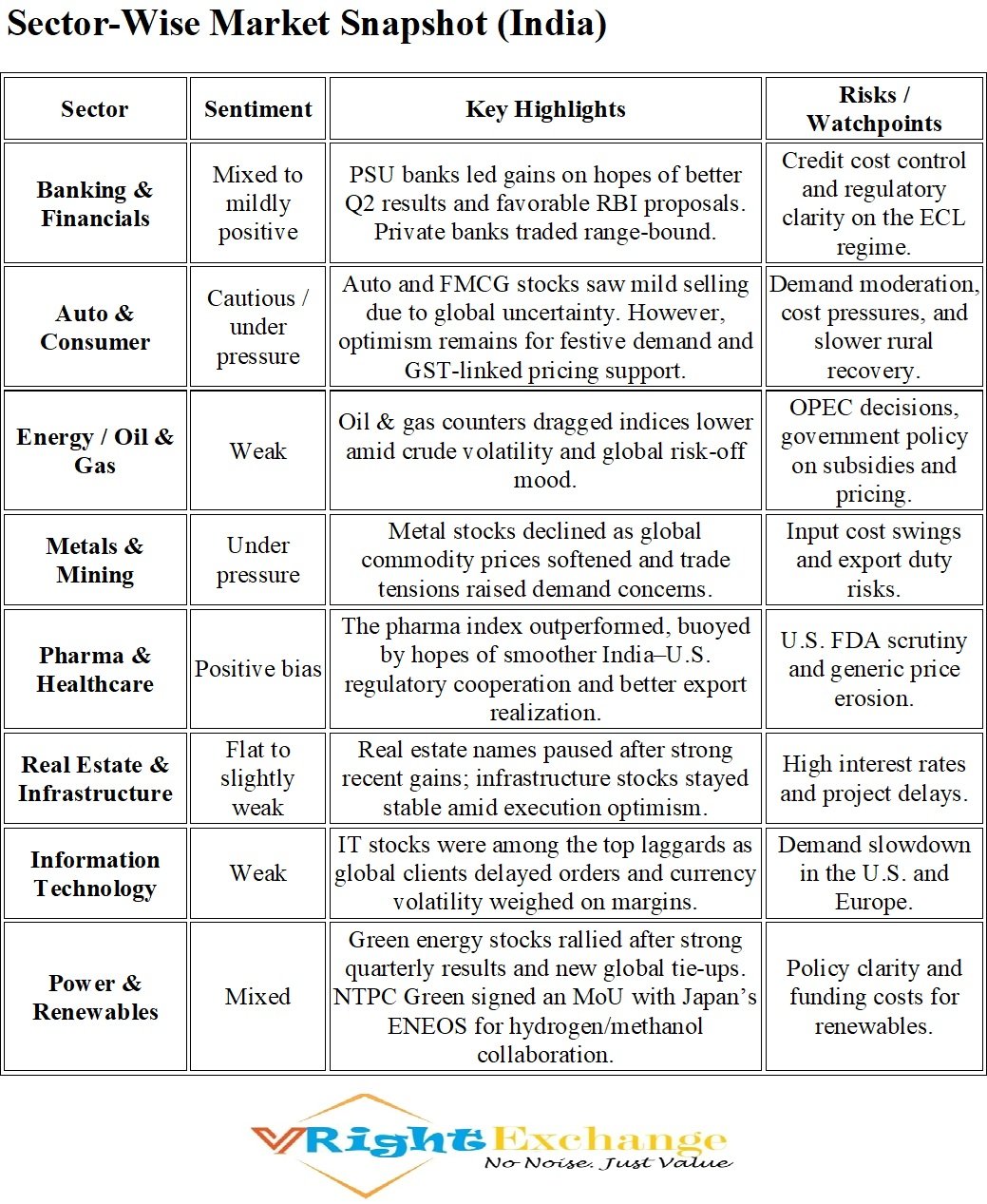

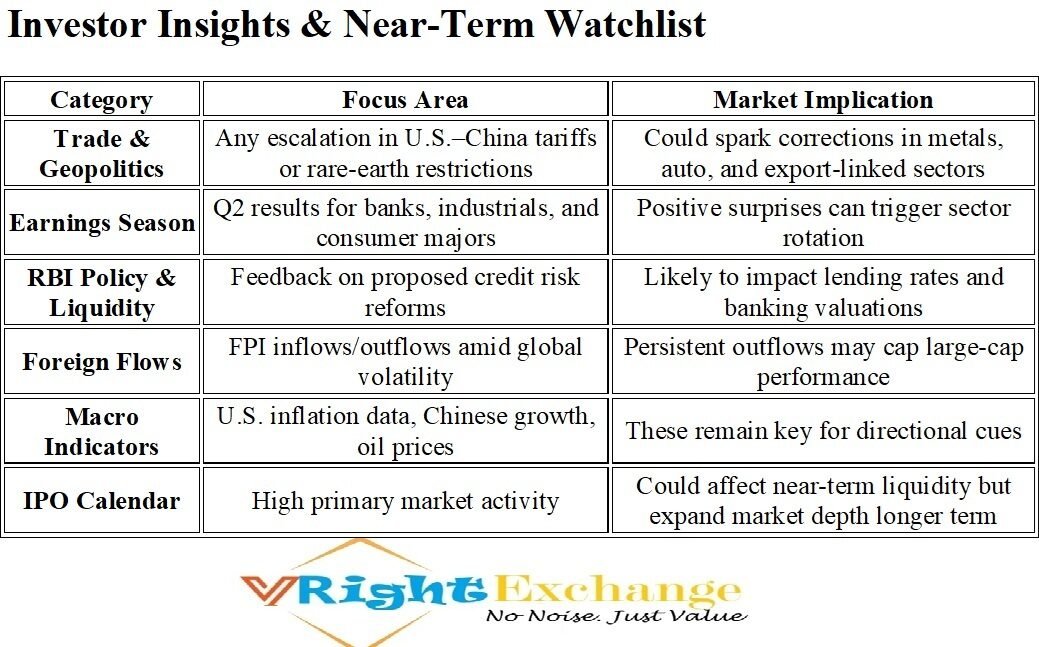

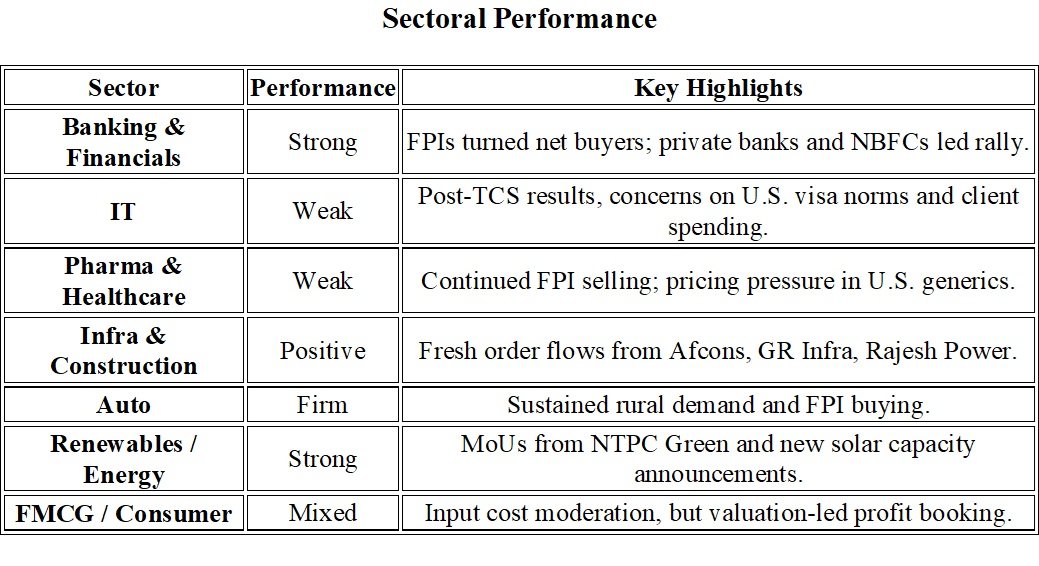

3 weeks agoVRIGHT EXCHANGE | Daily Market Update — 14 October 2025

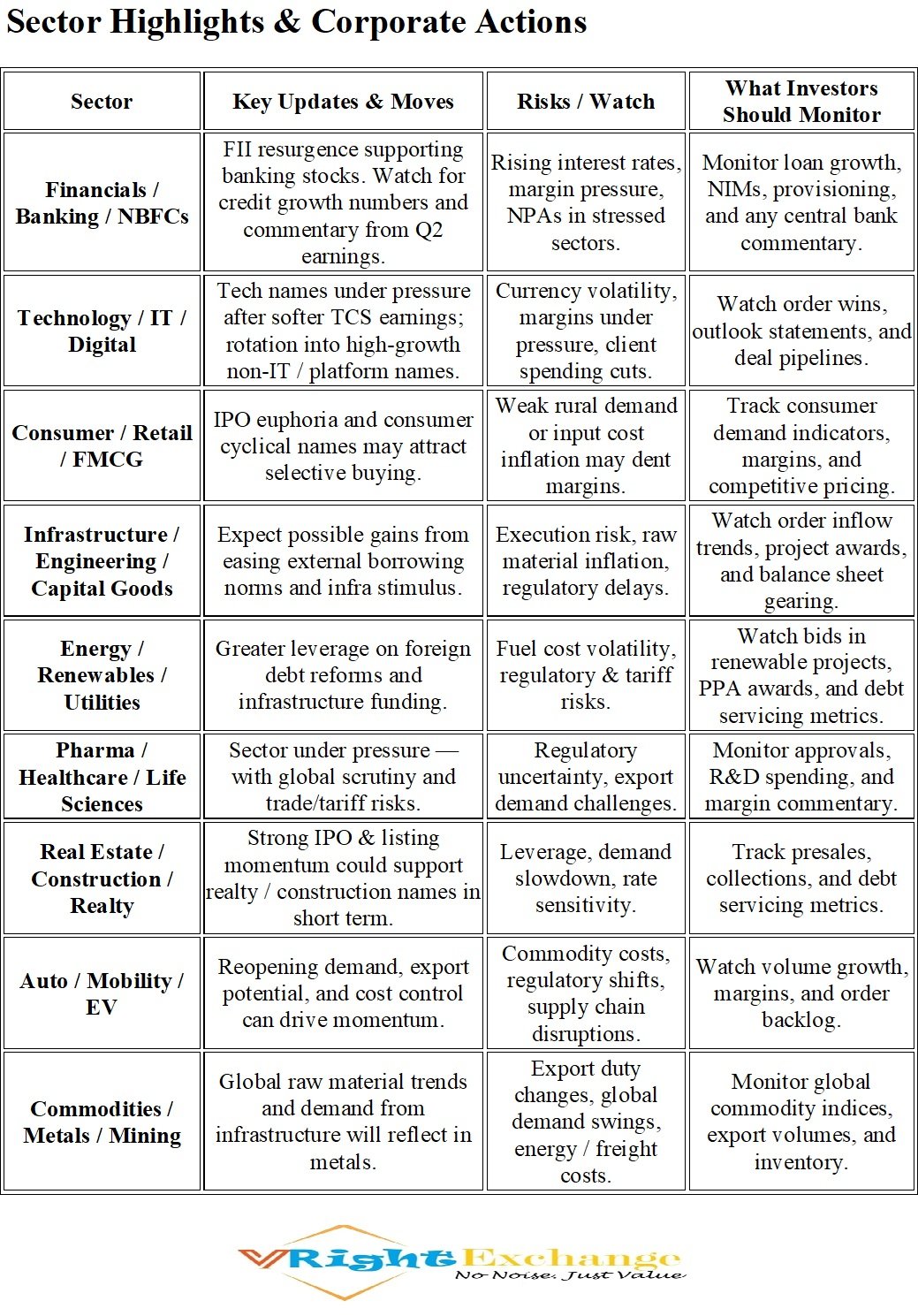

Sector-Wise Overview | Corporate, Macro & Investor Insights

Global & Macro Trends

• U.S.–China Trade Tensions: Renewed frictions over rare-earth export controls and reciprocal port fees have heightened global supply chain concerns. Manufacturing, tech, and logistics sectors are seeing senti…[Read more] -

VRIGHT Exchange | Research & Strategy Desk posted an update in the group VRIGHT Exchange | Market Movers

3 weeks, 1 day agoStocks in Radar — October 13, 2025

Industrial & Infrastructure

• Elecon Engineering: Open order book stands at ₹1,226 crore as of Sept 2025.

• Welspun Enterprises: Board meet on Oct 15 to consider fundraising via warrants or preferential issue. Bags ₹7,300 crore Pune–Shirur highway and ₹3,145 crore Panjrapur WTP projects with Veolia.

• HCC…[Read more] -

VRIGHT Exchange | Research & Strategy Desk posted an update in the group VRIGHT Exchange-IPO Tracker

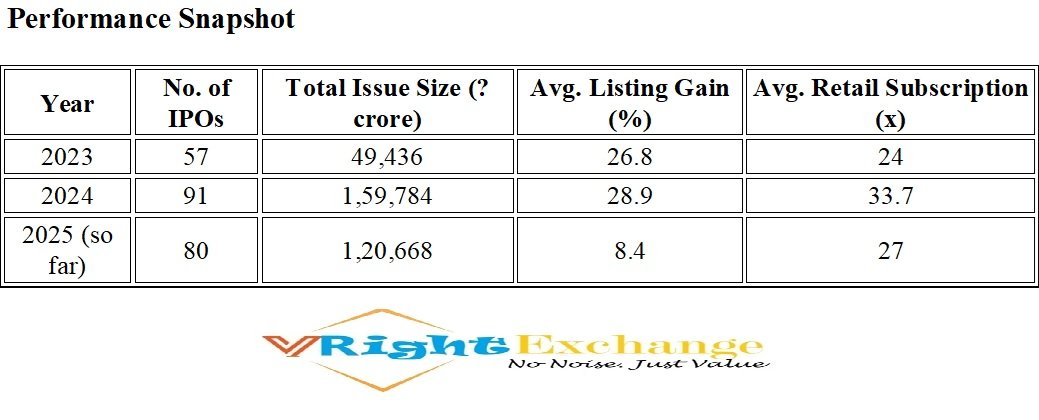

3 weeks, 1 day agoInvestor Update | Retail Participation in IPOs Sees Sharp Dip

Key Insight:

Retail investor participation in India’s primary markets has slowed sharply in 2025 as listing gains and subscription enthusiasm moderate after two years of robust activity.Market Overview

According to data from Prime Database, retail investors’ average subscription in…[Read more] -

VRIGHT Exchange – IPO Pulse posted an update in the group VRIGHT Exchange-IPO Tracker

3 weeks, 1 day agoTata Capital – Listing Update

• Shares debut today following an IPO that was 1.95x subscribed, led by strong institutional demand (QIBs: 3.42x, NIIs: 1.98x, Retail: 1.1x).IPO PRICE: 326

LOT SIZE – RETAIL: 46

LOT SIZE – RETAIL MAX: 522

LOT SIZE – sHNI: 644

LOT SIZE – bHNI: 1733LISTING PRICE: 330(+4₹,+1.23%)

LISTING GAIN – RETAIL: 184/-…[Read more] -

VRIGHT Exchange – IPO Pulse posted an update in the group VRIGHT Exchange-IPO Tracker

3 weeks, 1 day agoLG Electronics India Ltd

Basis of AllotmentQIB – 175.1716x

HNI Bucket1(Rs2 -10Lacs) –

35 : 559 (15.97) allotted 182 sharesHNI Bucket2(Above 10 lacs)-

269 : 1204 (4.48) allotted

182 sharesRetail –

1135 : 2261 (1.99) allotted 13 sharesLG IPO

BASIS…[Read more] -

VRIGHT Exchange – Daily Digest posted an update in the group VRIGHT Exchange | Daily Digest: Corporate & Economy

3 weeks, 1 day agoMacro & Global Overview

Global Trade & Economy

• The U.S.–China trade war has flared up again, with Washington threatening to impose 100% tariffs on Chinese imports from November 1. Beijing’s export controls on rare earth elements have heightened global supply chain concerns.

• Asian markets declined nearly 2% (excluding Japan), while U.S. fu…[Read more] -

VRIGHT Exchange – Daily Digest posted an update in the group VRIGHT Exchange | Daily Digest: Corporate & Economy

3 weeks, 1 day agoMacro & Global Overview

Global Trade & Economy

• The U.S.–China trade war has flared up again, with Washington threatening to impose 100% tariffs on Chinese imports from November 1. Beijing’s export controls on rare earth elements have heightened global supply chain concerns.

• Asian markets declined nearly 2% (excluding Japan), while U.S. fu…[Read more] -

VRIGHT Exchange | Research & Strategy Desk posted an update in the group VRIGHT Exchange | Daily Digest: Corporate & Economy

3 weeks, 2 days agoGLOBAL SHOCK: OCTOBER 11, 2025

On October 11, 2025, President Donald Trump announced 100% tariffs on all Chinese imports and export restrictions on critical U.S. software, retaliating against China’s rare earth mineral export ban.

The decision triggered a global market meltdown:

Global equities lost $1.6 trillion in value in a single trading s…[Read more]

-

VRIGHT Exchange | Research & Strategy Desk posted an update in the group VRIGHT Exchange | Daily Digest: Corporate & Economy

3 weeks, 3 days agoWeekly Market Review: Oct 6 – 10, 2025

Market Overview

Indian equities posted a steady performance through the week, with the Nifty50 hovering around the 25,200 mark and the Sensex near 82,700, supported by renewed FPI inflows, strong domestic liquidity, and selective buying in financials and infrastructure.

The market absorbed global v…[Read more]

-

VRIGHT Exchange – Daily Digest posted an update in the group VRIGHT Exchange | Daily Digest: Corporate & Economy

3 weeks, 4 days agoMacro & Market Overview

• Mixed Global Cues & IPO Buzz: Indian markets opened with mixed tone. The LG Electronics India IPO saw strong subscription interest, reflecting appetite for marquee listings.

• FII Return & Cautious Optimism: Foreign institutional investors have resumed buying over the past few sessions, helping benchmarks regain foo…[Read more]

-

VRIGHT Exchange – IPO Pulse posted an update in the group VRIGHT Exchange-IPO Tracker

3 weeks, 4 days agoInvestor Update: LG Electronics India IPO — A Record-Breaking ₹11,607 Crore Listing

Overview

LG Electronics India Ltd’s ₹11,607 crore initial public offering (IPO) has made history as one of India’s largest and most heavily subscribed equity issues to date. The appliance and consumer electronics major attracted an astonishing ₹4.4 trillion (U…[Read more]

-

VRIGHT Exchange – IPO Pulse posted an update in the group VRIGHT Exchange-IPO Tracker

3 weeks, 4 days agoLISTING UPDATE

WEWORK

IPO PRICE: 648

LOT SIZE – RETAIL: 23

LOT SIZE – HNI: 322

LOT SIZE – HNI: 1564LISTING PRICE: 650(+2₹,+0.31%)

LISTING GAIN – RETAIL: 46/-

LISTING GAIN – HNI: 644/-

LISTING GAIN – HNI: 3128/- -

VRIGHT Exchange | Research & Strategy Desk posted an update in the group VRIGHT Exchange | Market Movers

3 weeks, 5 days agoStocks in Radar – 9 Oct 2025

Positive Developments

HFCL – Secures export orders worth ₹303.35 crore for optical fiber cables via its overseas subsidiary.

Garuda Construction – Bags civil work order worth ₹144 crore for a redevelopment project in Mumbai.

Asahi India Glass – CRISIL upgrades rating on the company’s bank facilities.…[Read more]

-

VRIGHT Exchange | Research & Strategy Desk posted an update in the group VRIGHT Exchange | Market Movers

3 weeks, 5 days agoStocks in Focus – 9 October 2025

• Adani Power: Seeks consent for approval of an additional ₹2,000 crore for an already approved material related-party transaction.

• Oswal Agro Mills: Announces resignation of Narinder Kumar as CEO and Whole-Time Director.

• Paradeep Phosphates: Board approves the NCLT-sanctioned merger scheme between Mangalore…[Read more]

-

VRIGHT Exchange | Research & Strategy Desk posted an update in the group VRIGHT Exchange | Market Movers

3 weeks, 5 days agoStocks to Watch

IRB InvIT Fund

The infrastructure investment trust launched its Qualified Institutions Placement (QIP) on October 8 with a floor price of ₹62.69 per unit. According to market sources, the QIP size is expected to be around ₹3,000 crore, with an additional upsize option of ₹250 crore.GR Infraprojects

The company has received a Let…[Read more] -

VRIGHT Exchange – IPO Pulse posted an update in the group VRIGHT Exchange-IPO Tracker

3 weeks, 5 days agoLISTING UPDATE

GREENLEAF – SME

IPO PRICE: 136

LOT SIZE – INDIVIDUAL: 2000

LOT SIZE – HNI: 3000LISTING PRICE: 134.90(-1.10₹,-0.81%)

LISTING LOSS – INDIVIDUAL: 2200/-

LISTING LOSS – HNI: 3300/-DSM FRESH FOODS- SME

IPO PRICE: 100

LOT SIZE – INDIVIDUAL: 2400

LOT SIZE – HNI: 3600LISTING PRICE: 120(+20₹,+20%)

LISTING GAIN – INDIVIDUAL: 48,…[Read more] -

VRIGHT Exchange – IPO Pulse posted an update in the group VRIGHT Exchange-IPO Tracker

3 weeks, 5 days agoLISTING UPDATE -Oct 8

https://vrightexchange.com/activity/p/2268

Oct IPO Report by Axis Capital

https://vrightexchange.com/activity/p/2265

FUNDRAISING

https://vrightexchange.com/activity/p/2267